Analysis of Actual Jeonse Transaction Prices in Seoul in May

Gangnam, Mokdong, and Others Down Over 500 Million Won from Peak Prices

Experts Predict "Reverse Jeonse Crisis Peak in Second Half"

Concerns are rising that the reverse jeonse crisis, which has hit non-apartment properties such as villas and officetels in Seoul, could massively spread to apartments in the second half of the year. Since jeonse prices peaked at the end of 2021, there is an analysis that a deposit non-return crisis could occur at the end of this year when contract expirations come due. Already, across Seoul, transactions showing a drop of more than 500 million KRW compared to jeonse prices two years ago are occurring frequently.

Banpo Aripak National Standard Jeonse Price Drops from 2.3 Billion KRW to 1.55 Billion KRW

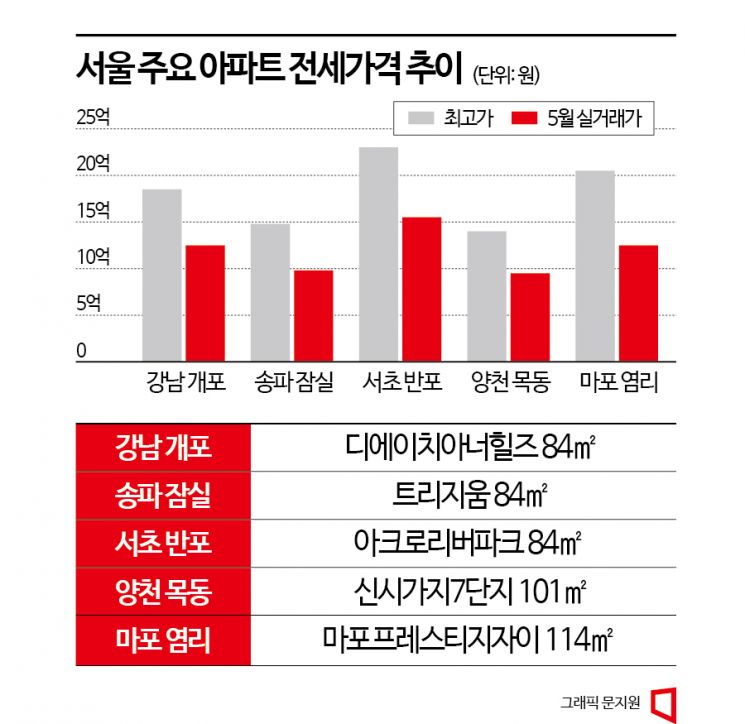

On the 11th, Asia Economy analyzed the actual jeonse transaction prices of major Seoul apartments in May and found contracts with differences of up to 700 million KRW or more compared to the highest prices recorded in 2021-2022.

First, focusing on the Gangnam 3 districts, in Gaepo-dong, Gangnam-gu, the D.H. Honor Hills 84㎡ (exclusive area) signed a jeonse contract on the 1st for 1.25 billion KRW. This is 600 million KRW lower than the highest price of 1.85 billion KRW recorded in September 2021. Due to rising interest rates intensifying the aversion to jeonse, and the move-in of residents to nearby Gaepo Xi Residence, landlords who could not find tenants lowered the jeonse price.

Similarly, in Jamsil-dong, Songpa-gu, the Trizium 84㎡ signed a jeonse contract on the same day for 980 million KRW, which is 500 million KRW lower than the 1.48 billion KRW recorded in October 2021.

Additionally, in Banpo-dong, Seocho-gu, the Acro River Park 84㎡ renewed its jeonse contract on the 8th for 1.55 billion KRW, a drop of 750 million KRW compared to 2.3 billion KRW in May last year.

Signs of Reverse Jeonse Crisis Across Seoul Beyond Gangnam 3 Districts... Mokdong Not Exempt

In the market, a situation where jeonse prices fall making it difficult to return deposits is commonly called ‘reverse jeonse,’ and such signs are appearing not only in the Gangnam 3 districts but throughout Seoul.

In Yeomni-dong, Mapo-gu, Mapo Prestige Xi 114㎡ signed a jeonse contract on the 1st for 1.25 billion KRW, which is 750 million KRW less than 2 billion KRW in June last year.

In Pyeong-dong, Jongno-gu, Kyunheegung Xi Complex 3, 84㎡ also traded on the same day for 900 million KRW, which is 500 million KRW less than 1.4 billion KRW in October 2021.

Likewise, Mokdong in Yangcheon-gu, known for its high demand due to school districts, is no exception. On the 9th, Shinsigaji Complex 7 signed a jeonse contract for 950 million KRW, which is 450 million KRW less than the highest price of 1.4 billion KRW recorded in December 2021. A real estate agent in Mokdong said, "It’s fortunate if they can find tenants at all, but some landlords have been unable to find tenants for over three months after contract expiration and are paying hundreds of thousands in jeonse eviction loan interest."

Expert: "Apartment Reverse Jeonse Peak Will Be at Year-End... DSR Adjustment Needed to Open Exit for Landlords"

The bigger problem is that the ‘apartment reverse jeonse peak’ has not yet arrived. Experts point out that a large number of deposit non-return cases could occur in the second half of this year. Cha Sang-wook, CEO of Connected Ground, explained, "Currently, the reverse jeonse problem is with villas, but reverse jeonse will intensify in the apartment market as well," adding, "Since jeonse prices peaked at the end of last year, structurally, the peak of reverse jeonse will inevitably be at the end of this year."

Park Won-gap, Senior Specialist at KB Kookmin Bank, also said, "Many areas saw jeonse prices peak in 2021, but with the shock of high interest rates, jeonse prices have fallen and now landlords have become the weaker party," adding, "The reverse jeonse crisis will be a major variable in this year’s real estate market."

There are also calls to open an exit for landlords to stabilize the jeonse market before the reverse jeonse peak arrives. Yoon Ji-hae, Research Team Leader at Real Estate R114, said, "With the DSR limited to 40%, rental businesses are restricted and lack the capacity to return deposits," adding, "It is necessary to raise the ratio for those who cannot pay deposits due to liquidity constraints."

Ultimately, there are arguments that the jeonse system itself should be abolished. CEO Cha said, "The government should not promote the private jeonse system by even guaranteeing it," adding, "The limit of jeonse deposit insurance should be drastically lowered so that it naturally disappears from the market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.