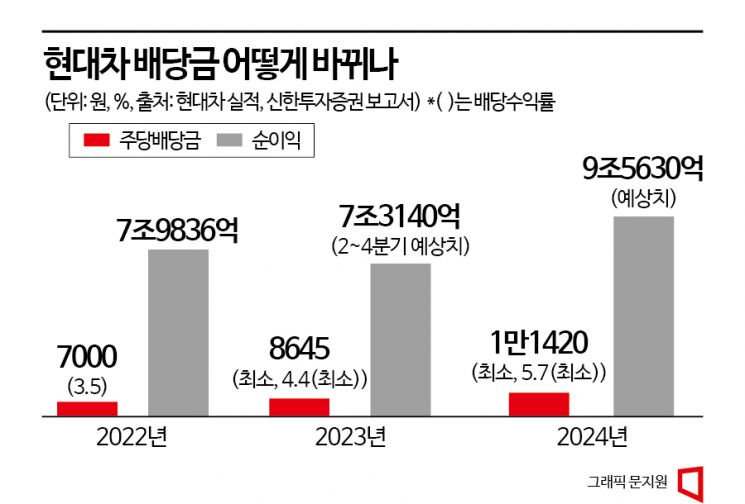

Minimum Dividend Yield of 5.7% Next Year

Double the Average Deposit Interest Rate of 2.77% at 5 Major Banks

Dividend per Share Expected to Rise to at Least 11,420 Won

Hyundai Motor Company, which posted its highest-ever quarterly earnings, has changed its dividend policy. Hyundai's stock price is said to be undervalued. In other words, it does not rise. Despite strong earnings, Hyundai offered higher dividends to shareholders disappointed that the stock price did not increase as expected. The expected dividend yield for Hyundai next year is at least 5.7%. The current average interest rate for fixed deposits at the five major banks (Kookmin, Shinhan, Woori, Nonghyup, Hana) is 2.77%. Simply put, dividend income is more than twice the interest income.

On the 25th, Hyundai announced its "mid- to long-term shareholder return policy" during the Q1 earnings conference call. The key points are ▲changing the dividend payout ratio criteria ▲quarterly dividends ▲share buyback cancellations. The previous policy used 30-50% of free cash flow (FCF) for shareholder returns, but it has been changed to pay dividends of at least 25% of net income (consolidated controlling shareholder basis). Free cash flow refers to the cash remaining after deducting taxes, operating expenses, etc., from the money a company earns. Since the dividend is now based on net income minus increases in fixed assets, it is more beneficial for shareholders. Also, instead of paying dividends twice a year, Hyundai will pay dividends quarterly starting from Q2 this year. Hyundai added that it plans to cancel 1% of issued shares (2,115,000 shares) of treasury stock over three years.

This policy change will increase the dividend per share (DPS) by at least 1,645 KRW. DPS is calculated by multiplying quarterly net income by the dividend payout ratio and dividing by Hyundai’s issued shares (211.5 million shares). Based on common stock, last year’s annual DPS was 7,000 KRW, with a dividend yield of 3.5%. However, using the expected net income for Q2 to Q4 this year (according to Shinhan Investment Corp.), the DPS is at least 8,645 KRW. Dividend yield rises to 4.3%.

Next year’s DPS will be even higher. Reflecting the expected net income (9.563 trillion KRW) and 1% treasury stock cancellation, next year’s DPS is at least 11,420 KRW. This is an increase of 2,775 KRW compared to this year. The dividend yield is expected to reach at least 5.7%. Hyundai plans to cancel 6,345,000 shares of treasury stock over three years. As of March, Hyundai held 8,671,500 shares of treasury stock (4.1% of issued shares). It plans to reduce this to 2,326,500 shares over three years. With fewer shares to distribute dividends on, the amount per share increases.

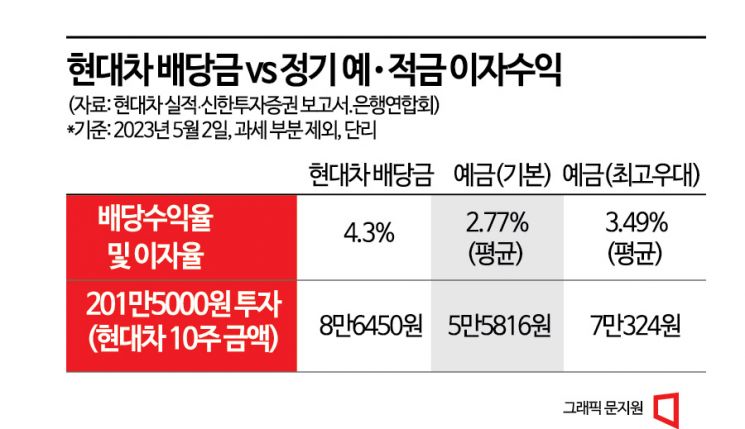

Compared to representative financial products such as fixed deposits and savings accounts, dividend income is higher. Calculations are based on the closing price on the 2nd (201,500 KRW) and exclude taxes such as dividend income tax. As of the 2nd, the average base interest rate for one-year fixed deposits at the five major banks is 2.77% (based on seven products from the Bankers Association portal). If you deposit 2,015,000 KRW, equivalent to 10 Hyundai shares, you would earn 55,816 KRW in interest. This is 30,634 KRW less than the dividend of 86,450 KRW for 10 Hyundai shares this year. Even with the highest preferential interest rate (average 3.49%), interest income would be 70,324 KRW, which is 16,126 KRW less.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.