Non-Interest Income Hits 5-Year High... Net Profit at 1.1 Trillion Won

Interest Income and NIM Decrease Compared to Previous Quarter

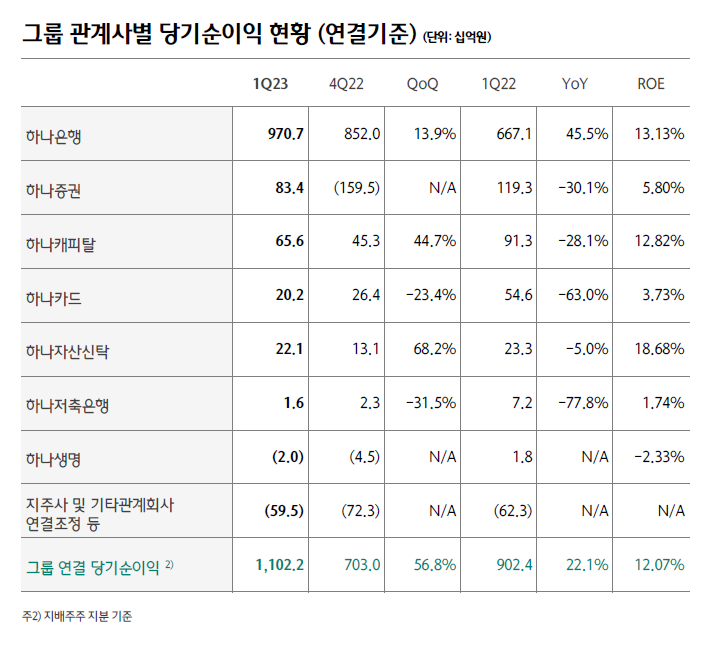

Hana Financial Group's net profit for the first quarter of this year increased by more than 20% compared to the same period last year, reaching the 1.1 trillion KRW level. Efforts in stable cost management were effective, and non-interest income also showed signs of structural improvement, reaching the highest level in five years.

Hana Financial Group announced on the 27th that its consolidated net profit for the first quarter of this year was 1.1022 trillion KRW, an increase of 22.1% (199.8 billion KRW) compared to the same period last year.

Hana Financial explained, "Despite increased risks due to domestic and international economic slowdown and financial market instability, we realized gains from securities trading through appropriate responses to interest rate volatility," adding, "Increased fee income through customer base expansion and stable cost management efforts were also effective."

The group's provision for loan losses and other transfers in the first quarter amounted to 343.2 billion KRW, an increase of 108.5% (178.6 billion KRW) compared to the same period last year. This was to strengthen loss absorption capacity by sufficiently provisioning for loan losses in preparation for internal and external uncertainties.

Specifically, non-interest income reached 778.8 billion KRW, a 52.9% increase compared to the same period last year, marking the largest scale in the past five years. Trading gains from foreign exchange transactions and securities of major affiliates increased, with trading evaluation gains rising 136.4% (277.1 billion KRW) year-on-year to 480.1 billion KRW. Additionally, fee income was recorded at 445.2 billion KRW. A Hana Financial representative explained, "This is due to increased asset management fees from retirement pensions and bancassurance, as well as increased fees related to operating leases and foreign exchange."

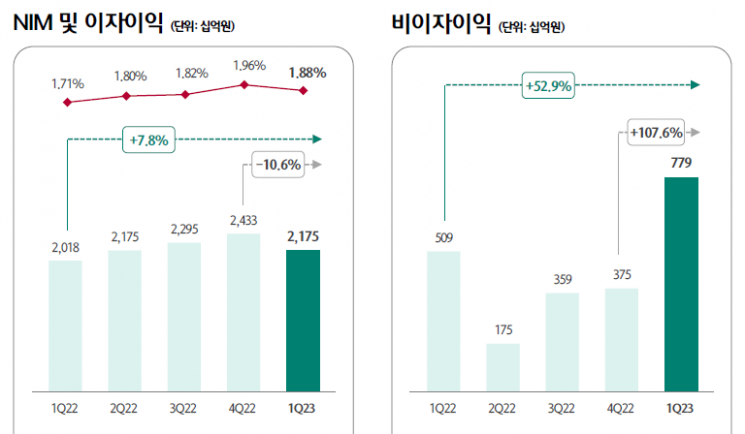

Interest income was 2.175 trillion KRW, down 10.6% (257.5 billion KRW) from the previous quarter. This is attributed to a decline in net interest margin (NIM) (1.88%, down 0.08 percentage points from the previous quarter), fewer days in the quarter, and the impact of IFRS17 adoption. However, it increased by 7.8% compared to the same period last year.

The group's return on equity (ROE) was 12.07%, and return on assets (ROA) was 0.78%. The cost-to-income ratio (CIR) rose 12.2 percentage points year-on-year to 37.5%. Hana Financial stated, "We raised CIR through stable cost management efforts," describing it as "the industry's best cost efficiency."

The NPL coverage ratio was 172.7%, and the ratio of non-performing loans was 0.40%. The estimated Basel III capital adequacy ratio (BIS ratio) and common equity tier 1 ratio were 15.31% and 12.84%, respectively. As of the end of the first quarter, trust assets stood at 169.2216 trillion KRW, and the group's total assets were 757.022 trillion KRW.

Meanwhile, this year Hana Financial Group introduced quarterly dividends for the first time since the establishment of the holding company in 2005. For the first quarter of this year, a quarterly cash dividend of 600 KRW per share will be paid. A Hana Financial representative said, "Based on the group's ‘medium- to long-term shareholder return policy,’ we plan to continue implementing various measures to repay shareholders' trust and enhance shareholder value."

By affiliate, Hana Bank recorded a consolidated net profit of 970.7 billion KRW for the first quarter, a 45.5% increase year-on-year. This is attributed to the won-based net interest spread (NIS), which excludes interest income and interest expenses, increasing by 0.12 percentage points year-on-year to 1.61%, as well as trading evaluation gains and fee income increasing by 112.6% (166.2 billion KRW) compared to the same period last year. Hana Bank's NIM also rose 0.18 percentage points year-on-year to 1.68%.

The NPL coverage ratio was 230.4%, the ratio of non-performing loans was 0.21%, and the delinquency rate was 0.23%. As of the end of the first quarter, the bank's total assets, including trust assets of 86.8896 trillion KRW, amounted to 583.3736 trillion KRW.

Except for Hana Life, which recorded a net loss of 2 billion KRW, down 2.33% year-on-year, all major affiliates such as Hana Securities, Hana Card, and Hana Savings Bank saw net profits increase compared to the same period last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.