China's sluggish economic recovery and the sharp decline of the yuan are pouring cold water on South Korea's economy, which was expecting a 'low in the first half, high in the second half' pattern. Since the Korean won is considered a 'proxy currency' for the yuan, when the yuan falls, the won also depreciates, acting as a factor that pushes up the won-dollar exchange rate. While China's economic recovery is delayed, South Korea has recorded a trade deficit for 14 consecutive months, and the won-dollar exchange rate surpassed its previous high (1,342.9 won) again last week.

However, experts predict that the yuan's downward trend will not last long. This is because Chinese authorities are focusing their efforts on economic recovery, and recently have even expressed their intention to intervene in the market if necessary to curb the yuan's sharp decline. Once the protracted U.S. debt ceiling negotiations are resolved and the yuan's depreciation halts, the won-dollar exchange rate is expected to stabilize.

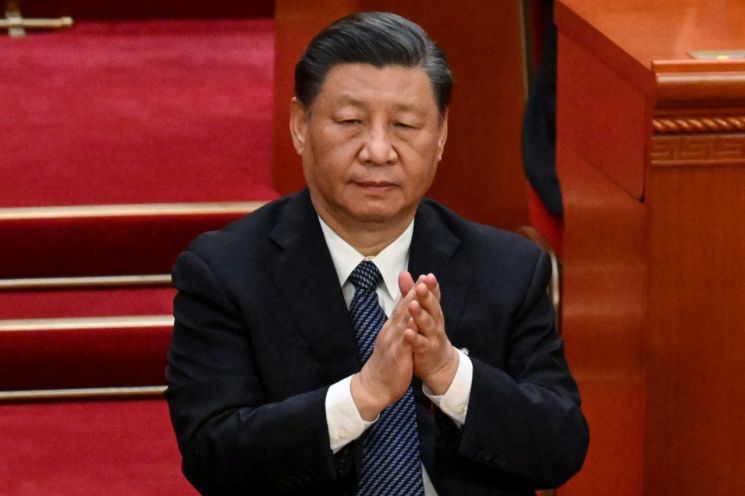

Chinese President Xi Jinping is clapping at the 5th plenary session of the 1st meeting of the 14th National People's Congress (NPC) held at the Great Hall of the People in Beijing on March 12.

Chinese President Xi Jinping is clapping at the 5th plenary session of the 1st meeting of the 14th National People's Congress (NPC) held at the Great Hall of the People in Beijing on March 12. [Image source=Yonhap News]

According to the Seoul foreign exchange market on the 22nd, the won-dollar exchange rate started trading at 1,326 won, down 0.7 won from the previous trading day. Although this is somewhat lower than the previous high of 1,343 won recorded last week, it remains at a high level compared to below the 1,300 won level in February. The delayed resolution of the U.S. debt ceiling negotiations has led to a preference for safe assets, strengthening the dollar, while the yuan's continued depreciation is interpreted as pushing up the upper limit of the won-dollar exchange rate.

In particular, recent yuan weakness is analyzed to have had a significant impact on the sharp rise in the exchange rate. Currently, the yuan value per dollar fluctuates around 7 yuan during trading hours, which is seriously regarded in China as 'Po Qi (破七).' This term reflects the poor state of the Chinese economy. In fact, last month, China's retail sales and industrial production year-on-year growth rates were 18.4% and 5.6%, respectively, both falling short of market expectations (20.1% and 10.9%).

Earlier this month, Chinese authorities lowered deposit interest rates by at least 30 to 50 basis points (1 bp = 0.01 percentage points) to ease the interest rate spread between banks' deposits and loans and to stimulate household consumption. This widened the real interest rate gap between the U.S. and China, further weakening the yuan. Additionally, global demand for the dollar as a safe asset increased due to concerns over a U.S. default, and China's expansion of its U.S. Treasury holdings in March for the first time in eight months also appears to have influenced the yuan's depreciation against the dollar.

In the short term, the biggest variables for the won-dollar exchange rate and South Korea's financial market are the outcome of the U.S. debt ceiling negotiations and the dollar's movement. However, whether the yuan will weaken further is also an important factor. Last weekend, Federal Reserve Chair Jerome Powell's dovish remarks and foreign investors' net purchases of domestic stocks are factors that could lower the exchange rate, while ongoing Chinese economic recession, yuan weakness, and the possibility of a U.S. default are expected to push the exchange rate higher.

Experts predict that the yuan and the Chinese economy will not continue to show sustained weakness. In particular, the Bank of Korea mentioned that Chinese financial authorities lowered the 7-day and 1-day 'notice deposit rates' for major banks starting from the 15th, and local analyses suggest that such policies will help revive domestic demand in China. If the yuan's depreciation stops and China's economy recovers, it could positively impact South Korea's exports and exchange rate stability.

The notice deposit rate is a deposit product that guarantees a relatively high interest rate if the depositor notifies the bank of withdrawal plans a certain period in advance, even before the deposit matures. Lowering the notice deposit rate reduces financial institutions' funding costs and helps induce excess savings to shift toward consumption. The Bank of Korea stated, "In the financial market, the lowering of the notice deposit rate is evaluated to improve the operating conditions of financial institutions and help convert China's savings demand into consumption."

Recently, China's foreign exchange authorities' willingness to intervene in the exchange rate has also been partially confirmed. According to local media, the China Foreign Exchange Market Guidance Committee announced at a meeting on the 18th that "the People's Bank of China and the State Administration of Foreign Exchange will strengthen management, supervision, and monitoring of the foreign exchange market, correct one-sided movements in the exchange rate when necessary, and suppress speculation and sharp exchange rate fluctuations." This is interpreted as a response to the yuan being pushed to 'Po Qi' due to the strong dollar.

Kim Kyunghwan, a researcher at Hana Securities, explained, "We assess the possibility of a trend shift to sustained yuan depreciation as low," adding, "Based on the moderate rebound expected in Chinese household consumption and inventory cycles in the second half and mid-term, the possibility of China's economic rebound in the third quarter, the downward stabilization of the dollar index, and the increase in global yuan settlement demand, we maintain an optimistic view."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.