U.S. President Joe Biden is delivering a speech on the federal government debt ceiling at SUNY Westchester Community College in Valhalla, New York, on the 10th (local time). On this day, President Biden defined raising the debt ceiling as an issue to protect "the reputation we have painstakingly built as the most trusted and reliable country in the world," and reiterated his determination to push through the debt ceiling increase without compromise with the Republican Party. [Image source=Yonhap News]

U.S. President Joe Biden is delivering a speech on the federal government debt ceiling at SUNY Westchester Community College in Valhalla, New York, on the 10th (local time). On this day, President Biden defined raising the debt ceiling as an issue to protect "the reputation we have painstakingly built as the most trusted and reliable country in the world," and reiterated his determination to push through the debt ceiling increase without compromise with the Republican Party. [Image source=Yonhap News]

U.S. President Joe Biden and the opposition Republican Party will hold a second round of negotiations next week over adjusting the federal government debt ceiling. With less than three weeks remaining until the so-called default 'X-date' mentioned by U.S. Treasury Secretary Janet Yellen, attention is focused on whether a dramatic agreement can be reached. As the U.S. default crisis could significantly impact the global economy, economic authorities and markets are also on high alert.

Earlier, President Biden, Senate Democratic Leader Chuck Schumer, Senate Republican Leader Mitch McConnell, House Speaker Kevin McCarthy, and House Democratic Leader Hakeem Jeffries met for about an hour on the 9th to resolve the debt ceiling increase issue but failed to reach an agreement. They had initially planned to meet again on the 12th to continue discussions but postponed the schedule to next week.

President Biden is scheduled to depart for Japan on the 17th (local time) to attend the Group of Seven (G7) summit, so it is highly likely that a meeting will take place on the 15th or 16th. There was speculation that Biden might attend the summit online instead of traveling to Japan if the default issue was not resolved, but the U.S. government maintains that there is no change to Biden’s plan to attend the G7 summit in person.

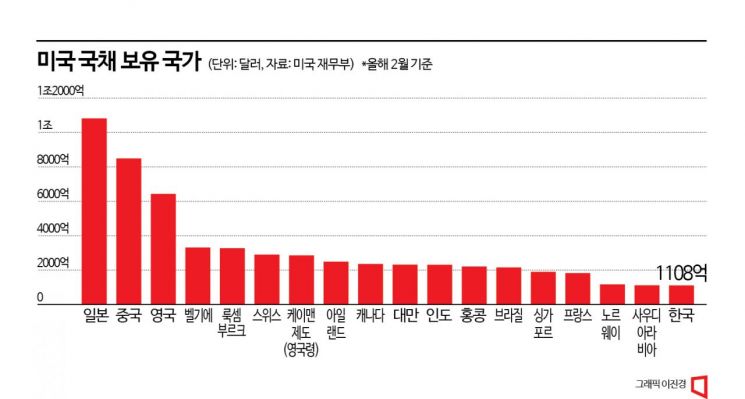

The U.S. government’s statutory debt limit is $31.4 trillion, which was already reached in January. The government insists that Congress must raise the limit unconditionally to avoid default, but the Republicans are demanding government spending cuts. Treasury Secretary Yellen, who mentioned the federal government default date as next month’s 1st, said, "If Congress fails to negotiate, it will truly damage the United States’ creditworthiness."

If a U.S. default materializes next month, the suspension of U.S. Treasury interest payments could plunge the global economy into turmoil. Julie Kozack, spokesperson for the International Monetary Fund (IMF), said at a briefing on the 11th (local time), "If the U.S. defaults, it would have very serious effects not only on the U.S. but also on the global economy, including the possibility of increased borrowing costs."

Jamie Dimon, CEO of JPMorgan Chase, recently stated in an interview with Bloomberg TV that a U.S. default could be a disaster and that he is convening weekly war room meetings. He said, "The closer we get to default, the more panic there will be," adding, "It will affect customers worldwide."

As concerns over a U.S. default grow, a preference for safe assets may spread, potentially causing a sharp outflow of foreign investment from emerging markets such as South Korea. In 2011, Democrats and Republicans clashed over the debt ceiling limit and came close to default, prompting global credit rating agency Standard & Poor’s (S&P) to downgrade the U.S. sovereign credit rating by one notch. This led to a sharp decline in stock prices not only in the U.S. but also in South Korea and Europe, intensifying the debt crisis.

On the previous day in the New York foreign exchange market, the dollar traded at 135.720 yen, up 1.165 yen (0.87%) from the previous New York session’s closing price of 134.555 yen. The dollar index, which reflects the dollar’s value against six major currencies, rose 0.59% to 102.677 from the previous close of 102.072. This is interpreted as increased market anxiety due to the sluggish debt ceiling negotiations and a rise in demand for the dollar as a safe asset.

The key question is whether the debt ceiling issue can be resolved before President Biden’s departure. If negotiations fail again at next week’s meeting, Biden’s overseas schedule could be affected. After the G7 summit, there will be just over a week left until the U.S. default deadline. As the default date approaches, market anxiety will intensify, making financial market shocks inevitable.

At the G7 finance ministers’ meeting in Niigata, Japan, Treasury Secretary Yellen emphasized that the threat of default alone could lead to a downgrade of the U.S. sovereign credit rating, similar to 2011. Since a U.S. default could also affect economic recession, exchange rates, and domestic financial market instability, South Korea’s Ministry of Economy and Finance and the Bank of Korea are closely monitoring the situation. Moody’s has warned that if a default occurs, the U.S. gross domestic product (GDP) could shrink by 4%, and more than 7 million people could lose their jobs.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)