Analysis of Real Estate Platform Zigbang

Sharp Drop in Apartment Jeonse Prices in Major Regional Cities

Last month, the nationwide apartment jeonse prices fell by 11.8% compared to two years ago. In particular, jeonse prices in Incheon and Daegu have returned to levels seen three and five years ago, respectively, raising concerns about reverse jeonse difficulties.

On the 22nd, according to a review of the recent trends and the rate of change compared to two years ago of the apartment jeonse price index based on a machine learning model provided through Zigbang's real estate big data solution ZigbangRED, the nationwide apartment jeonse price index was found to have dropped by 11.8% compared to two years ago (April 2021).

By region, the largest declines in jeonse prices were seen in Sejong, which fell by 28.5%, and Daegu, which fell by 26.5%. This was followed by Ulsan (-18.9%), Incheon (-17.1%), Busan (-16.9%), and Daejeon (-15.1%) in order of the steepest declines.

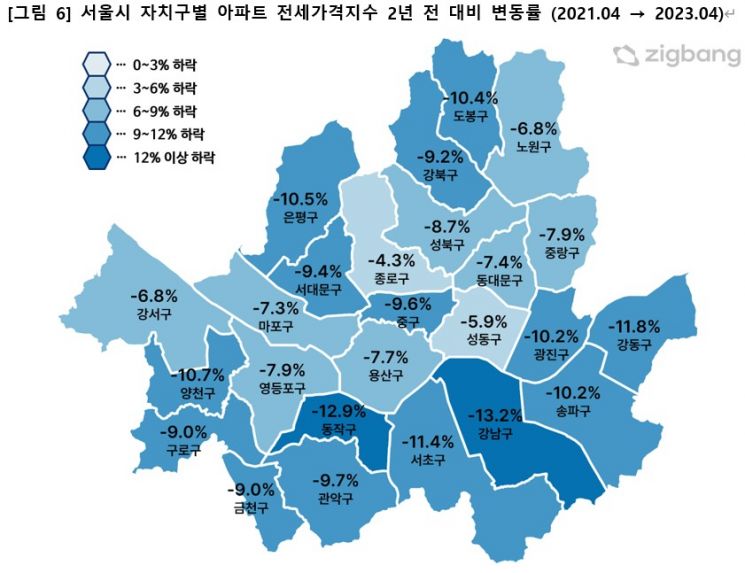

Looking at jeonse prices by autonomous districts in Seoul, as of April 2023, apartment jeonse prices in Gangnam-gu and Dongjak-gu fell the most compared to two years ago, by -13.2% and -12.9%, respectively. By area, there was a contrast between the northern region (Nodogang area) and the southeastern region (Gangnam 3 districts area).

In the case of the Gangnam 3 districts, there was a steady upward trend of around 10% annually from 2019 until the first half of 2022, but after mid-2022, the trend reversed to a decline, showing a sharp drop of nearly 15-17% from the peak over one year.

On the other hand, the northern region (Nodogang area) saw a rapid rise in jeonse prices in 2020, followed by a stable trend for two years, then a decline starting in the second half of 2022. However, the decline rate was relatively slower at around 10-11% compared to the southeastern region. Meanwhile, some autonomous districts such as Gangbuk-gu and Songpa-gu have shown signs of beginning a rebound in March-April 2023.

The jeonse price trends in the three metropolitan area provinces showed similar patterns until 2020, but after 2020, Incheon and Gyeonggi showed relatively larger fluctuations in apartment jeonse prices compared to Seoul. In particular, Incheon recorded a peak in October 2021 and has since experienced a sharp decline in jeonse prices. At the beginning of 2023, prices fell to levels similar to those in early 2020, three years prior.

In the Gyeongsang region, Daegu's decline was the steepest nationwide except for Sejong. As of April 2023, Daegu's jeonse price index was 85.8 points, which is similar to the level in October 2016, indicating a fall to prices from five and a half years ago.

In the Chungcheong region, Sejong City experienced very large fluctuations. After experiencing the fastest rise in jeonse prices nationwide in 2020, Sejong showed a sharp decline starting in the second half of 2021, and as of 2023, prices have fallen to levels seen in early 2020, three years ago.

In Jeonnam, compared to the small increase during the real estate overheating period in 2021, a steady decline has been observed since 2022, and as of April 2023, prices have fallen to the 2019 level. Meanwhile, Gangwon and Jeju have shown the most gradual decline trends nationwide recently, but unlike the metropolitan area, they have not shown any particular signs of rebound.

Ham Young-jin, head of Zigbang Big Data Lab, analyzed, "Local large cities such as Incheon, Daegu, and Sejong began their decline phase around mid-2021, with steep declines in jeonse prices. In particular, concerns about reverse jeonse difficulties are becoming a reality in Incheon and Daegu."

He added, "Even in the metropolitan area where rebound signals are detected, considering the increased social attention to jeonse fraud risks and the indication of further interest rate hikes in the U.S., financial market risks have not yet been resolved. Therefore, rather than prematurely discussing a rebound at this point, it is necessary to continuously monitor future transaction trends."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)