The metropolitan area subscription market, which showed signs of stagnation last year, is reviving. This is due to the government's deregulation policies introduced earlier this year and the recovery of the housing sales market, which has led to an influx of investment demand into the subscription market. However, there are concerns that a clear polarization phenomenon is emerging in subscriptions, with a large number of prospective subscribers flocking depending on factors such as sale prices and locations, calling for caution in investment.

A banner announcing the closing of the first priority subscription is hung in front of a redevelopment complex in Gangbuk-gu, Seoul.

A banner announcing the closing of the first priority subscription is hung in front of a redevelopment complex in Gangbuk-gu, Seoul. [Photo by Yonhap News]

According to Korea Real Estate Agency's Subscription Home on the 18th, Doosan We've Trigeum near Saejeol Station in Eunpyeong-gu, Seoul, recorded an average competition rate of 78.9 to 1, with a total of 9,550 applicants for 121 general sale units in the first-priority subscription held on the 16th. The highest competition rate was for the 59.9㎡ (exclusive area) T-type, where 494 applicants competed for one unit, resulting in a 494 to 1 competition rate. This complex also recorded an average competition rate of 27.5 to 1 in the special supply subscription held the previous day, with 3,133 applicants for 114 units.

Recently, other sale complexes in Seoul have also seen high competition rates. In the first-priority subscription for Huigyeong Xi Decencia in Huigyeong-dong, Dongdaemun-gu, held last month, 17,013 applicants competed for 329 units, resulting in a high competition rate of 51.7 to 1. In March, in Yangpyeong-dong, Yeongdeungpo-gu, the first-priority subscription for Yeongdeungpo Xi Dignity saw 19,478 applicants for 98 units, with an average competition rate of 198.76 to 1.

The success of these complexes is attributed to their sale prices being lower than the surrounding market prices. The average sale price per 3.3㎡ at Doosan We've Trigeum near Saejeol Station was 26.1 million KRW, priced at 700 million to 800 million KRW for an 84㎡ unit. Huigyeong Xi Decencia averaged 29.3 million KRW per 3.3㎡, with 84㎡ units priced between 820 million and 970 million KRW, while Yeongdeungpo Xi Dignity averaged 34.11 million KRW per 3.3㎡, with 84㎡ units around 1.17 billion KRW. The sale prices are similar to or about 100 million KRW cheaper than nearby market prices, which is considered reasonable given the soaring sale prices centered in the metropolitan area.

On the other hand, in other metropolitan areas such as the outskirts of Incheon and Gyeonggi, some complexes are experiencing subscription shortfalls depending on location and price. Michuhol Lubru Sungui in Sungui-dong, Michuhol-gu, Incheon, received only 31 applications for 50 units during the first and second priority subscriptions until the 16th, resulting in a low competition rate of 0.62 to 1. In Wondang-dong, Seo-gu, Incheon, Cantavil The Suite conducted first and second priority subscriptions for 609 units last month but only received 232 applications, resulting in a shortfall with a competition rate of 0.38 to 1.

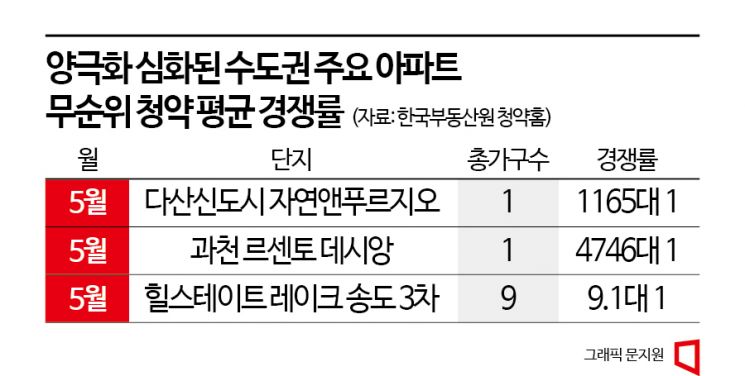

Meanwhile, polarization is intensifying even in the no-priority subscription market. On the 15th, a no-priority subscription was held for a total of 6 units across 4 complexes in Gwacheon Knowledge Information Town, attracting 14,175 applicants and recording an average competition rate of 2,362.5 to 1. Among the complexes, Lesento Desiang in Gwacheon recorded the highest competition rate with 4,746 applicants for one unit. In Dasan New Town, Namyangju, Gyeonggi, 1,165 applicants competed for one unit canceled from the contract at Jayeon & Prugio in a no-priority subscription held on the 8th.

Conversely, the no-priority subscription market in Incheon showed poor results. Hills State Lake Songdo 3rd phase, located in Songdo-dong, Yeonsu-gu, recruited 9 units canceled from contracts through no-priority subscription but only 82 applicants applied, resulting in a competition rate of 9.1 to 1. Considering that this complex recorded an average competition rate of 44.7 to 1 in the first-priority subscription when it was first sold in 2020, this subscription, supplied at the same price as three years ago, is considered to have underperformed.

The revival of the subscription market atmosphere is interpreted as an effect of deregulation. Earlier this year, the government removed all autonomous districts except the Gangnam 3 districts and Yongsan-gu from the regulated areas and significantly eased the resale restriction period.

Park Jimin, head of the Monthly Subscription Research Institute, explained, "After the government's deregulation, the subscription market has become active, and prospective subscribers are flocking to complexes supplied at low sale prices," adding, "As the housing market outlook brightens with continued rebound transactions in the sales market, the subscription market is also reviving."

Park Wongab, senior real estate specialist at KB Kookmin Bank, said, "A super-polarization phenomenon is occurring where subscribers flock only to profitable places," adding, "However, since deregulation recently allows household members and multi-homeowners to subscribe, which may cause an illusion of inflated subscriber numbers, it is more accurate to look at contract rates as an indicator."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.