Only New Loan Interest Rates Have Dropped

Outstanding Loan Interest Rates Continue to Rise

The Atmosphere Still Fails to Feel the Interest Rate Decline

Although banks have lowered their loan interest rates, it feels like a different world for existing borrowers. While the interest rates on new loans have decreased, the outstanding loan interest rates have reached their highest levels in over a decade. Both credit loan and mortgage loan (Judaemdae) interest rates for existing borrowers continue to rise without showing signs of decline.

Interest Burden Continues to Increase for Existing Credit and Mortgage Loan Borrowers

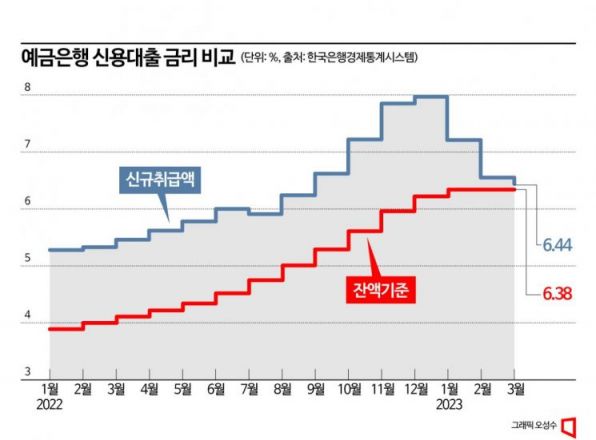

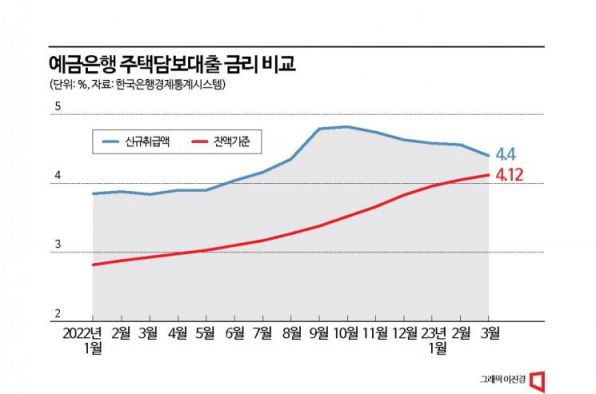

According to the Bank of Korea's Economic Statistics System on the 17th, the outstanding balance-based interest rates at domestic deposit banks continue to rise. The outstanding balance-based interest rate applies to existing borrowers. As of March, the credit loan interest rate was 6.38%, marking the highest level since November 2013 (6.39%). The mortgage loan interest rate was 4.12%, the highest since September 2013 (4.13%).

Both loan interest rates have not dropped even once since hitting their lowest points in May 2021 and have been rising until March this year. During this period, credit loan rates increased by 3.17 percentage points (from 3.22% to 6.39%), and mortgage loan rates rose by 1.48 percentage points (from 2.64% to 4.12%).

This is quite different from the rapidly declining interest rates applied to new borrowers at banks. The new loan interest rate for credit loans peaked at 7.97% in December last year and dropped to 6.44% by March this year. Mortgage loan interest rates also rose to 4.82% in October last year before falling to 4.40%.

The trend of rising interest rates for existing borrowers means that many do not feel the effects of the rate cuts. A representative from a commercial bank said, "New borrowers would definitely notice a drop in interest rates if they consult for loans now compared to earlier this year, but existing borrowers face their own interest rate adjustment cycles, so it will take more time for them to feel the rate cuts. Since the outstanding loan amount is much larger than the new loan amount, most people still think interest rates are going up."

The rising delinquency rates are also largely influenced by the increasing interest rates for existing borrowers. According to the Financial Supervisory Service, as of February, the delinquency rate for credit loans was 0.64%, and for mortgage loans, it was 0.20%. These figures represent increases of 0.27 percentage points and 0.09 percentage points respectively compared to a year ago.

Banks Lower Interest Rates Only on New Loans, Limitations Are Clear

Although the Financial Services Commission and the Financial Supervisory Service are pressuring banks to lower loan interest rates, the limitations are clear. Banks have only reduced rates for new borrowers. Even within banks, this is seen as a superficial gesture. To provide interest rate reductions to existing borrowers, banks would need to adjust the additional interest rates, which is not an easy task. Moreover, since new loans are not as actively issued as in the past, the effect of interest rate reductions is expected to be limited.

A financial industry official said, "To expect a proper effect from interest rate cuts, policies should include both new and existing borrowers, but no bank has ever done this. However, considering that many borrowers have chosen variable-rate mortgage loans and the downward trend of COFIX, it is expected that interest rates for existing borrowers will also start to decline in the second half of this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)