Credit Rating Agencies Hint at Possible US Credit Downgrade

Moody's: "Outlook May Be Lowered If Less Confident"

Debt ceiling negotiations to avoid a U.S. default have reached a 'No deal' status as Congress has gone into recess. With the so-called 'X-Day,' the date identified by U.S. Treasury Secretary Janet Yellen as when available funds will be exhausted, fast approaching, both sides have failed to make progress in talks and are engaged in a blame game, showing no signs of narrowing their differences.

On the 25th (local time), according to U.S. political media outlet The Hill and others, both the Senate and the House entered recess in the afternoon without reaching a deal, just one week before X-Day. The Senate will be in recess around Memorial Day (May 19?29), and the House will also be in recess during the week starting May 29. That week includes June 1, the X-Day set by the Treasury. When Congress is in recess, most lawmakers return to their districts and cannot process legislation.

The White House and the Republican working team are continuing negotiations online. Politico reported, "Both sides are optimistic about nearing a deal to avoid default next week, but as of yesterday, an agreement does not appear imminent." Patrick McHenry, the Republican negotiator leading the team, told The Hill in an interview, "Both sides are negotiating in good faith, but the remaining issues are more difficult."

Democrats and Republicans are engaged in a tense standoff, trading blame over the negotiation deadlock. Some Democrats sharply criticized House Republican leaders for approving the scheduled recess despite the looming default deadline. Democratic Representative Susan Wild told The Hill, "Leaving Washington in the face of an imminent disaster is unacceptable."

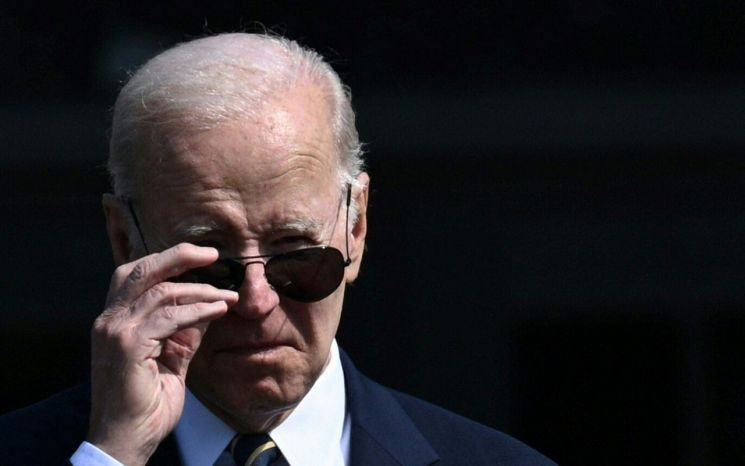

Criticism has also been directed at President Joe Biden. Unlike House Speaker Kevin McCarthy, who has repeatedly appealed for spending cuts in media briefings, Democratic Representative Steven Horsford said, "President Biden needs to exercise the power of the podium," arguing that Biden has not sufficiently voiced the drawbacks of the Republican proposals.

With X-Day drawing near and the gap between Democrats and Republicans only reaffirmed, the market is anticipating the possibility of default. The U.S. Treasury bond market has plunged into turmoil, with yields on short-term Treasury bills maturing in early June surpassing 7%. Bloomberg reported that ultra-short-term Treasury yields maturing on June 1 and June 6 rose above 7%, about 4 percentage points higher than the May 30 maturity.

International credit rating agencies have also hinted at the possibility of downgrading the United States' current top-tier (AAA) credit rating. William Foster, Senior Vice President at Moody's, said the previous day, "I do not believe there will ever be a scenario where the U.S. misses an interest payment after X-Day," but added, "If we become less confident, we will downgrade the U.S. sovereign credit rating outlook to 'negative'." A 'negative' outlook implies a potential downgrade.

Earlier, British rating agency Fitch moved the U.S. sovereign credit rating outlook from 'stable' to 'negative watch,' indicating a possible future downgrade. Fitch had also placed the U.S. on negative watch in 2013 during a federal government shutdown caused by debt ceiling disputes, before returning it to 'stable' five months later.

Uncertainty over the debt ceiling negotiations is also weighing on the U.S. stock market. Michael Reynolds, Vice President at U.S. asset management firm Glenmede, told CNN, "Many investors will weigh their options and seek to profit by investing in U.S. Treasuries over stocks," explaining that "this temporarily absorbs liquidity from the stock market." Secretary Yellen also mentioned the previous day, "One of the concerns is that even if an agreement is reached, there could still be significant financial market pain." She warned, "In 2011, U.S. Treasuries were actually downgraded, and the New York stock market suffered nearly a 20% drop."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.