[Battery, the Trap of Overproduction] (Part 1)

Battery factories surge but electric vehicle sales lag

Korean 3 companies to produce 463GWh in 2025... supply 6.95 million units

Domestic battery companies have launched large-scale investments to secure a foothold in the North American market, but concerns are emerging that they will soon fall into the ‘trap’ of overproduction. If the construction of factories by the three domestic companies in the North American region proceeds as planned, they will secure production capacity capable of supplying batteries for about 7 million electric vehicles starting in 2025.

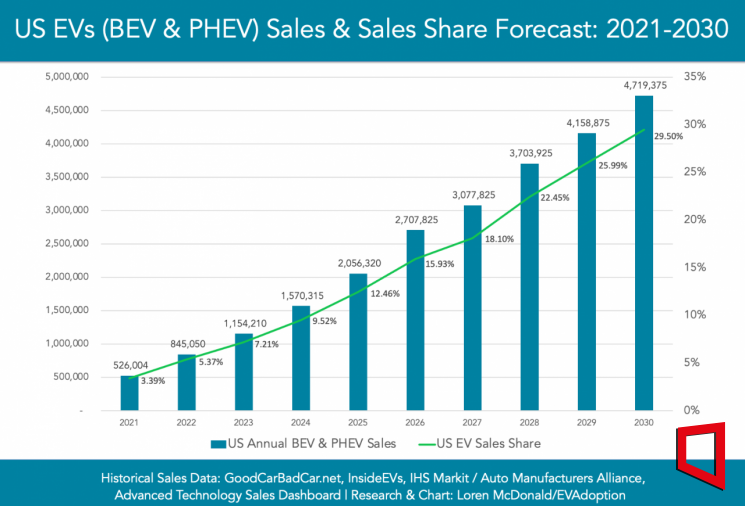

However, the U.S. electric vehicle market is expected to be unable to keep pace with that speed. The U.S. automotive market research firm EVAdoption forecasts that the U.S. electric vehicle market will grow from 850,000 units last year to 2.05 million units by 2025. The International Energy Agency (IEA) also expects 3.5 million electric vehicles to be sold in the U.S. in 2025.

EV Adoption, a U.S. automotive market research firm, forecast trends for electric vehicle sales in the United States

EV Adoption, a U.S. automotive market research firm, forecast trends for electric vehicle sales in the United States

In addition, battery manufacturers including Japan’s Panasonic, which supplies batteries to Tesla, are also expanding their production facilities. If supply exceeds demand, prices will fall and profitability will inevitably deteriorate. Some point out that proactive countermeasures should be prepared in advance, keeping in mind the possibility of facing a battery overproduction situation.

The North American production capacity of the three domestic battery companies will increase explosively from two years later. At the end of last year, the production capacity was 61.5 GWh. LG Energy Solution has facilities capable of producing 40 GWh at its Michigan plant, and SK On has facilities capable of producing 21.5 GWh at its Georgia plants 1 and 2.

By 2025, when joint venture factories with automakers start operations, the production capacity of the three companies will surge to 463 GWh. LG Energy Solution will have a battery production capacity of 255 GWh as joint ventures such as Ultium Cells with General Motors (GM) begin operations. SK On will have the capacity to produce 185.5 GWh through joint ventures with Ford and Hyundai Motor. Samsung SDI will operate production facilities of 23 GWh jointly with Stellantis.

A battery production capacity of 1 GWh corresponds to the supply for 15,000 electric vehicles, so the combined production capacity of the three companies can supply approximately 6.95 million vehicles. This amount is close to half of the total U.S. vehicle sales last year (13.73 million units).

Japanese and Chinese companies are also actively entering the North American market.

Panasonic, which has factories in Nevada and Kansas in the U.S., is considering building a third electric vehicle battery factory in Oklahoma. It is also reportedly discussing battery factory establishment with Stellantis, BMW, and others. The Chinese company CATL plans to build battery factories in the U.S. through joint ventures with automakers such as Tesla and Ford.

Automakers themselves also plan to build independent battery production plants in North America. Tesla, Ford, Volkswagen, and Toyota have all entered the race. Tesla announced it will invest $3.6 billion (about 4.7 trillion KRW) near its Nevada Gigafactory to build a battery factory and an electric truck factory capable of producing new 4680 batteries for 2 million vehicles annually.

Volkswagen also plans to invest 20 billion Canadian dollars (about 20 trillion KRW) to build a large-scale battery factory in St. Thomas, Ontario, Canada. The production scale will be 90 GWh, enough to supply over 1 million electric vehicles annually. Ford is also establishing a battery development center in Michigan and is exploring in-house battery cell production.

The reason so many battery production facilities are being established simultaneously in North America is to receive benefits under the Inflation Reduction Act (IRA).

The IRA stipulates that if battery parts are produced or assembled within North America, or if critical minerals are extracted or processed in North America or countries with which the U.S. has free trade agreements (FTA), electric vehicle buyers can receive subsidies of up to $7,500 (about 10 million KRW). Additionally, battery manufacturers can receive production tax credits (AMPC) of $35 per kWh for cells and $10 per kWh for modules. Local factories are essential to enjoy these benefits.

However, this also increases the risk of facing oversupply problems. The U.S. Environmental Protection Agency plans to increase electric vehicles to two-thirds, or 67%, of new car sales by 2032. But there is still a long way to go. Last year, electric vehicles accounted for only 5.8% of new car sales in the U.S. The U.S. government has not yet officially announced a timeline for phasing out internal combustion engine vehicles.

Moreover, American consumers are losing interest in electric vehicles. In a recent consumer survey conducted by the University of Chicago’s research center, 47% of respondents said they are unlikely to purchase an electric vehicle next. The main reasons for reluctance to buy electric vehicles were high vehicle prices and lack of charging stations.

If the pace of electric vehicle adoption in the U.S. slows down more than expected, battery mass production plans will inevitably be affected. Especially for domestic companies with vulnerable raw material supply chains, there are concerns that they will bear risks such as increased operating costs, inventory buildup, and price declines. However, some point out that since battery factories cannot operate at 100% capacity immediately after completion, some degree of speed adjustment is possible.

Professor Park Cheol-wan of Seojeong University said, "Overproduction could occur as early as 2024 or 2025, so a Plan B to prepare for this is necessary," adding, "If demand does not increase in the U.S., alternatives such as supplying batteries produced locally to Europe or Asia should be prepared."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.