Financial Supervisory Service Investigates Kiwoom Securities Over SG Securities-Induced Stock Price Crash

Collective Lawsuit Movement Emerges Among Stock Manipulation Victims Amid Signs of Individual Investor Boycott

Kiwoom Securities is facing a crisis as it gets entangled in the stock price crash incident triggered by Soci?t? G?n?rale (SG) Securities. As suspicions of stock price manipulation involving Kim Ik-rae, chairman of Daou Kiwoom Group, grow, financial authorities have targeted Kiwoom Securities as the first subject of investigation related to the SG incident. Amidst a boycott movement led by angry retail investors, a class-action lawsuit against Kiwoom Securities is also imminent, compounding the situation. The plan for Kiwoom Securities to rise as a mega investment bank (IB) within the year is expected to face inevitable setbacks.

Intensive Inspection of Kiwoom Securities... Investigation into Chairman Kim Ik-rae’s Suspicions

According to the financial investment industry on the 9th, financial authorities are accelerating inspections of Kiwoom Securities to uncover the truth behind the SG Securities-led crash incident. They are focusing on allegations against the owner, Kim Ik-rae, chairman of Daou Kiwoom Group.

On the 24th of last month, a massive sell-off of eight stocks including Daol Investment & Securities, Samchully, Daesung Holdings, Seoul Gas, Sebang, Harim Holdings, Seonkwang, and Daou Data occurred at the foreign securities firm SG Securities’ counter, triggering a series of limit-down price drops. Two trading days before the crash, on the 20th of last month, Chairman Kim sold 1.4 million shares (3.65% stake) of Daou Data through an after-hours block deal. The disposal price per share was 43,245 KRW. The core suspect of stock price manipulation, Ra Deok-yeon, CEO of H Investment Advisory, pointed to Chairman Kim as the mastermind behind the crash, raising suspicions that Kim may have been aware in advance of the sell-off flooding SG Securities.

Kiwoom Securities is one of the domestic securities firms that signed a Contract for Difference (CFD) agreement with SG Securities, where the sell-off occurred. In fact, most of the volume that flooded SG Securities came from Kiwoom Securities. As of the end of February, Kiwoom Securities’ CFD balance was 518.1 billion KRW, the second highest among domestic securities firms after Kyobo Securities (613.1 billion KRW). Accordingly, the Financial Supervisory Service is focusing on whether Kiwoom Securities had prior knowledge of the CFD forced liquidation information. They are also examining whether Kiwoom Securities complied with conditions and regulations for individual professional investors regarding CFDs, whether customer order information was used, and whether internal employees were involved.

Boycott Movement and Class-Action Lawsuit... Image Damage Inevitable

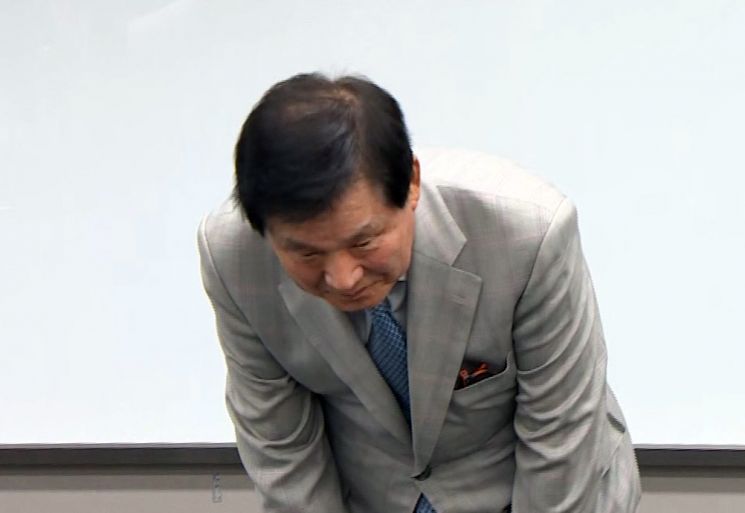

The incident has stirred public opinion, especially among individual investors, damaging Kiwoom Securities’ image as a “retail powerhouse.” Although Chairman Kim Ik-rae held a public apology press conference on the afternoon of the 4th and announced his resignation from the chairmanship of Daou Kiwoom Group and the chairmanship of Kiwoom Securities’ board, the angry public sentiment has not subsided.

Kiwoom Securities has held the No. 1 market share in domestic stock brokerage for 18 consecutive years. According to Kiwoom Securities’ year-end business report last year, it recorded a 35.4% market share in overseas stocks and 19.6% in domestic stocks. Considering that other large securities firms have about a 10% market share in domestic stocks, Kiwoom Securities dominates the stock trading market. Therefore, if distrust among individual investors grows, the business impact is expected to be significant. Currently, the Naver Kiwoom Securities stock discussion board is flooded with posts such as “Moving my account,” “Closing my Kiwoom account,” “I will move to another securities firm,” and “I have lost trust in Kiwoom Securities.”

A financial investment industry insider said, “As some securities firms are running replacement deposit events targeting customers of other firms, movements targeting Kiwoom Securities’ customers are expected to increase, accelerating customer outflow.” Accordingly, the reputation of Kiwoom Securities as the “No. 1 retail market share” is cracking. Founded in 2000 under the name Kiwoom.com Securities, Kiwoom Securities has a large proportion of individual customers, giving it strength in retail brokerage commission fees.

There is also growing momentum for a class-action lawsuit, drawing attention to future developments. Law firm One & Partners plans to recruit class-action plaintiffs starting today, including two individuals who have already requested damages lawsuits. While some law firms are preparing lawsuits against Ra Deok-yeon and his associates, this is the first time a securities firm itself is being sued directly. The plaintiffs acknowledge that they entrusted their ID cards and mobile phones to Ra and his group but argue that the firm failed in its role as an intermediary financial institution by opening high-risk derivative CFD accounts non-face-to-face without proper identity verification, planning to claim damages worth tens of billions of KRW. However, Kiwoom Securities stated, “We have not yet been contacted separately by the legal team,” but emphasized, “Identity verification is naturally conducted when opening non-face-to-face accounts.”

Kim Ik-rae, Chairman of Daou Kiwoom Group, bows his head during a press conference on the afternoon of the 4th at the Kiwoom Securities headquarters in Yeouido, Seoul, regarding the recent stock price crash caused by the foreign securities firm Soci?t? G?n?rale (SG) Securities. Photo by Yonhap News.

Kim Ik-rae, Chairman of Daou Kiwoom Group, bows his head during a press conference on the afternoon of the 4th at the Kiwoom Securities headquarters in Yeouido, Seoul, regarding the recent stock price crash caused by the foreign securities firm Soci?t? G?n?rale (SG) Securities. Photo by Yonhap News.

Plan to Enter Mega IB Market This Year at Risk

Kiwoom Securities’ plan to leap into the mega investment bank (IB) category within the year is also expected to face setbacks. Even if Chairman Kim Ik-rae, embroiled in the stock price crash incident, is cleared of unfair stock trading allegations by the prosecution, the moral hazard of the major shareholder is expected to be a stumbling block, making it difficult to obtain mega IB approval from financial authorities.

Mega IBs can issue promissory notes up to twice their capital to raise funds, allowing stable responses even during liquidity crises. Currently, four securities firms have obtained licenses for promissory note issuance: Mirae Asset Securities, Korea Investment & Securities, NH Investment & Securities, and KB Securities.

Kiwoom Securities has already met the separate capital requirement of 4 trillion KRW, qualifying it to apply for mega IB status. However, with Chairman Kim unable to avoid investigations by prosecutors and financial authorities, the “owner risk” has increased. A financial investment industry insider said, “It is unusual for the owner of a large securities firm to be suspected of unfair trading such as market manipulation and insider trading,” adding, “From the perspective of financial authorities responsible for screening, they cannot ignore public opinion, so approval will be difficult.” Moreover, under current regulations, financial authorities are allowed to suspend screening based on “reputation.” According to Article 12, Paragraph 6 of the Capital Markets Act, one of the key requirements for major shareholders when licensing financial investment businesses is “social credit.”

Jung Eui-jung, head of the Korea Stock Investors Association, said, “Kiwoom Securities claims that Chairman Kim’s sale was a coincidence to raise gift tax, but public suspicion is growing,” and added, “If Chairman Kim is innocent as Kiwoom Securities CEO Hwang Hyun-soon claims, then Chairman Kim should come forward and prove that the party who bought the block deal shares for 60.5 billion KRW was not a manipulative force.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)