CEO Score, Q1 Performance Analysis of 309 Out of Top 500 Companies

Operating Profit Plummets from 50.5 to 25.9 Trillion Won in One Year

Samsung Electronics and SK Hynix Hit Hardest, Hyundai Motor and Kia Show Growth

Operating profits of major domestic conglomerates have halved in one year, decreasing by about 25 trillion won. This is due to the semiconductor industry being hit, leading to a decline in operating profits in the IT and electrical electronics sectors, including Samsung Electronics and SK Hynix. Hyundai Motor and Kia showed resilience by increasing their operating profits.

According to a survey by CEO Score, a corporate data research institute, on the 16th, among the top 500 domestic companies by sales, 309 companies recorded operating profits of 25.8985 trillion won in the first quarter, down 48.8% from the same period last year (50.5567 trillion won). The operating profits of these companies have decreased for three consecutive quarters: -11.4% in Q3 last year, -69.1% in Q4, and -48.8% in Q1 this year. First-quarter sales increased by 6.8% to 700.7684 trillion won compared to 656.4551 trillion won in the same period last year.

By industry, operating profits decreased in 11 out of 19 sectors. The IT and electrical electronics sector saw the largest decrease in operating profits. This sector posted operating profits of 20.943 trillion won in Q1 last year but recorded an operating loss of 794.1 billion won in Q1 this year, turning to a deficit. The sectors with significant decreases in operating profits were petrochemicals (-3.4023 trillion won, down 41.4%), transportation (-3.2064 trillion won, down 65.5%), pharmaceuticals (-688.5 billion won, down 62.2%), and steel (-657.8 billion won, down 41.1%).

On the other hand, the automotive and parts sector's operating profit in Q1 was 7.9671 trillion won, up 81.6% from 4.3861 trillion won in the same period last year. Shipbuilding and machinery equipment (1.58 trillion won, up 4109.9%), services (470 billion won, up 15.6%), securities (271.7 billion won, up 11.8%), and distribution (145 billion won, up 39.6%) also saw significant increases in operating profits.

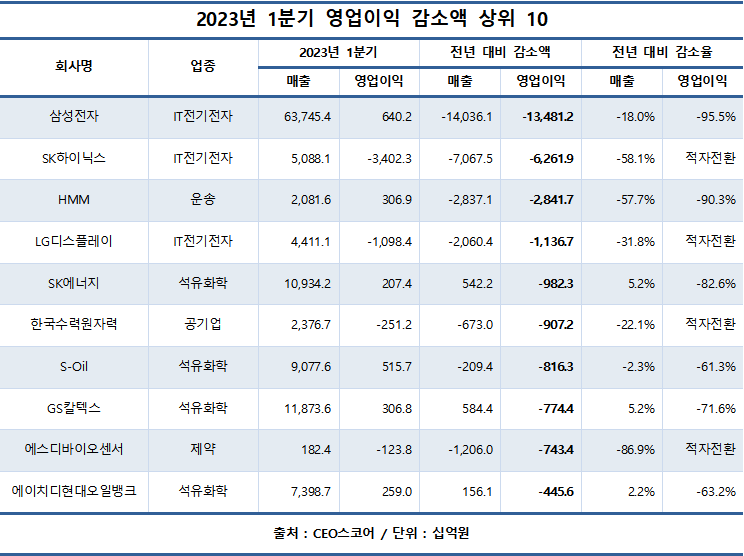

By company, Samsung Electronics had the largest decrease in operating profits in Q1. It recorded 640.2 billion won, plunging 95.5% compared to the same period last year. This was the lowest performance in 14 years since Q1 2009 (590 billion won). Samsung Electronics also officially announced plans to cut memory semiconductor production for the first time in 25 years since 1998. SK Hynix, also suffering from the 'semiconductor cold wave' like Samsung Electronics, followed. SK Hynix posted an operating loss of 3.4023 trillion won in Q1, turning to a deficit. This is the worst loss since it was acquired by the SK Group in 2012.

HMM had the next largest decrease in operating profits. HMM's Q1 operating profit plunged 90.3% year-on-year to 306.9 billion won. This was affected by maritime freight rates falling back to pre-COVID-19 pandemic levels. LG Display (down 1.1367 trillion won) and SK Energy (down 982.3 billion won) followed.

The company with the largest increase in operating profits was Hyundai Motor. Hyundai Motor's operating profit in Q1 this year was 3.5927 trillion won, up 1.6638 trillion won (86.3%) from 1.9289 trillion won in the same period last year. Korea Electric Power Corporation (KEPCO) followed Hyundai Motor. Although KEPCO posted a loss in Q1, the deficit was significantly reduced compared to last year. KEPCO recorded an operating loss of 6.1776 trillion won in Q1, down from 7.7869 trillion won in Q1 last year, reducing the deficit by about 1.6 trillion won.

Kia (up 1.2675 trillion won), Hanwha (up 907.3 billion won), and SK (up 539.7 billion won) also increased their operating profits.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.