Debt and tax delinquency rates were found to be high mainly in the outskirts of Seoul, where housing prices have sharply declined this year. In particular, the northeastern areas such as Gangbuk and Dobong-gu, and the southwestern areas such as Geumcheon and Gwanak-gu, where the drop in sale prices was pronounced, showed delinquency rates exceeding the overall rate for Seoul, indicating a heavy burden of delinquency.

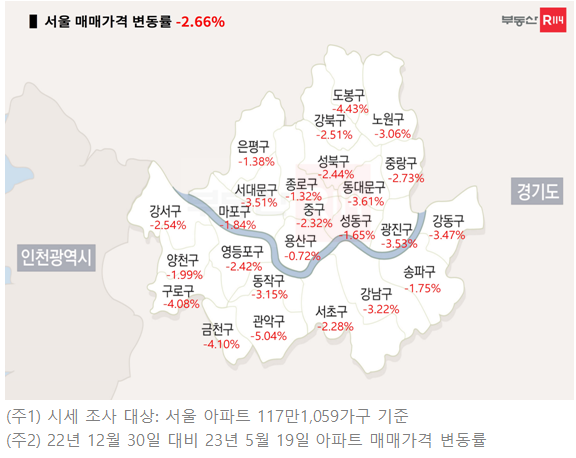

On the 29th, Real Estate R114 surveyed the change rate of apartment sale prices in Seoul this year and found that apartment prices in Seoul fell by 2.66% compared to the end of last year. By region, Gwanak-gu recorded the largest decline at -5.04%, followed by Dobong (-4.43%), Geumcheon (-4.10%), and Guro-gu (-4.08%), all showing a drop of over 4%.

The northeastern and southwestern outskirts, where apartment price declines were significant, also had relatively high delinquency rates. The delinquency rate refers to the proportion of debtors or taxpayers who have delayed payment by more than one month. According to Real Estate R114’s big data solution, the debt and tax delinquency rates in Seoul have increased significantly since September last year. The delinquency rate in March was 0.92%, slightly down from 0.93% in February, but up by 0.12 percentage points compared to 0.80% in the same month last year.

By district, Gangbuk (1.34%), Jungnang (1.24%), and Gwanak-gu (1.21%) had the highest delinquency rates, with Dobong-gu recorded at 1.08%, up 0.19 percentage points from 0.89% a year ago.

These areas are densely populated with mid- to low-priced apartments and were regions where the buying power of the 2030 generation was strong during the recent real estate boom. The analysis suggests that the economic slowdown has reduced the consumption capacity of the working class, and increased interest repayment burdens have led to rising delinquency rates.

A representative from Real Estate R114 said, “With high interest rates, high inflation, and downward pressure on housing prices, there are concerns about the deterioration of household financial health among financially vulnerable groups such as young people, small business owners, and low-credit individuals who have relatively low debt repayment capacity. It is necessary to conduct checks for stable management of delinquency rates, and in the long term, measures should be taken to encourage individuals to make efforts to manage their financial conditions and credit risks on their own.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.