Hyundai Motor and Kia Hit 52-Week Highs Fueled by Strong Earnings

Foreign Investors Buy 1.1599 Trillion KRW of Hyundai and 505.5 Billion KRW of Kia Since Early Year

The KOSPI closed below the 2,500 mark, seemingly confirming the stock market adage "Sell in May." Amid this, the rally in automobile stocks stands out. Hyundai Motor and Kia have both surged to new 52-week highs, showing unstoppable momentum. In particular, foreign investors are driving the stock price increases by concentrating their purchases on automobile stocks.

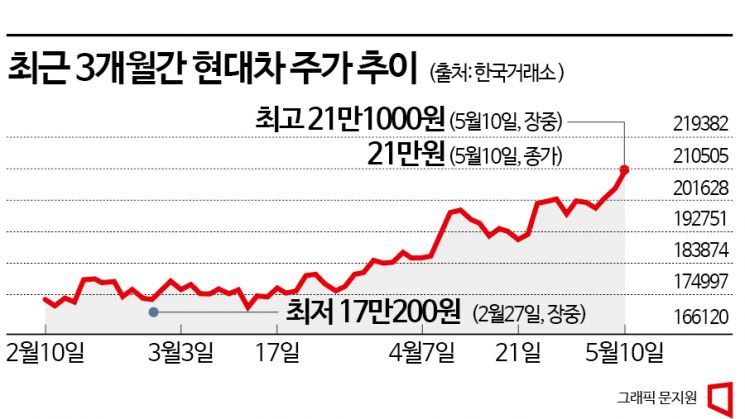

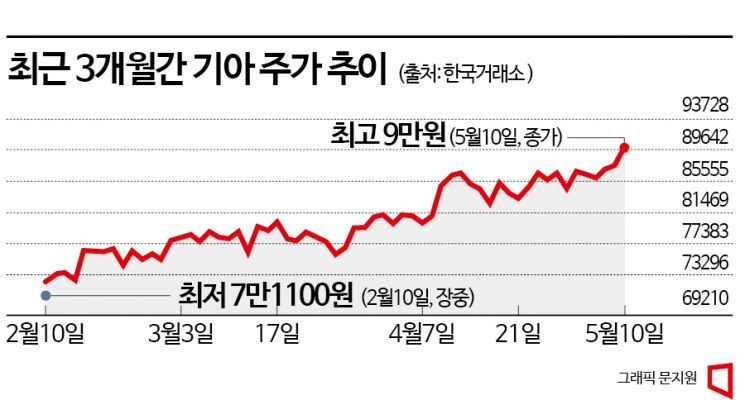

According to the Korea Exchange, on the 10th, Hyundai Motor and Kia both reached new 52-week highs. Hyundai Motor's stock price closed at 210,000 KRW, up 2.44% from the previous trading day. During the session, Hyundai Motor's price briefly rose to 211,000 KRW, marking a new 52-week high. Kia also closed at 90,000 KRW, up 2.74% from the previous day, setting a new 52-week high. Since the beginning of the year, Hyundai Motor and Kia have risen 39.07% and 51.77%, respectively.

The driving force behind Hyundai Motor and Kia's stock prices is foreign investors. Over the past month (April 10 to May 10), foreigners purchased 425 billion KRW worth of Hyundai Motor shares and 224.6 billion KRW worth of Kia shares. Since the start of the year, foreigners have bought 1.1599 trillion KRW of Hyundai Motor and 505.5 billion KRW of Kia shares. Notably, foreigners have been continuously buying Hyundai Motor for 11 consecutive trading days and Kia for 8 consecutive trading days, sending strong buy signals.

The solid first-quarter earnings underpin the unstoppable rally of Hyundai Motor and Kia's stock prices. Hyundai Motor reported first-quarter sales of 37.7787 trillion KRW, a 24.7% increase compared to the same period last year, and operating profit of 3.5927 trillion KRW, up 86.3% year-over-year. The operating profit exceeded market consensus by 23%. Kia's operating profit also rose 78.9% year-over-year to 2.874 trillion KRW, surpassing consensus by 24%.

In the securities industry, Hyundai Motor and Kia's earnings are expected not to be just short-term earnings surprises, leading to raised expectations. According to FnGuide, Hyundai Motor's operating profit forecast for this year has been revised upward by 21.6% from 10.6563 trillion KRW a month ago to 13.021 trillion KRW. Kia's operating profit forecast for this year also increased by 22.8% to 10.6563 trillion KRW compared to a month ago. Securities firms are raising target prices for Hyundai Motor and Kia one after another. Hana Securities and Eugene Investment & Securities have named Hyundai Motor and Kia as their top picks in the automobile industry and issued "overweight" recommendations.

Researcher Lim Eun-young of Samsung Securities said, "Hyundai Motor is entering a recovery phase for investments accumulated over the past 20 years amid inflation and high interest rate environments, making it a comfortable investment target that offers not only stock price appreciation but also dividend yields." She added, "By 2026, Hyundai Motor's global sales volume is expected to reach 9.2 million units, surpassing Toyota to become the world's number one automaker." She continued, "Kia's first-quarter operating margin was 12.1%, exceeding Tesla's automotive segment operating margin of 11%. Regarding fixed costs, Kia's amortization ratio relative to sales fell to 2.8% last year, whereas Tesla's was 17.6%. After 2024, as electric vehicles enter a price competition era, companies with lower fixed costs will have an advantage."

Researcher Nam Ju-shin of Kyobo Securities analyzed, "Although the first quarter is traditionally an off-season, Kia is likely to exceed its early-year guidance due to expanded sales of high-margin SUVs and electric vehicles. The current stock price is still undervalued with a low price-to-earnings ratio (PER) of 4 to 5 times, making it a top pick within the sector."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.