Impact of Surge in Overseas Travel Demand

Increase in Searches for Credit Card Travel Benefits

Authorities Issue Overseas Card Usage Advisory

On the 4th, the international terminal at Gimpo Airport in Gangseo-gu, Seoul, is bustling with travelers during the golden holiday period that includes Labor Day and Children's Day. Photo by Jinhyung Kang aymsdream@

On the 4th, the international terminal at Gimpo Airport in Gangseo-gu, Seoul, is bustling with travelers during the golden holiday period that includes Labor Day and Children's Day. Photo by Jinhyung Kang aymsdream@

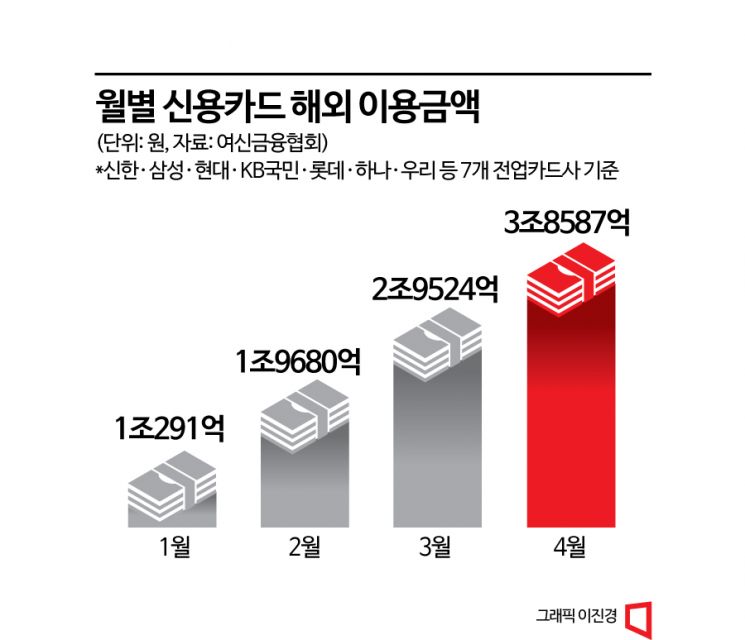

Last month, the overseas usage amount of major domestic credit card companies nearly reached 4 trillion won, about four times higher than at the beginning of the year. This is attributed to the surge in travel demand as the COVID-19 situation eases.

According to the Credit Finance Association on the 24th, the overseas credit card usage amount for individuals from seven major full-service card companies?Shinhan, Samsung, Hyundai, KB Kookmin, Lotte, Hana, and Woori?was recorded at 3.8587 trillion won last month. This is about four times the 1.0291 trillion won recorded in January. Usage increased by about 1 trillion won each month, with 1.968 trillion won in February and 2.9524 trillion won in March.

This is attributed to the rapid increase in overseas travel as the COVID-19 situation eases. According to aviation statistics from the Ministry of Land, Infrastructure and Transport, the number of international passengers from January to April totaled 18,800,861, more than ten times the 1,753,836 passengers during the same period last year.

Interest also surged in credit cards offering travel-related benefits. According to the 'Q1 Credit Card Search Report' released by Card Gorilla, the largest credit card platform in Korea, searches for travel-related benefits skyrocketed compared to the same period last year. All of the top five categories with increased searches were related to travel benefits. Specifically, searches for 'Airport Lounge/PP' benefits increased by 372% compared to the previous year, ranking first by a wide margin. This was followed by 'Airline Mileage (180%)', travel and accommodation (117%), and 'Overseas (102%)'. Go Seung-hoon, CEO of Card Gorilla, explained, "It is believed that travel demand has surged rapidly in the endemic era of COVID-19. Interest has also focused on premium cards that allow users to enjoy multiple points accumulation, discounts, and travel benefits with just one card."

As travel demand surged, authorities also took action. The Financial Supervisory Service recently issued a consumer alert regarding overseas credit card usage, fearing an increase in fraudulent use due to card theft, loss, and cloning. Overseas incidents tend to result in larger losses and more diverse fraud methods because it is harder to respond to incidents abroad compared to domestic cases. According to the Financial Supervisory Service, the average amount per fraudulent transaction overseas is 1,289,000 won, 5.35 times higher than the 241,000 won domestically.

Through the consumer alert, the Financial Supervisory Service urged consumers to set restrictions on card usage countries, daily spending limits, and usage periods to block fraudulent overseas transactions. They also advised consumers to visually confirm the card payment process at places like restaurants to prevent unauthorized card cloning. Additionally, they emphasized refraining from using local private ATMs, blocking overseas payments after entry confirmation, signing receipts, and promptly reporting lost cards.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)