Letter from Acting Chairman Kim Byung-joon Ahead of June Evaluation

5 Reasons Including 7th Largest Trading Volume Worldwide and Foreign Exchange Market Liberalization Policy... Efforts to Resolve '30-Year Wish'

The Federation of Korean Industries (FKI) announced on the 22nd that it sent a letter signed by Acting Chairman Kim Byung-joon to Henry Fernandez, Chairman of MSCI, requesting that South Korea be included in the MSCI Morgan Stanley Capital International (MSCI) 'watchlist countries.'

Inclusion in the MSCI developed markets index has been a long-standing goal for the Korean stock market, having faced setbacks for over 30 years since being included in the emerging markets index in 1992.

MSCI classifies global stock markets into developed markets, emerging markets, frontier markets, and standalone markets. South Korea has been classified as an emerging market since 1992. It was included in the watchlist for promotion to developed market status in 2008 but was removed from the watchlist in 2014 and has been attempting to requalify since then. The developed markets category includes 23 countries such as the United States and Japan.

MSCI conducts market accessibility evaluations every early June and announces the watchlist countries by the end of the same month. Once listed as a watchlist country, a one-year qualification review process for promotion takes place. The promotion decision is communicated by the end of June the following year. Being included in the developed markets index increases opportunities for greater investment from global institutional investors.

The FKI presented five reasons to MSCI, requesting South Korea's inclusion in the watchlist. They stated that South Korea ▲holds the status of a global economic powerhouse, ▲has a stock market size comparable to developed markets, ▲has lowered barriers to foreign investment, ▲is making efforts to improve corporate information accessibility, and ▲is working to expand openness in the foreign exchange market.

In simple terms, this means that the Korean market is large enough to be included in the MSCI developed markets index and is striving to open its foreign exchange market to meet the expectations of foreign investors.

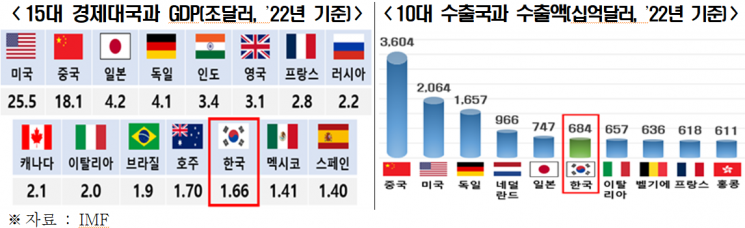

South Korea's gross domestic product (GDP) was $1.66 trillion (approximately 2,194 trillion KRW) last year, ranking 13th globally. Its export volume was $683.6 billion (approximately 904 trillion KRW), ranking 6th worldwide, and its total trade volume including imports was $1.41 trillion (approximately 1,864 trillion KRW), ranking 7th globally.

Per capita gross national income (GNI) also meets MSCI developed market criteria. Last year, it was $33,000 (approximately 43.62 million KRW), which is 2.5 times the World Bank's high-income country threshold of $13,000 (approximately 17.18 million KRW). To meet MSCI standards, a country must exceed 1.25 times the World Bank threshold for three consecutive years.

The stock market size and liquidity also satisfy MSCI developed market requirements. The Korean stock market (Korea Exchange) had a trading volume of $3.02 trillion (approximately 3,992 trillion KRW) last year, ranking 7th globally. Its market capitalization was $1.64 trillion (approximately 2,168 trillion KRW) as of the end of last year, ranking 16th worldwide. This is larger than the stock markets of Spain, Singapore, and Austria, which are included in the MSCI developed markets.

The FKI reported that the Korean government is easing restrictions on foreign investment transactions. The pre-registration system for foreign investors, which MSCI had pointed out, is planned to be abolished within this year. The foreign investor over-the-counter (OTC) transaction review system will expand the scope of post-reporting to reduce the burden of prior review.

Efforts are also underway to improve foreign investors' access to corporate information. The Korean government decided in January to mandate English disclosures for listed companies starting next year. Previously, dividends were paid only after the dividend record date, but the Capital Market Act will be amended to set dividend amounts before the record date.

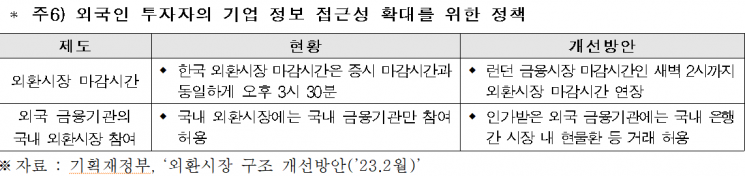

The FKI emphasized that the Korean government is striving to enhance openness in the foreign exchange market in response to MSCI's concerns.

First, the government is working to activate the offshore non-deliverable forward (NDF) market. The Bank of Korea stated that the size of the Korean offshore market's won-denominated NDF transactions accounts for about 40% of onshore foreign exchange trading volume, indicating active trading. NDFs are transactions where, at maturity, only the difference between the contracted forward rate and the market spot rate is settled in a designated currency (usually the dollar), rather than exchanging the full notional amount. This method reduces settlement risk and is preferred by foreign investors. Although there is no offshore foreign exchange market, the Korean foreign exchange market is sufficiently open to not inconvenience foreign investors.

It is expected that the openness of the onshore foreign exchange market's closing market will also expand in the future. In February, the Ministry of Economy and Finance prepared a plan to extend the domestic foreign exchange market's closing time to 2 a.m. (Korean time), aligning it with the London financial market. Additionally, the ministry plans to allow not only domestic financial institutions but also authorized foreign financial institutions to directly participate in the Korean foreign exchange market. Following the announcement of this plan, related legal amendments are underway.

The FKI stated, "Although the Korean government does not permit offshore market transactions as MSCI requested, it will increase accessibility to the onshore foreign exchange market to create an environment where foreign investors can trade more freely and conveniently."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.