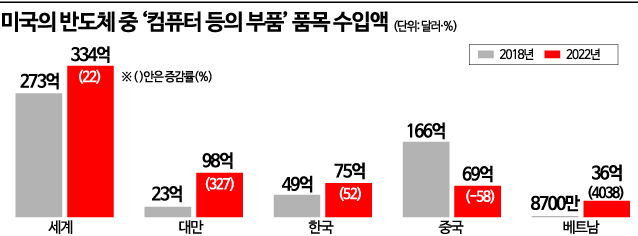

China's Declining Presence in the U.S. Market Filled by Taiwan and Vietnam Instead of Korea

The reality that Taiwan, a semiconductor competitor of South Korea, is the biggest beneficiary of the restructuring of the U.S. semiconductor import market is a warning sign for South Korea, whose economy heavily depends on semiconductor exports. If South Korea fails to fill the gap left by Chinese products in the U.S. semiconductor import market amid ongoing U.S. restrictions on Chinese semiconductors and continues to lose ground to Taiwan, the competitiveness gap between South Korea and Taiwan in semiconductors will inevitably widen.

On the 9th, the semiconductor industry identified the main reason South Korea is not fully benefiting from the restructuring of the U.S. semiconductor import market as the mismatch between South Korea’s main semiconductor export products and the product groups with high U.S. import dependency. This means that South Korea has focused only on exports to China and has not established a proper strategy for semiconductor exports to other countries like the U.S. Taiwan and Vietnam were different. Both countries actively targeted the U.S.’s largest semiconductor import category, 'computer parts,' quickly replacing the Chinese void and also focused on strengthening their positions in high-growth categories within the U.S. semiconductor import market.

For example, the third-largest U.S. semiconductor import category, 'other electronic integrated circuits,' increased by 77% from 2018 to 2022, while imports from Taiwan grew by 119%. In the case of photosensitive semiconductor devices and LEDs, the fourth-largest U.S. semiconductor import category, imports increased by 135%, while imports from Vietnam surged by 874%. An Gi-hyun, Executive Director of the Korea Semiconductor Industry Association, said, "Looking at the categories where Taiwan and Vietnam’s shares in U.S. semiconductor imports have increased, they are electronic components and system semiconductors, which are not South Korea’s main export products." Since South Korea’s and China’s semiconductor export items do not overlap, South Korea could not replace the Chinese void, he explained.

The Korea International Trade Association analyzed the 'U.S. major semiconductor product supply chain structure' and concluded that system semiconductors are dominated by Malaysia, Taiwan, and Vietnam, where U.S. semiconductor back-end process factories are concentrated, leaving no room for South Korea. In memory semiconductors, Taiwan’s market share is 30.7%, surpassing South Korea’s 25.8%. Regarding this, Kim Kyung-hoon, head of the supply chain analysis team at the Korea International Trade Association, said, "Ultimately, a domestic base must be established to move beyond memory-limited exports and enable strategic allocation," adding, "Efforts such as increasing investment in back-end processes and nurturing foundry companies other than Samsung Electronics are necessary."

South Korea’s semiconductor business structure, which is heavily concentrated in China, is also problematic. Samsung Electronics and SK Hynix, which have high global semiconductor market shares, have production plants in China. As the U.S. reorganizes semiconductor supply chains centered on allied countries, semiconductors produced by South Korean companies in China could also be affected. The proportion of overseas production centered in China is 22.4% for Samsung Electronics and 42.6% for SK Hynix, which is significantly higher than Taiwan’s TSMC at 8.5%. This means Taiwan produces most of its semiconductors domestically. This is also why U.S. companies prefer Taiwan over South Korea as a semiconductor manufacturing base.

However, the trend of domestic semiconductor companies establishing production bases in the U.S. could be positive for expanding their influence in the U.S. market, as semiconductors produced in the U.S. can be sold locally. Currently, Samsung Electronics is building a foundry plant in Taylor, Texas, and SK Hynix plans to construct an advanced packaging (back-end process) plant in the U.S.

Meanwhile, concerns have been raised that South Korea’s relatively low research and development investment ratio and high dependence on foreign equipment and materials are obstacles to securing semiconductor competitiveness. South Korea’s R&D ratio relative to semiconductor sales was 8.1% in 2021, the lowest among major countries such as the U.S. (16.9%), China (12.7%), Japan (11.5%), and Taiwan (11.3%). Choo Kwang-ho, head of the Economic and Industrial Headquarters at the Federation of Korean Industries, emphasized, "As our government accelerates improvements in the domestic investment environment, such as expanding tax credits for advanced strategic industry facility investments and speeding up investment permit processing, we must use the global supply chain restructuring as a turning point to strengthen the domestic semiconductor production base and diversify semiconductor export items."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)