Rising Sugar Prices Boost Sugar Manufacturers' Stocks

Domino Effect Expected to Lift Food, Beverage, and Confectionery Shares

With "Sugarflation" (sugar + inflation) driving sugar manufacturers' stock prices to hit the upper limit, confectionery-related stocks are also gaining attention. This is due to expectations that rising raw material costs will lead to product price increases, stimulating investor sentiment.

According to the Korea Exchange on the 9th, the stock price of Daehan Sugar, a sugar manufacturer, closed at 4,065 won, up 29.87% from the previous trading day. Samyang Corporation also closed at 53,300 won, up 29.84% from the previous trading day.

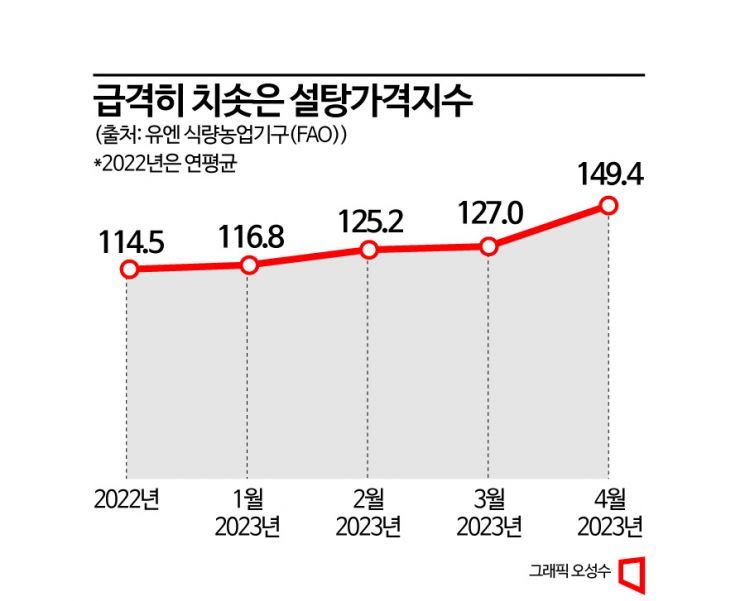

The sharp rise in sugar manufacturers' stock prices is due to the rapidly soaring sugar prices. According to the Ministry of Agriculture, Food and Rural Affairs, the FAO (Food and Agriculture Organization of the United Nations) announced that the global sugar price index for April was 149.4, up 17.6% from the previous month (127.0). Compared to January, it surged 27.9%, marking the highest level in 11 years and 6 months since October 2011. The sugar price index is calculated by setting the average price from 2014 to 2016 as 100% and comparing it accordingly.

The rise in sugar prices is attributed to forecasts of reduced production in major sugar-producing countries. Production outlooks for major sugar producers such as China, India, and Thailand have been continuously downgraded, while the prolonged Russia-Ukraine war and rising international crude oil prices have further fueled the increase in sugar prices. In particular, Brazil, the world's largest sugar producer, is expected to have a favorable sugarcane yield, but increased rainfall due to climate change has delayed harvesting, which is also analyzed to be contributing to the rise in sugar prices.

Due to sugarflation, not only sugar manufacturers but also confectionery and snack-related stocks that use sugar as a raw material are expected to experience a domino effect of price increases. The rise in sugar prices caused by sugarflation has not yet been fully reflected in producer prices, which could lead to further price hikes. According to the industry, there is usually a lag of 4 months to as long as 1 year before consumer prices are affected, and if this trend of sugarflation continues, it will inevitably lead to product price increases. Confectionery companies such as Binggrae and Lotte Confectionery have already implemented a price increase once in March.

While consumer prices are on alert, stock prices in the food sector, including confectionery, are trending upward. According to the Korea Exchange, the food and beverage sector rose 2.59% on the 8th in the KOSPI market. Representative food and beverage and confectionery companies, Binggrae and Orion, rose 15.85% and 20.89%, respectively, compared to the beginning of the year.

Jiwoo Oh, a researcher at Ebest Investment & Securities, said, "Sugar accounts for about 12% of the manufacturing cost in the confectionery sector," adding, "Despite concerns over rising raw sugar prices, cost burdens are expected to ease compared to the end of last year, and the effect of already implemented price increases means that cost burdens will not significantly impact the performance of confectionery and food and beverage sectors." Chansol Park, a researcher at SK Securities, forecasted, "Considering that the period for raw material prices to be reflected in performance is on average six months, operating profit margins of food and beverage companies are expected to improve in the second half of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.