Hyundai Motor Group 1Q Operating Profit Margin 10.5%

Top Operating Profit Margin Among Mass Brands

Volkswagen 7.5% · Toyota 6.5%

Hyundai Motor Group's Low Fixed Costs Key to Profitability

"It is groundbreaking for a mass brand of a complete car manufacturer to achieve double-digit operating profit margins during a period of great transformation like today."

Hyundai Motor Group achieved a double-digit operating profit margin (10.5%) in the first quarter of this year. Based on the profitability indicator of operating profit margin, it surpassed Toyota and Volkswagen to claim the top spot among mass brands. Industry insiders evaluate that it is unusual for a mass brand covering everything from mid-range to premium vehicles to achieve double-digit operating profit margins. Now, it is on par with Mercedes-Benz and BMW, which generate high profits from premium vehicles.

Hyundai Motor Group Ranks '1st' in Operating Profit Margin Among Mass Brands

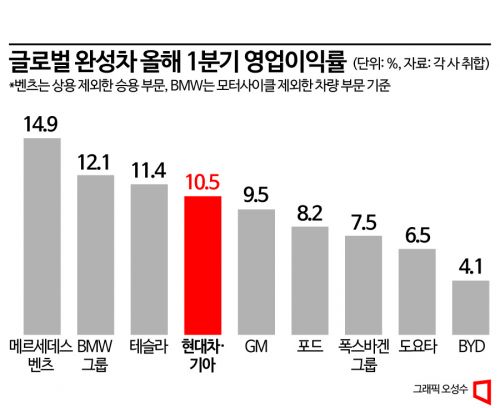

With Toyota's earnings announcement on the 10th (local time), the first quarter earnings season for major global complete car manufacturers has concluded. Asia Economy analyzed the first quarter earnings of nine major complete car manufacturers (Toyota, Mercedes-Benz, Tesla, Ford, Volkswagen Group, Hyundai Motor Group, BMW, BYD, GM) and found that Hyundai Motor Group recorded the highest operating profit margin among mass brands at 10.5%. Hyundai Motor had 9.5%, and Kia had 12.1%.

Expanding the scope to include premium brands, Mercedes-Benz (passenger car division) showed the highest operating profit margin at 14.9%. Next were BMW (vehicle division) at 12.1%, Tesla at 11.4%, Hyundai Motor and Kia at 10.5%, GM at 9.5%, Ford at 8.2%, Volkswagen Group at 7.5%, Toyota at 6.5%, and BYD at 4.1%.

In particular, Kia surpassed the premium electric vehicle brand Tesla (11.4%). It is at the same level as BMW (12.1%), which only sells high-performance and high-priced passenger cars.

Although Hyundai Motor and Kia lagged behind Toyota in terms of global sales volume and revenue, they secured the world’s second position by surpassing Toyota in operating profit and operating profit margin, which are profitability indicators. Toyota's revenue was 93.42 trillion KRW, 1.5 times more than Hyundai Motor and Kia, but operating profit was similar at around 6 trillion KRW (applying the average exchange rate for the first quarter).

In terms of global sales volume in the first quarter of this year, Toyota ranked first with 2.33 million units sold (Toyota’s figure is retail, Volkswagen and Hyundai Motor’s are wholesale). Volkswagen Group was second with 2.12 million units, and Hyundai Motor Group was third with 1.79 million units.

Hyundai Motor and Kia’s Profitability Secret: ‘Low Fixed Costs’

Experts attribute Hyundai Motor Group’s high profitability to 'low fixed costs.' In Korea, they maximized the use of existing internal combustion engine plants for electric vehicle production, and overseas, they minimized labor costs through parts modularization, which proved effective.

Hyundai Motor and Kia have entered a period where depreciation of previously invested internal combustion engine plants and facilities is almost complete. Hyundai Motor’s Asan plant was built in 1994, and Kia’s Hwaseong Plant 3 was built in 1997, the most recent domestic plants.

In other words, the existing domestic plants producing internal combustion engine vehicles have almost finished reflecting fixed costs (depreciation) over more than 25 years. Going forward, it is expected that the proportion of operating existing plants converted into electric vehicle production lines will be higher than establishing new plants for production efficiency.

While new brands like Tesla are struggling with establishing new plants to reduce costs, Hyundai Motor Group only needs to modify existing plants. Mixed production of existing internal combustion engine vehicles, parts sharing, and production line rearrangement are possible. This means a significantly reduced investment (fixed cost) burden.

Overseas, where there are relatively many new plants, they reduced labor costs by creating parts clusters near the plants. When parts suppliers that entered alongside deliver modularized ‘chunk parts,’ Hyundai Motor and Kia only need to perform final assembly.

Samsung Securities analyzed that Hyundai Motor and Kia have the lowest fixed cost ratio relative to sales among global companies, at 11.2% and 9.7%, respectively. Researcher Im Eun-young of Samsung Securities said, "Existing complete car manufacturers have entered the investment recovery period for internal combustion engine vehicles," adding, "Hyundai Motor and Kia, which have the lowest fixed cost ratio relative to sales and are expected to have high sales growth, will show the most remarkable improvement in profitability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)