Seoul Guarantee Insurance (SGI) and Korea Housing Finance Corporation

Rapid Increase in Jeonse Deposit Guarantee Insurance Payouts

On the 26th, members of the National Countermeasure Committee for Jeonse Fraud and Empty Jeonse Victims held a press conference in front of the main building of the National Assembly in Yeouido, Seoul, urging the enactment of a special law on Jeonse fraud. Photo by Hyunmin Kim kimhyun81@

On the 26th, members of the National Countermeasure Committee for Jeonse Fraud and Empty Jeonse Victims held a press conference in front of the main building of the National Assembly in Yeouido, Seoul, urging the enactment of a special law on Jeonse fraud. Photo by Hyunmin Kim kimhyun81@

'Forced auction execution.' Jeong Aram (36), who got married three years ago, feels dizzy just thinking about it a year ago. The moving date was approaching, but the landlord disappeared without answering calls. Jeong said, "People kept coming to the house we were renting under a jeonse contract, so I checked the registry and found that the landlord had moved their address to our house and had huge debts like mortgages and bond settings registered," adding, "Meanwhile, the credit card company even posted a notice on our door saying 'the forced auction procedure will begin.'"

It was literally my money but not really my money. My legs trembled, but the jeonse insurance I had taken out in advance was my savior. He said, "After many twists and turns, it took a month and a half to get the jeonse deposit back, but I never dreamed something like this would happen to me," and added, "If you fall victim to jeonse fraud, the person who has to solve it is the tenant, so even if it costs money, you must get insurance."

You Can Recover Your Deposit Even If the Jeonse House Goes to Auction

As jeonse fraud cases surge, the insurance payout amounts from Seoul Guarantee Insurance (SGI) and Korea Housing Finance Corporation (KHFC), which sell jeonse deposit guarantee insurance products, are also rising sharply.

Jeonse deposit guarantee insurance is a product designed to protect tenants who cannot get their deposits back on time. If the landlord does not return the jeonse deposit after the contract period ends, the guarantee institution pays the deposit to the tenant on behalf of the landlord and later claims the amount from the landlord. Even if the jeonse house goes to auction, tenants who have taken out guarantee insurance can recover their deposits.

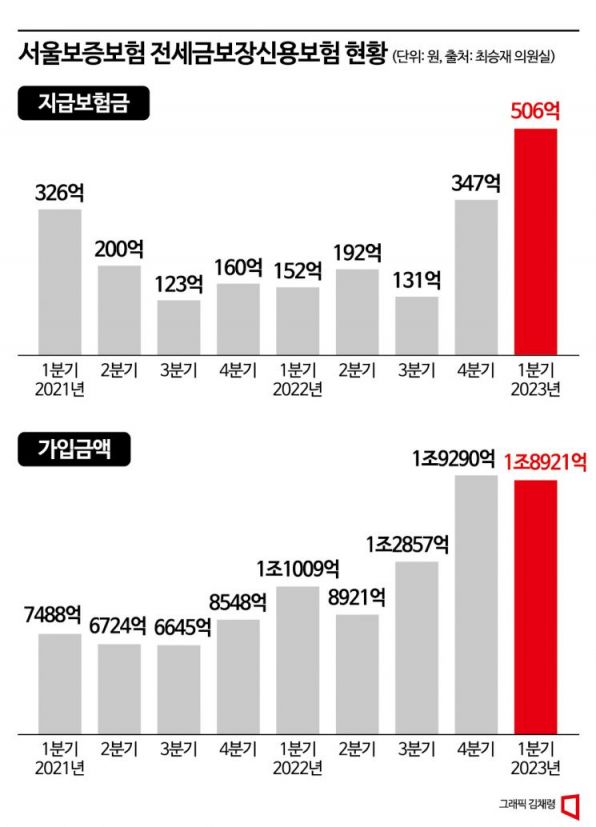

According to related statistics received on the 3rd by Choi Seung-jae, a member of the National Assembly's Political Affairs Committee from the People Power Party, from the two institutions, insurance payouts have increased significantly in the first quarter of this year.

Looking at the last two years of statistics for SGI's 'Jeonse Deposit Guarantee Credit Insurance,' the payout amount had been declining to 13.1 billion KRW in the third quarter of last year. However, it rose to 34.7 billion KRW in the fourth quarter of last year and further increased to 50.6 billion KRW in the first quarter of this year. As the sense of crisis over jeonse fraud spread, the number of tenants taking out insurance steadily increased as well. The subscription amounts by year were 2.94 trillion KRW in 2021 and 5.21 trillion KRW in 2022. In the first quarter of this year alone, it already recorded 1.89 trillion KRW.

KHFC launched the 'Jeonse Deposit Return Guarantee Insurance' product in 2021. About two years after the product was introduced, insurance payouts began to occur starting from the fourth quarter of last year (5.5 billion KRW). In the first quarter of this year, it paid out 10.4 billion KRW to tenants on behalf of landlords, about twice the amount of the previous quarter. This product's subscription amount is also increasing. It was 1.07 trillion KRW in 2021, 3.065 trillion KRW in 2022, and recorded 1.6986 trillion KRW in the first quarter of this year, half of last year's amount.

Government Strengthens Guarantee Insurance Subscription Criteria to Prevent Jeonse Fraud

In addition to SGI and KHFC, the Housing and Urban Guarantee Corporation (HUG) also operates jeonse deposit return guarantee insurance. As a government measure to prevent jeonse fraud, HUG's subscription criteria for jeonse deposit return guarantee insurance have been strengthened starting this month. Previously, it was possible to subscribe up to 1.5 times the publicly announced price, but now it is limited to 1.26 times the publicly announced price.

This is expected to have the effect of lowering jeonse prices. The jeonse guarantee insurance limit acts as an upper limit for the jeonse deposit. Tenants tend to rent within the guarantee limit to avoid losing their deposits. Until now, even if the jeonse price approached the house price, known as 'empty-can houses,' tenants could subscribe to return guarantees, which malicious landlords exploited to induce contracts for empty-can houses. This measure is intended to prevent such incidents.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)