The apartment price change rate in Gangnam-gu, Seoul turned positive this week at 0.01%. This is the first time in 10 months since the third week of July last year. In particular, the weekly change rates for reconstruction complexes in the four Gangnam districts (Gangnam, Seocho, Songpa, Gangdong) all recorded stability, raising expectations for a price increase. However, since most areas in Seoul are still trading mainly through urgent sales or price-adjusted listings, the trend is expected to continue sideways without significant price fluctuations for the time being.

A view of the Yeouido apartment area in Yeongdeungpo-gu, Seoul, seen from the 63 Building

A view of the Yeouido apartment area in Yeongdeungpo-gu, Seoul, seen from the 63 Building [Photo by Ryu Taemin]

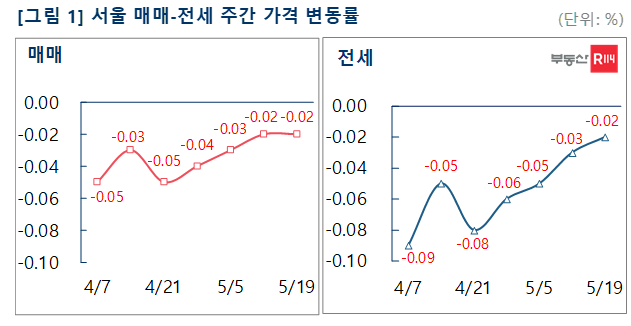

According to Real Estate R114 on the 21st, the apartment sales price change rate in Seoul remained the same as last week at -0.02%. The reconstruction sector showed a slight decrease in the rate of decline compared to the previous week (-0.01%) and recorded stability (0.00%), while general apartments fell by 0.02%. New towns and Gyeonggi/Incheon also dropped by 0.02% respectively.

In Seoul, weakness continued mainly in large-sized units in older complexes, with a gap remaining between sellers' and buyers' desired prices. By region, the declines were as follows: ▲Dongdaemun (-0.13%) ▲Gwanak (-0.09%) ▲Mapo (-0.09%) ▲Dongjak (-0.07%) ▲Jungnang (-0.07%) ▲Guro (-0.05%) ▲Gangbuk (-0.04%) ▲Seongbuk (-0.04%) ▲Yeongdeungpo (-0.04%).

In new towns, the decline was centered on first-generation new towns, with ▲Ilsan (-0.12%) ▲Pyeongchon (-0.04%) ▲Sanbon (-0.03%) ▲Jungdong (-0.02%) falling. In contrast, all second-generation new towns remained stable.

In Gyeonggi and Incheon, the downward adjustments were as follows: ▲Paju (-0.08%) ▲Uiwang (-0.07%) ▲Bucheon (-0.06%) ▲Gimpo (-0.04%) ▲Uijeongbu (-0.04%) ▲Osan (-0.04%) ▲Gunpo (-0.03%) ▲Yongin (-0.03%) ▲Goyang (-0.02%) ▲Namyangju (-0.02%) ▲Icheon (-0.02%).

Baek Saerom, lead researcher at Real Estate R114, said, "Most areas in Seoul are still trading occasionally with urgent sales or price-reduced listings. Considering that there are no noticeable positive factors to reverse the market, it is judged that the trend of sideways movement without significant price fluctuations will continue for the time being."

The jeonse (long-term lease) market is showing signs of a gradual slowdown in the rate of decline as accumulated listings are quickly absorbed. Seoul fell by 0.02%, marking a reduction in the decline for four consecutive weeks. New towns and Gyeonggi/Incheon fell by 0.03%.

In Seoul, the downward trend in jeonse prices continued this week, mainly in the northeastern area, as in the previous week. By region, the declines were: ▲Dongdaemun (-0.11%) ▲Jungnang (-0.10%) ▲Gangbuk (-0.07%) ▲Gangseo (-0.07%) ▲Dongjak (-0.07%) ▲Gangdong (-0.05%) ▲Seocho (-0.04%) ▲Seongbuk (-0.03%) ▲Yongsan (-0.03%) ▲Jung-gu (-0.03%).

In new towns, declines were seen in ▲Ilsan (-0.19%) ▲Jungdong (-0.05%) ▲Dongtan (-0.03%) ▲Bundang (-0.01%).

In Gyeonggi and Incheon, the decline was mainly in large complexes, with the number of stable areas increasing by three from a week ago to 16. By region, the declines were: ▲Uiwang (-0.18%) ▲Bucheon (-0.08%) ▲Gimpo (-0.07%) ▲Namyangju (-0.05%) ▲Yongin (-0.05%) ▲Uijeongbu (-0.05%) ▲Siheung (-0.03%) ▲Anyang (-0.03%) ▲Icheon (-0.02%).

Researcher Baek explained, "It is expected to take some time before jeonse prices reach a recovery stage. Although the recent decline in jeonse prices has slowed, factors such as anxiety over jeonse fraud, discounted transactions due to reverse jeonse, new supply from newly built apartments, and seasonal off-peak periods could act as variables, so there is a possibility of further price declines."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)