Harim Holdings Caught in Plunge Triggered by SG Securities, Stock Price Plummets

Kim Jun-young, De Facto Largest Shareholder of Harim Holdings, Appointed as Executive Director of NS Shopping

As an Unlisted Company, Management Burden is Low... Chairman Kim Hong-guk Likely to Focus on Yangjae-dong Development

Mr. Kim Jun-young, who was appointed as an internal director of NS Shopping last March. He is the eldest son of Kim Hong-guk, chairman of Harim Group, and the largest shareholder of Harim Holdings.

Mr. Kim Jun-young, who was appointed as an internal director of NS Shopping last March. He is the eldest son of Kim Hong-guk, chairman of Harim Group, and the largest shareholder of Harim Holdings.

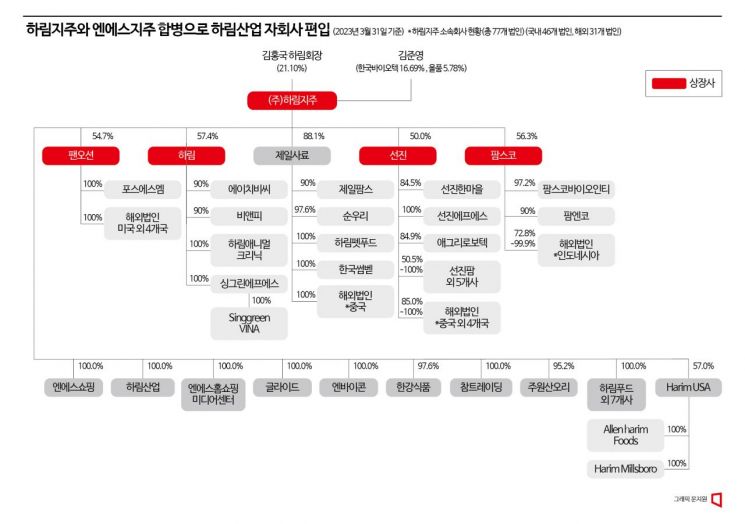

Kim Jun-young, the de facto largest shareholder of Harim Holdings who was caught up in the stock plunge triggered by Soci?t? G?n?rale (SG) Securities, is set to take a full-fledged role in management. Recently, Kim Hong-guk, Chairman of Harim Group, handed over the executive director position at NS Shopping, the operator of NS Home Shopping, to his eldest son Jun-young. Harim Group completed its corporate governance restructuring last year through affiliate splits and mergers. Accordingly, it appears that Jun-young has begun his formal management training.

NS Shopping held a shareholders' meeting on March 28 and newly appointed Jun-young as an inside director. He is currently serving as a non-executive director without holding any official position. The business community views Jun-young’s return as a registered executive of NS Shopping, one of the group's key affiliates, after joining Harim Holdings’ management support office in 2018 and leaving in 2021, as part of his management training.

NS Shopping is an unlisted affiliate wholly owned by Harim Holdings. Compared to listed affiliates such as Pan Ocean, Harim, Seonjin, and Farmsco, it is relatively free from shareholder pressures. Last year, NS Shopping recorded sales of 550.9 billion KRW and operating profit of 39.7 billion KRW. While sales remained similar to 2021, operating profit decreased by 36%. If Jun-young can deliver results at NS Shopping, where profitability improvement is urgent, it could reduce friction when he joins the management of major affiliates.

On the 4th, NS Shopping held the 22nd anniversary ceremony of NS Home Shopping’s founding. In a video congratulatory message, Chairman Kim Hong-guk said, "The home shopping business must undergo a complete transformation suitable for the digital environment and pioneer new areas. If we move forward without fear and without bending, our path will open there." Born in 1992, Jun-young was thus given a justification to actively take on new challenges at NS Shopping.

Group Governance Restructuring from Kim Jun-young → Allpum → Harim Holdings

Previously, Harim Group began restructuring its affiliates over a decade ago to enable Jun-young to secure shares. In 2012, Chairman Kim gifted 100% of Allpum shares to Jun-young, incurring gift tax in the hundreds of billions of KRW. Harim Group began supporting Allpum through its affiliates. Pig farms such as Farmsco and Porkland purchased animal pharmaceuticals from Allpum, while feed companies like Seonjin and Jeil Feed procured functional feed additives through Allpum.

With support from Harim Group affiliates, Allpum laid the foundation for growth. On December 16, 2015, Allpum’s extraordinary shareholders’ meeting resolved to buy back and cancel 62,500 common shares at 160,000 KRW per share. Jun-young sold his Allpum shares and pocketed 10 billion KRW.

Harim Group then restructured its governance through affiliate splits and mergers. Last year, the restructuring was finalized by making NS Shopping a wholly owned subsidiary. After making NS Shopping a 100% subsidiary, the company was split into distribution and investment business divisions. The investment division, NS Holdings, was merged with Harim Holdings, and Harim Industry, which is promoting the urban high-tech logistics complex project in Yangjae-dong, was made a subsidiary.

After the governance restructuring, Allpum, wholly owned by Jun-young, rose to the top of Harim Group’s governance structure. Allpum holds 5.78% of Harim Holdings’ shares. Korean Biotech, a 100% subsidiary of Allpum, also holds 16.69% of Harim Holdings’ shares. Effectively, they hold 22.47% of Harim Holdings, making them the largest shareholder. Chairman Kim Hong-guk holds 21.1% of Harim Holdings. Last year, Harim Holdings recorded consolidated sales of 13.7753 trillion KRW, operating profit of 941.3 billion KRW, and net profit of 569 billion KRW.

Chairman Kim, who passed the NS Shopping executive director position to his son, is expected to focus on the urban high-tech logistics complex project in Yangjae-dong. Harim Group is developing an urban high-tech logistics complex on the site of the Korean Cargo Terminal (Pi City) in Yangjae-dong. The Korean Cargo Terminal site in Yangjae-dong spans 91,082 square meters (about 28,000 pyeong). Harim Group has submitted the urban high-tech logistics complex development plan application to Seoul City and is awaiting approval.

Recently, Seoul City’s Urban and Architectural Joint Committee approved the "Yangjae Residential District Unit Plan Decision," which covers about 3 million square meters around the Yangjae Interchange (IC). With the Yangjae IC area freed from regulations, expectations for Harim Group’s development project are rising.

Kim Jang-won, a researcher at IBK Investment & Securities, explained, "Harim Group is promoting development with a floor area ratio of 800%," and "The news that the Gyeongbu Expressway will be undergrounded from Yangjae IC to Hannam IC is an opportunity for nearby land values to rise." He added, "The development of the Yangjae-dong site is closely related to the growth potential of Harim Group’s food business based on logistics."

※The recent stock plunge triggered by SG Securities has sounded an alarm for order in the capital market. Readers’ reports will be a great help in uncovering the truth. We welcome any reports regarding investment damage cases, suspicions of stock manipulation and asset concealment by the La Deok-yeon side, insider information on large-scale sales by major shareholders of Dow Data and Seoul Gas, or any other content (jebo1@asiae.co.kr). Asia Economy will do its best to establish transparent capital market order.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)