Nearly 29% Decrease in April KOSPI Trading Volume

Impact of SG Securities-Induced Crash... KOSDAQ Margin Loan Balance Also Declines

In May, the daily trading value of the KOSPI and KOSDAQ markets fell below 10 trillion won. The balance of credit loans, which indicates the scale of 'debt investment (debt-financed investment)', has also been decreasing after peaking last month. This is interpreted as a result of weakened investor sentiment following the stock price crash triggered by Soci?t? G?n?rale (SG) Securities. As individual investors leave the stock market, securities firms that had suspended or restricted credit loan transactions are now resuming credit loan services one after another, making an all-out effort to prevent customer attrition.

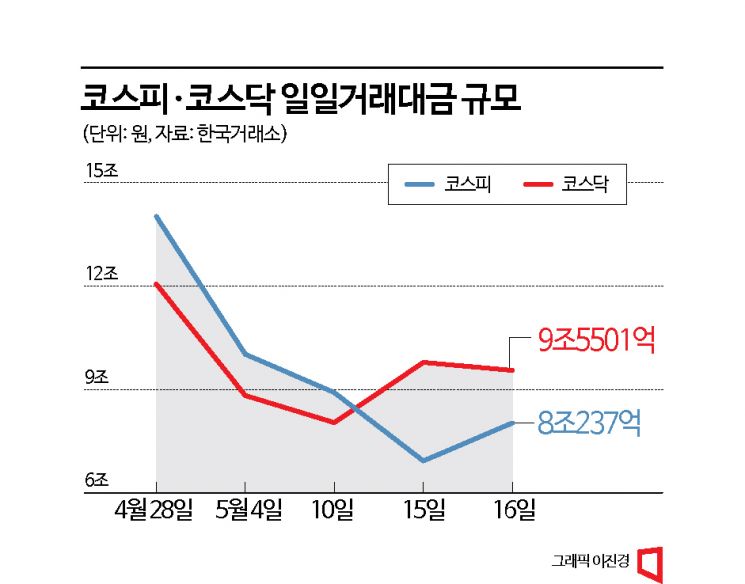

According to the Korea Exchange, the daily trading value of the KOSPI on the 16th was 8.0237 trillion won. Although this is a slight increase compared to 6.9203 trillion won the previous day, the average daily trading value in May has dropped sharply to around 8.9835 trillion won, falling below 10 trillion won. This represents a decrease of about 28.70% compared to the average daily trading value of 12.6 trillion won in April.

On the same day, the daily trading value of the KOSDAQ market also fell below 10 trillion won, recording 9.5501 trillion won. The daily trading value of the KOSDAQ market has been steadily declining below 10 trillion won since it peaked at 17.8227 trillion won on the 10th of last month. The daily trading value is an indicator of the degree of overheating in the stock market, and a decrease in daily trading value means that more investors are leaving the market.

The reduction in the amount of funds flowing into the stock market is interpreted as a result of heightened caution about debt investment following the SG Securities stock price crash and weakened investor sentiment toward some overheated stocks. The correction of secondary battery stocks, which led the rise of the KOSDAQ market this year, also appears to have had an impact.

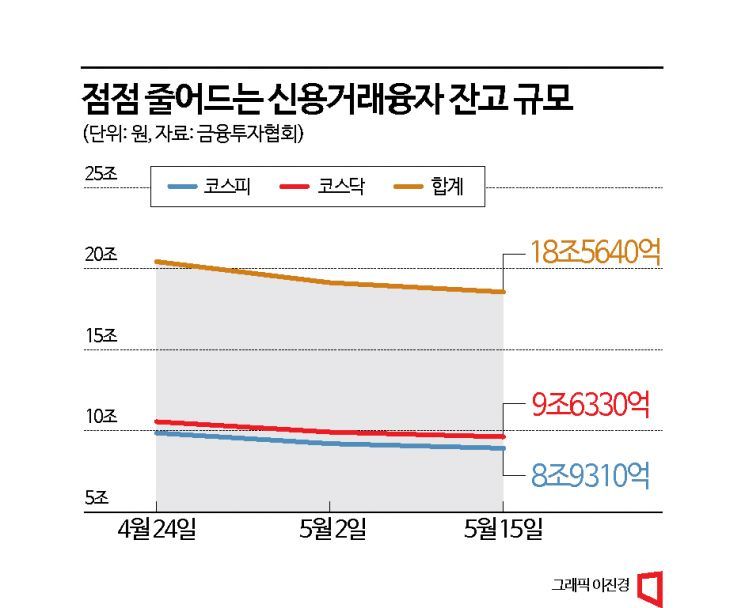

The scale of 'debt investment' is also decreasing. According to the Korea Financial Investment Association, the balance of credit loan transactions, which indicates the scale of debt investment, peaked at 20.4319 trillion won (KOSPI + KOSDAQ) on the 24th of last month, when the SG Securities stock price crash occurred, and has steadily decreased to 18.564 trillion won as of the 15th of this month. In particular, the balance of credit loan transactions in the KOSDAQ market has significantly decreased. It recorded 10.5631 trillion won on the 24th of last month but dropped to 9.633 trillion won as of the 15th, a decrease of about 8.8% in three weeks.

Soyeon Park, a researcher at Shin Young Securities, analyzed, “This year, individual investors’ cumulative net purchases in the KOSDAQ market amount to 4.7 trillion won, while the increase in credit loan balances reached 2.4 trillion won. The increase in credit loans exceeds 50% of the individual net purchase amount, indicating that the strong performance of the KOSDAQ market this year was significantly influenced by short-term leveraged betting.”

As the number of individual investors leaving the stock market increases, securities firms that had suspended or adjusted credit loan limits are resuming credit loan services one after another. Korea Investment & Securities resumed new credit loan purchases and securities collateral loans from 8 a.m. on the day. Previously, on the 21st of last month, Korea Investment & Securities had suspended credit loan services at all branches and online platforms due to the exhaustion of credit limits. KB Securities, which had restricted credit loan and securities collateral loan services since the 26th of last month, also announced the easing of service restrictions on the same day. The securities industry recorded 'surprise earnings' in the first quarter thanks to the stock market boom, but due to the possibility of large-scale unpaid receivables caused by forced liquidation of contracts for difference (CFD) trades, which are considered the epicenter of the SG Securities stock price crash, it has become difficult to guarantee second-quarter earnings. This is interpreted as a preemptive measure to prevent the outflow of individual investors before brokerage revenue, regarded as the main contributor to the first quarter’s surprise earnings, declines.

Junho Hwang, a researcher at Sangsangin Securities, diagnosed, “Following the SG Securities incident, major securities firms implemented measures such as suspending credit loans and raising margin rates, which contributed to weakened investor sentiment and additional downward pressure on the stock market. In particular, unlike foreign investors who have been net buyers of the KOSPI this year, individual investors have been net buyers in the KOSDAQ market through credit loans, so the tightening of credit loan conditions by securities firms can be seen as a major cause of the sharp decline in secondary battery stocks.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)