Samsung Electronics and SK Hynix Lose Ground in DRAM Market Share

Micron Transforms into No. 2 by Increasing DRAM Shipments

US Nvidia Posts Surprising Results Fueled by AI Impact

Opportunity for Korean Memory Industry Supplying HBM

The global semiconductor market is undergoing a significant shift. In the memory semiconductor DRAM market, the American semiconductor company Micron increased its market share in the first quarter, surpassing SK Hynix to take second place. However, it remains to be seen whether this will lead to long-term market changes. In the system semiconductor sector, another American company, NVIDIA, posted surprising results thanks to the ChatGPT effect. There are expectations that NVIDIA's momentum will extend to the domestic memory industry.

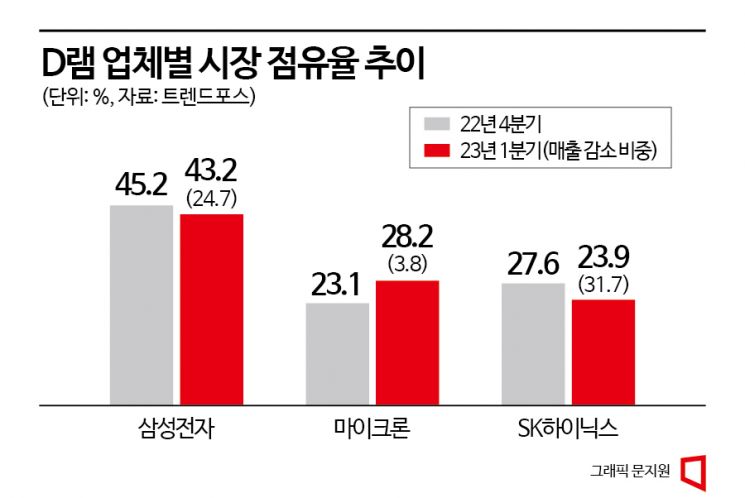

On the 26th, Taiwanese market research firm TrendForce released statistics on the DRAM market for the first quarter. Due to the semiconductor industry downturn that intensified last year, first-quarter DRAM market sales plummeted 21.2% from the previous quarter ($12.269 billion) to $9.663 billion. Sales of major DRAM companies also declined. However, the rate of decline varied by company. As a result, market shares shifted, changing the rankings for second and third place. In the first quarter, the market shares were ▲Samsung Electronics (43.2%) ▲U.S. Micron (28.2%) ▲SK Hynix (23.9%), with Micron overtaking SK Hynix. This is the first ranking change in nine years since the first quarter of 2014.

Samsung Electronics and SK Hynix saw their sales drop sharply by 24.7% and 31.7%, respectively, from the fourth quarter of last year to the first quarter of this year. Their market shares also fell by 2.0 and 4.7 percentage points, respectively. In contrast, Micron's first-quarter sales decreased by only 3.8% from the previous quarter, resulting in a 5.1 percentage point increase in market share. TrendForce analyzed that this outcome was due to Samsung Electronics and SK Hynix experiencing reduced shipments and lower average selling prices (ASP) during this period. Micron, on the other hand, was able to mitigate sales decline by increasing shipments based on orders received at the end of last year.

In fact, in March, Micron announced its fiscal year 2023 second-quarter results (December 2022 to February 2023), reporting that DRAM sales volume increased by the mid-teens percentage compared to the previous quarter. Micron's operating loss for the quarter was $2.33 billion (approximately 3.061 trillion KRW), which was less than SK Hynix's first-quarter operating loss of 3.402 trillion KRW. Samsung Electronics posted a loss of 4.58 trillion KRW in its entire semiconductor business (DS division), including memory and system semiconductors.

Within the semiconductor industry, it is interpreted that Micron, which has a higher proportion of legacy (older) semiconductors compared to Samsung Electronics and SK Hynix, supplied semiconductors at relatively lower prices, thereby increasing shipments and market share through inventory depletion. However, there is a consensus that it remains to be seen whether this ranking change will lead to meaningful market shifts. Some argue it could be a temporary effect. An industry insider said, "Market share statistics vary by research firm, and since this is not the primary statistic the industry monitors, the reliability should be verified through other statistics in the future."

While the memory industry experiences ranking changes, the system semiconductor sector posted surprising results. In the U.S., NVIDIA reported fiscal year 2024 first-quarter results (February to April 2023) with sales of $1.9 billion, down 13% year-on-year. Although this represents negative growth, it significantly exceeded market expectations and was considered a strong performance. Notably, sales in the data center segment rose 14% to $4.28 billion. The rise of generative artificial intelligence (AI) like ChatGPT has benefited NVIDIA, which supplies graphics processing units (GPUs) essential for AI servers.

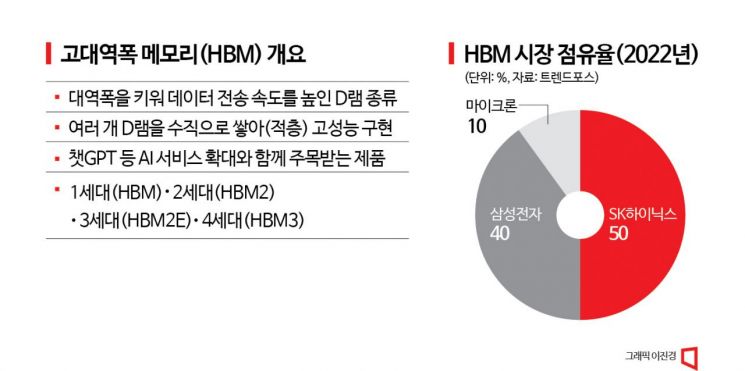

The industry expects NVIDIA's strong performance to extend to the domestic memory sector, including Samsung Electronics and SK Hynix. This is because high-performance, high-capacity DRAM is used alongside GPUs in AI servers. In particular, demand for high-bandwidth memory (HBM), which stacks multiple DRAM chips vertically to increase data transfer speeds compared to regular DRAM, is expected to surge. According to TrendForce statistics, Samsung Electronics (40%) and SK Hynix (50%) accounted for nearly 90% of the HBM market last year. Consequently, the stock prices of Samsung Electronics and SK Hynix have also been on the rise recently alongside NVIDIA.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)