Naver Records Highest Quarterly Revenue in Q1, Receives Praise

Kakao Sees Slight Revenue Increase but Earnings Shock in Operating Profit

Domestic and Foreign Securities Firms Lower Kakao Target Prices Consecutively

The stock prices of the national favorites 'Nakao (Naver + Kakao)' are diverging. In the first quarter earnings announcement, Naver recorded its highest quarterly sales, while Kakao saw a slight increase in sales but suffered an earnings shock in operating profit. Boosted by strong performance, Naver's stock price has been on the rise day after day. Kakao's situation is different. Securities firms are continuously lowering Kakao's target price.

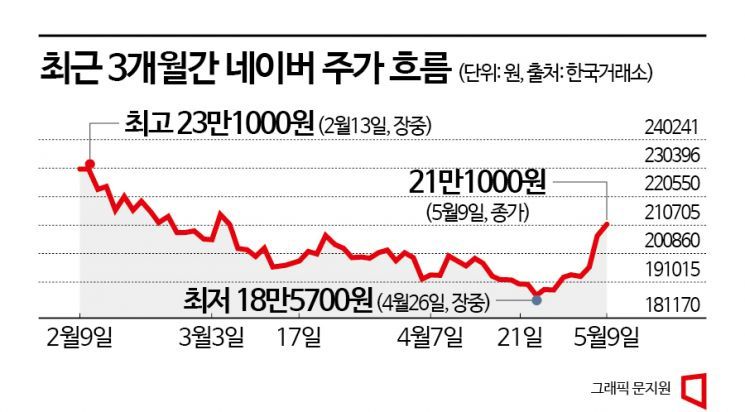

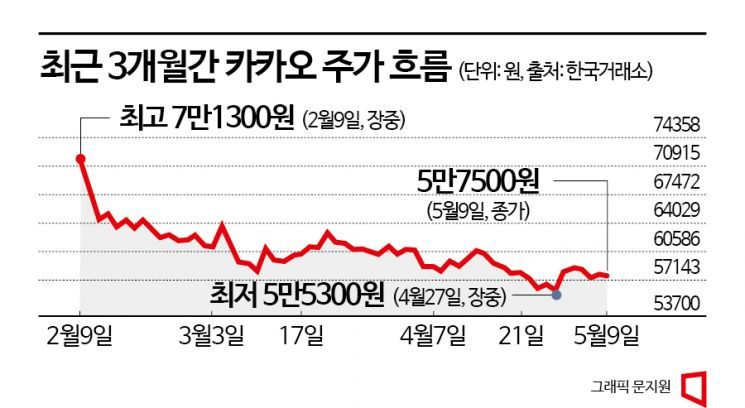

According to the Korea Exchange, on the 9th, Naver's stock price closed at 211,000 KRW, up 1.93% from the previous trading day. Naver's stock price showed strength by closing higher for eight consecutive trading days since the 26th. Kakao closed the day at 57,500 KRW, down 0.35% from the previous trading day. Compared to the beginning of the year (January 2 to May 9), Naver rose 18.87%, while Kakao only increased by 8.29%.

The first quarter earnings are what separated the fortunes of Naver and Kakao, which once ranked side by side in the top 10 market capitalization on the KOSPI and became national favorites. Naver's first-quarter sales increased by 23.6% year-on-year to 2.2804 trillion KRW, while Kakao's sales rose by 5% to 1.7403 trillion KRW. In operating profit, Naver recorded 330.5 billion KRW, up 9.5% year-on-year, exceeding market expectations, but Kakao suffered an earnings shock with operating profit dropping 55% to 71.1 billion KRW during the same period.

Accordingly, the views of securities firms on Naver and Kakao are diverging. So-hye Kim, a researcher at Hanwha Investment & Securities, said, "Naver's first-quarter earnings exceeded expectations," adding, "Despite prolonged economic downturn, Naver maintains a higher growth rate compared to global big tech companies." Ho-yoon Jung, a researcher at Korea Investment & Securities, also evaluated, "The effect of Naver's acquisition of Poshmark appeared faster than initially expected, achieving EBITDA profitability from this quarter. Besides Poshmark, high growth in seller-centered D2C (Direct to Consumer) and reservation services is rapidly increasing commission revenue, which is positive."

Securities firms are continuously lowering Kakao's target price. As of this day, five securities firms including Mirae Asset, Kiwoom, Hana, Hanwha, and Kyobo Securities have simultaneously lowered Kakao's target price. Mirae Asset adjusted it from 82,000 KRW to 80,000 KRW, Kiwoom from 82,000 KRW to 78,000 KRW. Hana (85,000 KRW → 80,000 KRW), Hanwha (80,000 KRW → 75,000 KRW), and Kyobo (87,000 KRW → 74,000 KRW) followed suit. Foreign securities firms also recently lowered Kakao's target price. JP Morgan reduced Kakao's target price from 59,000 KRW to 54,000 KRW, and Citi Securities from 66,000 KRW to 64,000 KRW.

Hee-seok Lim, a researcher at Mirae Asset Securities, analyzed, "Kakao's recent stock price weakness continues due to profitability deterioration caused by sluggish advertising segment," adding, "If the advertising market rebounds significantly and KakaoTalk's user engagement time increases, a stock price rebound can be expected." So-hye Kim of Hanwha Investment & Securities also said, "Kakao's first-quarter earnings fell short of market expectations due to overall sales decline from weakening demand in upstream industries and larger-than-expected marketing and new business investments," forecasting, "Kakao has announced plans to invest more than expected in infrastructure, cloud, AI, and healthcare businesses, and related losses will increase further each quarter this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.