Federation of Korean Industries Analyzes Trade Specialization Index of Trade Items from 2013 to 2022

Number of Import-Specialized Items Increased from 815 in 2013 to 846 Last Year

Competitiveness of 7 out of 10 Major Items Including Semiconductors Weakened

The number of trade items with weaker competitiveness than foreign countries reached 846 last year, the highest since 2013. Among the top 10 export items, 7, including semiconductors, were analyzed to have weakened competitiveness.

On the 21st, the Federation of Korean Industries (FKI) released data titled 'Analysis of Export Item Trade Specialization Index from 2013 to 2022' containing these details.

The FKI stated that the number of export-specialized items showed a decreasing trend, while import-specialized items showed an increasing trend. Export-specialized items are those in which Korea has a competitive advantage in exports compared to foreign countries, and import-specialized items are those with a competitive disadvantage.

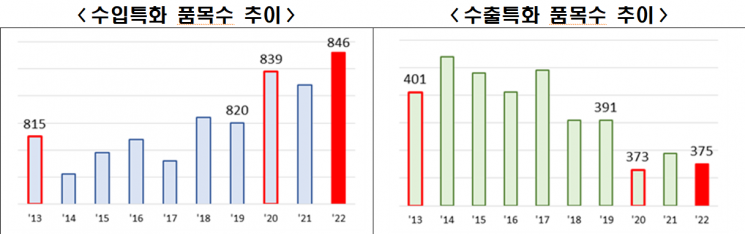

In 2013, import-specialized items accounted for 815 out of 1,216 items (67%), but last year, they increased by 31 to 846 out of 1,221 items (69.3%), marking the highest during the analysis period. Export-specialized items decreased by 26 from 401 to 375 during the same period.

Starting from 2020, when COVID-19 became widespread, the number of import-specialized items increased while export-specialized items began to decline. Compared to 2019, import-specialized items increased by 19, and export-specialized items decreased by 18.

The proportion of import-specialized items among all trade items rose from 67.7% in 2019 to 69.3% last year, an increase of 1.6 percentage points. The FKI commented, "The recent intensification of the increase in import-specialized items generally means that (export) competitiveness has weakened."

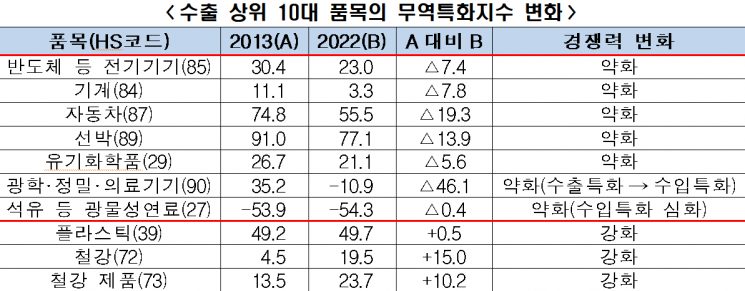

Notably, 7 of the top 10 export items, including semiconductors, have seen weakened competitiveness. The trade specialization index for semiconductors dropped by 7.4 points from 30.4 in 2013 to 23 last year.

Competitiveness also declined for machinery (11.1→3.3), automobiles (74.8→55.5), ships (91→77.1), organic chemicals (26.7→21.1), optical, medical, and precision instruments (35.2→-10.9), and petroleum and other mineral fuels (-53.9→-54.3). Only three items?plastics (49.2→49.7%), steel (4.5→19.5%), and steel products (13.5→23.7%)?showed improvement.

Import-specialized items increased from only petroleum and other mineral fuels in 2013 to two items last year, including optical, medical, and precision instruments.

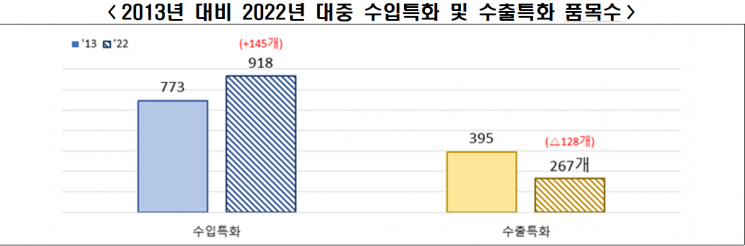

Import-specialized items were particularly prominent in trade with China, which accounts for a large share of Korea's exports. The number of import-specialized items with a negative trade specialization index in trade with China increased from 773 out of 1,168 items (66.2%) in 2013 to 918 out of 1,185 items (77.5%) last year. This means that 8 out of 10 export items to China have weak competitiveness.

The number of export-specialized items with a positive trade specialization index decreased by 128 from 395 to 267 during the same period. The proportion relative to all trade items also dropped by 10.3 percentage points from 33.8% to 22.5%. Among the top 10 export items to China, only one?refined oil and cosmetics?is export-specialized.

Choo Kwang-ho, head of the Economic and Industrial Headquarters at FKI, said, "It is concerning that Korea's export competitiveness in the global market and toward China is generally weakening."

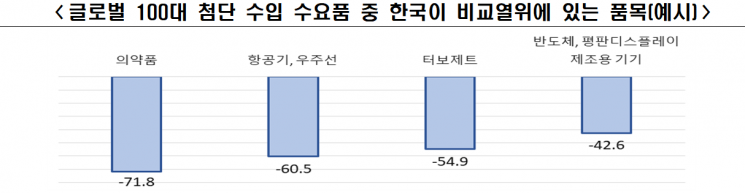

The FKI emphasized that converting import-specialized items into export-specialized items is necessary to increase exports. It stressed the need to strengthen competitiveness, especially in high-demand advanced products.

Pharmaceuticals (trade specialization index -71.8), aircraft and spacecraft (-60.5%), turbojets (-54.9), and semiconductor manufacturing equipment (-42.6%) remain in an import-specialized state with negative trade specialization indices. These items are included among the top 100 imports of the world's five largest importers: the United States, Germany, the Netherlands, Japan, and China.

Choo Kwang-ho stated, "To overcome export stagnation, it is necessary to discover high value-added product groups as main export items by utilizing Korea-US and Korea-Japan cooperation in advanced fields. Regulations on current key items such as semiconductors, machinery, and automobiles should be eased, and support for research and development (R&D) should be increased."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.