Sales Decline Since 2020

Several Companies Struggling with Losses

Industry Says "The Heyday Is Over"

The craft beer startup ‘The Starlight Brewing’ partnered with Nongshim last summer to launch ‘Kkang Beer Original’ and ‘Kkang Beer Black.’ At the time, these products, inspired by the iconic brand ‘Saewookkang,’ which uniquely recorded sales in the 100 billion KRW range within the domestic snack market, were very popular. However, the popularity did not last long. The Starlight Brewing did not see significant ‘fun’ in sales, and it has been unable to pay for the large-scale advertising expenses it undertook.

Domestic craft beers are displayed at an Emart24 convenience store in downtown Seoul.

Domestic craft beers are displayed at an Emart24 convenience store in downtown Seoul. [Photo by Emart24]

This unique craft beer, which gained great popularity among the MZ generation (Millennials + Generation Z) mainly at convenience stores, has entered a downward trend. This is a phenomenon resulting from the expansion of consumers’ alcoholic beverage choices amid the solo drinking culture established in our society after COVID-19, and the recovery of Japanese beer consumption, which had slowed due to the boycott of Japanese products.

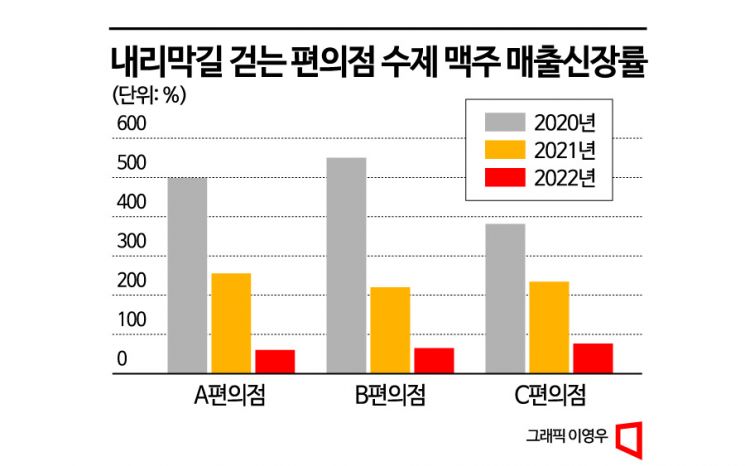

According to the convenience store industry on the 24th, domestic craft beer sales growth rates have sharply declined since last year. Convenience Store A’s craft beer sales growth rate, which reached 498.4% in 2020, dropped to 255.2% in 2021 and 60.1% last year. This year, the sales growth rate has clearly declined to 4.9% as of last month.

Convenience Store B also saw its craft beer sales growth rate plunge from nearly 550% in 2020 to 65% last year. This year, it shows only about a 10% sales growth rate. Convenience Store C, considered one of the top three convenience stores along with A and B, is in a similar situation. Its craft beer sales growth rate, which was 381.4% in 2020, fell to 234.1% in 2021 and 76.6% last year. Although it currently shows the highest sales growth rate among the three convenience stores at 31.1% this year, the ‘glory days’ have faded into the past.

On the other hand, Japanese beer has shown a remarkable recovery during this period. Convenience Store A’s Japanese beer sales growth rate rebounded from -93.9% in 2020 to 271.9% last year. This year, it continues to rise at 290.1% as of last month. Convenience Store B’s Japanese beer sales growth rate, which was -90% in 2020, turned positive at 350% last year and has maintained around 330% this year. Convenience Store C also saw a sharp increase in Japanese beer sales growth rate from -95.3% in 2020 to 992.1% last year. While Convenience Store C attributes this to a base effect rebound, the industry expects the upward trend of Japanese beer to continue as certain products are experiencing shortages.

Amid this so-called ‘reversal phenomenon,’ several domestic craft beer companies have been struggling with deficits. In fact, Jeju Beer, which once stood out with the growth of the craft beer market, has been showing increasing operating losses. According to the Financial Supervisory Service’s electronic disclosure system, Jeju Beer’s cumulative losses over six years amount to about 44 billion KRW. Operating losses, which were only 4.3 billion KRW in 2020 when craft beer was strong, ballooned to 7.2 billion KRW in 2021 and 11.6 billion KRW last year.

Industry insiders believe that with the ongoing solo drinking culture after the pandemic and the diversification of alcoholic beverages such as wine, whiskey, and highballs, the position of craft beer will not be easy. An industry official said, “Craft beer gained price competitiveness in 2020 due to tax benefits, and afterward, companies enjoyed a heyday by rapidly launching products and expanding factories. However, as we enter the endemic phase, dining-out consumption has increased, and alcoholic beverages tailored to the solo drinking culture developed during COVID-19 have diversified, leaving almost no craft beer products that consumers choose.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)