Hyundai Motor Group Focuses on Lithium Metal Battery Developed by US SES

30% Increased Driving Range and 90% Charge in 12 Minutes

SES in A-Sample Stage Jointly Developed by Hyundai, Honda, and GM

Electric Vehicle with Semi-Solid Battery Expected in 2025

As global automakers consecutively declare 'battery internalization,' the necessity for Hyundai Motor Group's own battery production is being raised. It is argued that to improve the performance and reduce the cost of batteries, which are key components of electric vehicles, they must be manufactured directly. Although Hyundai Motor Group has drawn a line by stating that immediate direct mass production of batteries is difficult, it is simultaneously investing in the development of next-generation batteries. There is a world of difference between relying on external procurement without battery technology and having core technology but outsourcing due to business considerations.

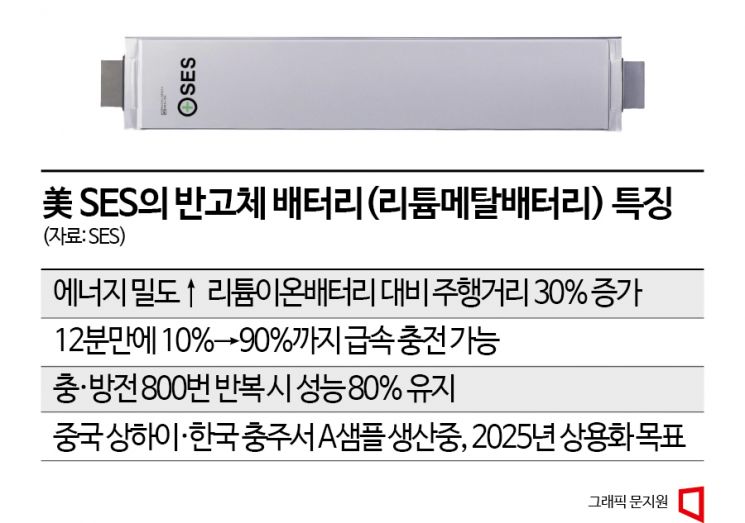

What Hyundai Motor Group is recently focusing on is the lithium metal battery, known as the 'semi-solid battery.' It can be seen as an intermediate stage between the widely used lithium-ion battery and the so-called 'solid-state battery,' the dream battery. The semi-solid battery is known to have a driving range 30% longer than lithium-ion batteries and can be charged up to 90% of its capacity in just 12 minutes.

Experts agree that for Hyundai Motor Group to leap forward as the number one future car company, it must invest not only in the transition to SDV (Software-Defined Vehicle) but also in electric vehicle battery development. In 2021, Hyundai Motor Group made a $100 million equity investment in SolidEnergy Systems (SES), a U.S. company developing lithium metal batteries. This company has attracted funding not only from domestic companies such as Hyundai, SK, and LG but also from global automakers including GM, Honda, SAIC Motor, and Geely.

On the 8th, SES announced in its Q1 earnings report that the 100Ah lithium metal battery jointly developed with Hyundai, GM, and Honda has entered the JDA (Joint Development Agreement) A-sample stage. In battery development, the A-sample is a prototype, the B-sample is an engineering sample that operates in vehicles, and the C-sample is a battery close to commercialization.

SES is establishing A-sample production lines in Shanghai, China, and Chungju, South Korea. The goal is to proceed through B and C sample stages in 2024 and start cell production in 2025. In February this year, SES signed an investment agreement worth 195.6 billion KRW with Chungcheongbuk-do Province and Chungju City. This is preparatory work to further expand the Chungju research facility and prototype production line. The industry expects SES to strengthen collaboration with Hyundai Motor Group through this agreement. If the development schedule proceeds as planned, it means that Hyundai and Kia electric vehicles equipped with semi-solid batteries could be launched by around 2025 at the latest.

Among global automakers, Volkswagen and Tesla are the most proactive in battery internalization. Volkswagen plans to produce battery cells directly through its subsidiary PowerCo. In March, Volkswagen announced that it would establish a battery cell factory with an annual capacity of 20GWh in Ontario, Canada, together with PowerCo. This factory is Volkswagen's first 'gigafactory' established overseas. Volkswagen has also set a goal to build six battery factories in Europe with a total annual capacity of 240GWh by 2030.

Tesla declared battery internalization in 2020 and has been building its own production facilities. It plans to produce cylindrical '4680 batteries' in its factories in Texas and Nevada, USA. Recently, Tesla added plans to build lithium refining and cathode material manufacturing facilities, moving toward securing battery raw materials. Tesla plans to build a lithium refinery in Texas by the end of this year. Next to it, a cathode material factory with an annual capacity of 60GWh will also be constructed. Trial operations are scheduled to begin in the second quarter.

BYD is the only company that produces both batteries and electric vehicles in-house. BYD's origin, 'BYD Industrial,' was a mobile phone battery company. Starting as a battery company, it has succeeded in internalizing all key components used in electric vehicles, including electric motors, vehicle semiconductors, and batteries. In the global battery market in Q1 this year, BYD ranked second with a market share of 16.2%. This was influenced by the rapid sales of electric vehicles equipped with domestic batteries in China, the world's largest electric vehicle market. In Q1 this year, two out of every five electric vehicles sold in China were BYD.

Toyota is focusing on the development of solid-state batteries, known as the dream battery. While other companies are paying attention to lithium-ion and lithium metal batteries, Toyota aims to challenge the mass production of the most advanced solid-state batteries. Since 2000, Toyota has held the world's number one position in patents related to solid-state batteries. Currently, Toyota is considered relatively behind in the electric vehicle market. Since the inauguration of new president Koji Sato in April, Toyota has been targeting the market with an 'electric vehicle first' strategy. The plan is to overturn the market landscape at once through advanced solid-state battery technology.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)