Thanks to the government's proactive deregulation policies and the financial sector's reduction of loan interest rates, the housing business outlook index has risen for four consecutive months this month. On the other hand, the financing index deteriorated, indicating that the financial pressure on housing construction companies is gradually intensifying.

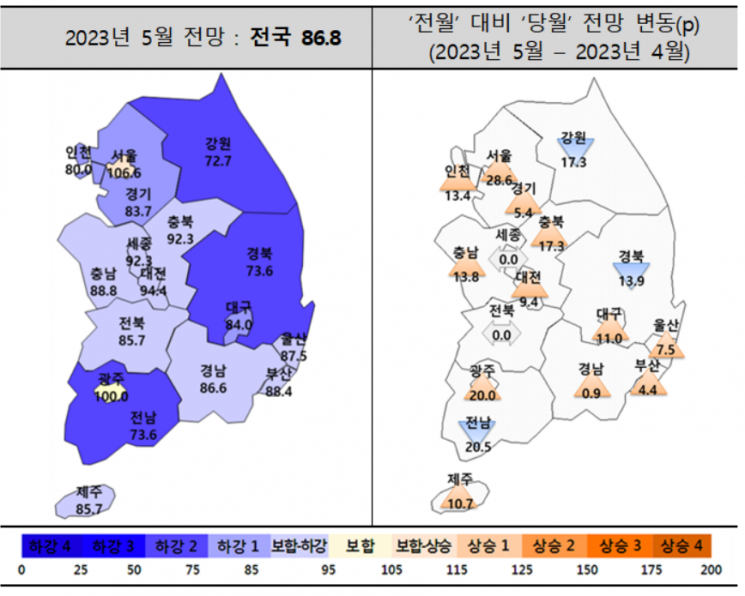

According to the Korea Housing Institute (KHI) on the 19th, a survey on the perceived business conditions of housing construction was conducted targeting members of the Korea Housing Association and the Korea Housing Builders Association. The nationwide housing business outlook index for this month was 86.8, up 5.3 points from the previous month. This marks the fourth consecutive month of increase following April's 81.5.

The improvement in the housing business outlook is due to the government's real estate deregulation measures and the financial sector's reduction of loan interest rates, which have increased housing transaction volumes since February. However, KHI explained that although the housing business outlook index has been on a general recovery trend since early this year, the index remains below 100 at 86.8, making it difficult to say that it has entered a full-fledged recovery phase.

By region, the rise was particularly notable in the Seoul metropolitan area. Seoul recorded 106.6, an increase of 28.6 points from the previous month, marking the largest increase among all regions. Incheon and Gyeonggi also rose by 13.4 points (66.6→80.0) and 5.4 points (78.3→83.7), respectively. This is attributed to the lifting of regulations across the metropolitan area, including adjustment zones, the launch of low-interest loan products such as the Special Home Loan (Teukrye Bogeumjari Loan), and housing demanders such as young actual buyers perceiving the current housing market as near the bottom, revitalizing the buying sentiment for housing in prime locations in the metropolitan area.

However, despite the nationwide upward trend, Jeonnam's index fell the most, dropping 20.5 points (94.1→73.6). This contrasts with Gwangju, which rose 20.0 points, the largest increase among non-metropolitan areas. KHI explained, "Previously, the indices for Gwangju and Jeonnam moved in similar patterns, but this month the indices moved sharply in opposite directions," adding, "This appears to be due to supply and demand conditions, employment, and the influx of young people."

Contrary to the improving trend in the housing business outlook, financing conditions have worsened. The financing index for May fell 6.0 points from 66.6 to 60.6. KHI analyzed, "The government is actively implementing measures to ease real estate financial tightening, such as expanding financial support for housing construction projects and increasing project financing (PF) loan guarantees. However, due to increased actual risks, the performance of PF guarantee expansion and unsold housing loan guarantees is very poor," adding, "As the housing market continues to stagnate with unsold housing stockpiles, financial institutions are reluctant to invest in real estate PF projects, reflecting the gradually intensifying financial pressure on housing construction companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.