Increase in Assets Under Management for Basic Trusts, ETFs, and ETNs Including Bitcoin

Funds Flowing into the Coin Market as an Alternative Investment Amid Banking Sector Crisis

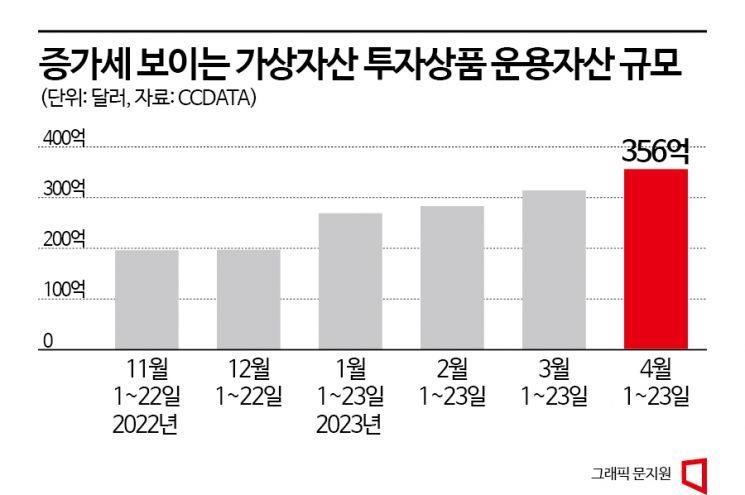

The assets under management (AUM) of virtual asset-related investment products have shown an increasing trend for five consecutive months.

According to virtual asset data provider CCDATA on the 10th, from the 1st to the 23rd of last month, the total AUM of virtual asset investment products was recorded at $35.6 billion (approximately 47.05 trillion KRW). This is an increase of $4.2 billion compared to $31.4 billion during the same period the previous month. The AUM of virtual asset investment products includes trusts, exchange-traded funds (ETFs), and exchange-traded notes (ETNs) based on Bitcoin, Ethereum, and other assets managed by overseas institutions.

The increase in AUM last month is interpreted as virtual assets gaining attention as an alternative investment destination amid ongoing financial market risks. CCDATA explained, "In a situation where new interest in virtual assets is emerging, the failures of traditional finance and market turmoil have had an impact."

Since the collapse of Silicon Valley Bank (SVB) in the U.S. in March, virtual assets have been recognized as a safe haven for investment. Bitcoin was perceived as a kind of 'digital gold,' and as liquidity crises and banking sector risks occurred, funds flowed into the coin market.

Additionally, Ethereum-related assets account for more than 20% of the total AUM, and the rise in Ethereum prices last month is also evaluated as a driver of the increase. The price increase of Ethereum was influenced by the Shapella upgrade conducted on the 14th of last month. Ethereum transitioned from the proof-of-work (PoW) method, where coins are obtained by mining through computer computations participating in the blockchain, to the proof-of-stake (PoS) method last September through the Merge upgrade. In PoS, virtual assets are staked on the blockchain network, and participants receive coins as rewards for operating and validating the blockchain network. To facilitate the Merge upgrade, the Ethereum Foundation recruited blockchain validators who staked a minimum of 32 Ethereum on the blockchain network. Through the Shapella upgrade on the 14th of last month, staked Ethereum could be withdrawn again. With the uncertainty removed by enabling the retrieval of staked Ethereum, the price, which had been in the $1800?$1900 range, even surpassed $2000.

The AUM has shown an increasing trend for five consecutive months since recording $19.6 billion from November 1 to 22 last year. Approximately 70% of the AUM is related to Bitcoin, and the increase in scale appears to be due to the rising price. Until November last year, Bitcoin prices were in the $15,000 range but rose to the $30,000 range last month.

However, adverse factors such as interest rate hikes and the temporary suspension of Bitcoin withdrawals by Binance, the world's largest global virtual asset exchange, due to network disruptions, have overlapped. As a result, Bitcoin prices fell to the $27,000 range, raising the possibility that the AUM growth trend may be halted.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.