Although the recent decline in real estate prices is gradually slowing down, analysts say it is still too early to talk about an overall rebound. Considering the still high interest rates and the unstable jeonse market situation, the downward trend is expected to continue for the time being. In particular, the expansion of 'Kkangtong Jeonse,' where the jeonse price exceeds the sale price, is expected to further increase the pressure on house prices to fall.

According to the Bank of Korea and the government on the 29th, the real estate market remains deeply sluggish, but some regions are showing signs of rising house prices. As the Bank of Korea recently held the base interest rate steady for three consecutive times, the fear of house price declines like last year has diminished, and the situation has improved in some parts of Gangnam, Seoul. According to Real Estate R114, most areas in Seoul saw apartment sale prices fall compared to the previous week, but Gangnam rose by 0.01%.

Lee Chang-yong, Governor of the Bank of Korea, said at a press conference after the monetary policy meeting on the 25th, "Last year, at the end of the year, when real estate prices fell very quickly, there were concerns about a hard landing, but now with interest rate adjustments, the possibility of a soft landing has increased." He added, "In fact, there is talk of a soft landing happening so quickly that there is concern about household debt increasing."

However, the overall real estate market still shows weakness. On the 26th (local time), Won Hee-ryong, Minister of Land, Infrastructure and Transport, said at a press conference held in Berlin, Germany, "On average, the effect of interest rates lasts a long time, so it is still too early to say that the market has turned to a rebound overall." He added, "In places with high demand or preference, prices may be less likely to fall further, but on a nationwide average, there is a possibility of a further decline."

The Bank of Korea also expected that although the sharp decline in the housing market has calmed, downward pressure will continue for the time being due to still high interest rates and instability in the jeonse market. In its economic outlook report, the Bank pointed out, "In the current situation where instability in the jeonse market continues due to Kkangtong Jeonse and reverse Jeonse, if landlords sell their owned houses to return existing jeonse deposits, the downward pressure on housing sale prices may increase."

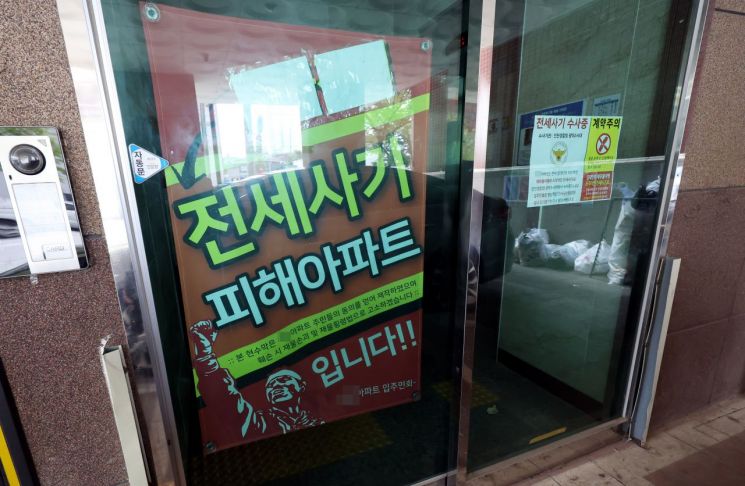

On the morning of the 17th of last month, a banner appealing for measures against jeonse fraud victims was hung on the main entrance door of an apartment in Michuhol-gu, Incheon, where Mr. A, a deceased victim of jeonse fraud, had lived.

On the morning of the 17th of last month, a banner appealing for measures against jeonse fraud victims was hung on the main entrance door of an apartment in Michuhol-gu, Incheon, where Mr. A, a deceased victim of jeonse fraud, had lived. [Image source=Yonhap News]

In fact, according to an analysis using microdata of actual transactions by the Bank of Korea, the proportion of households at risk of Kkangtong Jeonse among current jeonse contracts surged from 2.8% (56,000 households) in January last year to 8.3% (163,000 households) last month. The proportion of households at risk of reverse Jeonse also rose significantly from 25.9% (517,000 households) to 52.4% (1,026,000 households) during the same period. Regionally, non-metropolitan areas showed more risk than Seoul.

On average, in the case of Kkangtong Jeonse, the sale price was about 20 million KRW lower than the jeonse deposit, and in reverse Jeonse, the deposit was 70 million KRW higher than the current jeonse price. As of last month, the proportions of Kkangtong Jeonse and reverse Jeonse contracts maturing in the second half of this year were 36.7% and 28.3%, respectively. If the real estate market downturn continues, social problems such as jeonse fraud are likely to spread further.

Since the Bank of Korea has effectively halted its tight monetary policy, there is room for the real estate market to improve in the future, but global economic recession concerns make it difficult to make a hasty conclusion. Especially according to the Bank of Korea's analysis, the increase in Kkangtong Jeonse and reverse Jeonse not only expands the risk of non-return of jeonse deposits but may also increase downward pressure on the housing market.

The Bank of Korea pointed out, "If tenants do not secure the status of senior creditors, even if an auction proceeds, the risk of non-return of deposits may increase." It added, "Also, the burden of repaying deposits due to Kkangtong Jeonse and reverse Jeonse can lead to an increase in listings, which can act as downward pressure on sale prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)