Korean Battery 3 Companies Once Unified on Ternary Lithium-Ion Batteries

Diverging Paths Over Next-Generation Batteries

Domestic Investment Focus Shifts to R&D and Manufacturing Processes

SK and Samsung Drive 'All-Solid-State' with Pilot Plants

LG Focuses on Pouch Long Cells and Cylindrical Types for Process Optimization and Cost Reduction

The future strategies of the three battery companies, which have long walked the same path centered on NCM (Nickel-Cobalt-Manganese) ternary batteries, are subtly diverging. While LG Energy Solution is focusing on optimizing QCD (Quality, Cost, Delivery), SK On (a battery subsidiary of SK Innovation) and Samsung SDI are increasing investments in all-solid-state batteries, considered the next-generation battery. All-solid-state batteries solidify materials that were previously liquid or gel-like, such as electrolytes and anode materials. They are regarded as 'next-generation batteries' due to their safety and high energy density.

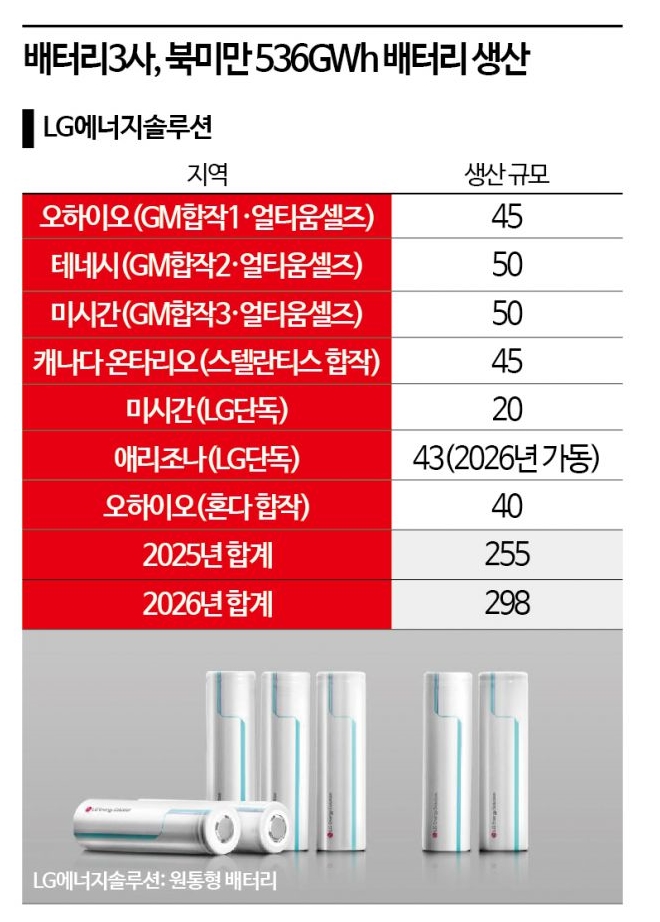

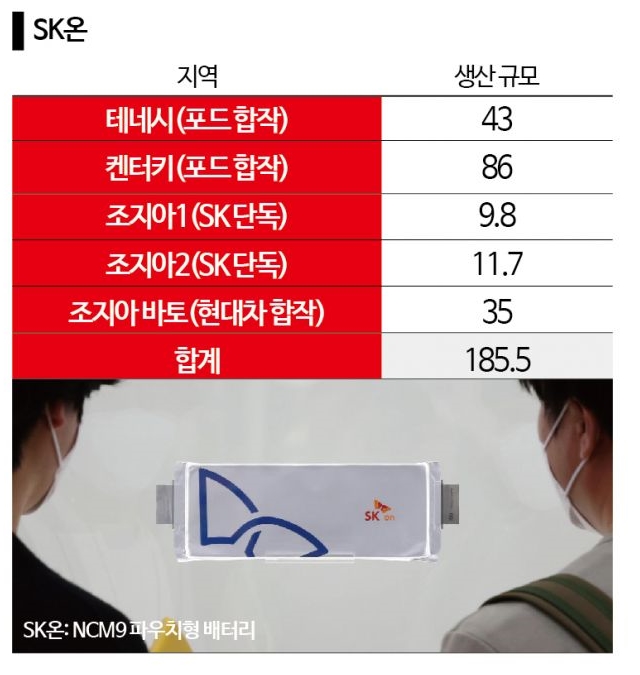

The three battery companies have entered the global market armed with high 'high-nickel batteries,' which contain more than 90% nickel among ternary batteries. There was no disagreement among the three companies that high-nickel batteries, which have high energy density and good output, are the 'answer' for electric vehicle batteries. The strengths unique to 'K-batteries,' such as high-nickel battery technology and manufacturing know-how from operating overseas battery plants, have led to love calls from global automakers. The three companies' global production target for 2025 reaches 873 GWh. The battery production capacity secured in North America alone is 536.5 GWh. Considering that a 1 GWh battery powers 15,000 electric vehicles, the three companies are expected to produce batteries for 13 million electric vehicles annually.

LG Energy Solution, the No. 1 domestic and No. 2 global battery company, is focused on cost and optimization. LG Energy Solution recently announced an investment of 600 billion KRW in 'Ochang Energy Plant 2' in Cheongju, Chungbuk, to establish a 'mother line.' The new mother line is conducting pilot production of 'pouch long-cell batteries' while verifying mass production feasibility. It plans to expand this to production lines worldwide. Long cells refer to batteries with a cell width of 500?600 mm or more. Compared to the existing 300 mm pouch cells, fewer cuts are needed, simplifying the process and reducing production costs. By maximizing the space inside the battery pack, energy density increases by about 20% compared to existing cells. However, the larger cell area may lead to a higher defect rate. Research and production of cylindrical batteries, which can streamline production processes, are also underway at Ochang Energy Plant.

Meanwhile, SK On and Samsung SDI are increasing investments in all-solid-state batteries.

SK On recently announced plans to invest 470 billion KRW by 2025 to build a next-generation all-solid-state battery pilot plant at the Daejeon Battery Research Institute. The plant will include experimental spaces equipped with special environmental facilities for developing materials for all-solid-state batteries and a pilot production line for securing large-scale mass production technology. SK On aims to develop all-solid-state battery prototypes in the second half of 2024 and begin commercialization by 2028. To research next-generation battery technology, SK On is investing in overseas advanced companies such as Solid Power, a leading U.S. all-solid-state battery company, and collaborating with prominent university researchers.

Samsung SDI has also been constructing an all-solid-state battery pilot line called 'S-Line' at its Suwon research center in Gyeonggi Province since March last year. The line is scheduled to be completed in the first half of this year, with sample production planned for the second half.

The three battery companies first conduct research and development and invest in processes domestically, then apply these to global production bases. The new facilities being built in Cheongju, Daejeon, and Suwon, along with the technologies honed there, will spread worldwide. The world is watching to see which judgment is correct among LG, which believes MCN will remain dominant, and Samsung and SK, which foresee the imminent era of all-solid-state batteries.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.