On the 25th, the Bank of Korea kept the base interest rate steady at 3.5% during the Monetary Policy Committee meeting and downgraded this year's real Gross Domestic Product (GDP) growth forecast to 1.4%. The growth outlook was lowered by 0.2 percentage points in three months due to continued export sluggishness and a slowdown in consumer recovery. The Bank of Korea's forecast of 1.4% is the lowest among domestic and international institutions. As the global economic slowdown continues to lower growth expectations, there are speculations that the timing for an interest rate cut could be approaching as early as the end of this year.

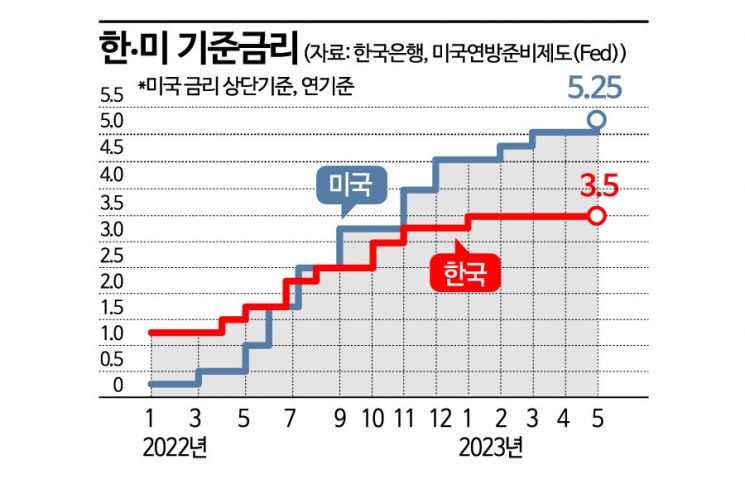

The Bank of Korea's Monetary Policy Committee held a meeting to decide on monetary policy direction and resolved to keep the base interest rate at 3.50%. Since August 2021, the Monetary Policy Committee had paused rate hikes for one year and six months starting in February, taking a 'breather.' By deciding to hold rates steady for three consecutive times including last month and this month, it is signaling that the rate hike cycle has reached its end. With the Bank of Korea maintaining the base rate, the gap with the U.S. rate (4.75~5.00%) remains at a record high upper limit of 1.75 percentage points.

The reason for the Bank of Korea's decision to hold rates this month is that inflationary pressure is gradually easing. Since the consumer price inflation rate in April fell to the 3% range for the first time in 14 months, the Bank intends to keep the base rate steady and monitor future inflation trends. On the 22nd, Bank of Korea Governor Lee Chang-yong attended a National Assembly Planning and Finance Committee hearing and predicted, "Inflation dropped to 3.7% last month and is expected to continue a downward trend for some time."

However, in its revised economic outlook, the Bank of Korea maintained the consumer price inflation forecast at 3.5%. Although inflationary pressure is expected to gradually decrease in the long term, core inflation is declining more slowly than anticipated, and recent price hikes in electricity and gas fees add inflationary factors that could influence future inflation trajectories.

This year's growth forecast was lowered by 0.2 percentage points from 1.6% to 1.4%. This is due to the reopening effect of China’s economy being less than expected and the semiconductor industry, a key export sector, hitting bottom, resulting in continued trade deficits. Jo Young-moo, a research fellow at LG Economic Research Institute, said, "The main variable for future monetary policy will be economic growth. If growth expectations continue to decline to the low 1% range annually, calls for interest rate cuts within the year will increase."

Governor Lee stated, "The domestic economy will continue a sluggish growth trend for some time, but from the second half of the year, it will gradually recover due to easing economic downturn in T and the ripple effects of China's economic recovery." He added, "The consumer price inflation rate significantly dropped due to base effects from last year's sharp rise in international oil prices, then will slightly rise and fluctuate around 3% until the end of the year." He emphasized, "The Monetary Policy Committee will continue to monitor growth while managing monetary policy to stabilize inflation at target levels in the medium term and pay attention to financial stability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)