Korea International Trade Association International Trade and Commerce Research Institute Report Release

"Significant Impact of Local Demand Slump... Need to Discover Consumer Goods"

Since last year, export volumes have declined not only in China but also in Next China countries such as India, the Philippines, and Malaysia, which were expected to replace China. Due to the global economic downturn and poor local economies, South Korea's export volumes have also decreased. Experts advised that tailored business strategies for each local market are necessary to revive exports.

The Korea International Trade Association's International Trade and Commerce Research Institute released a report titled "Recent Causes and Implications of Export Slumps to China and Next China" on the 27th. The report aims to examine the causes and countermeasures for the decline in exports not only to China but also to Next China countries (six countries including India + Indonesia, the Philippines, Thailand, and Malaysia).

According to the report, exports to China, South Korea's top export destination, grew at an average annual rate of 2.8% from 2011 to 2017 but slowed to 1.9% over the recent five years (2018?2022). Since June last year, exports to China have been declining. Exports to Next China countries increased by 5.5% over the past five years but have been decreasing since October last year.

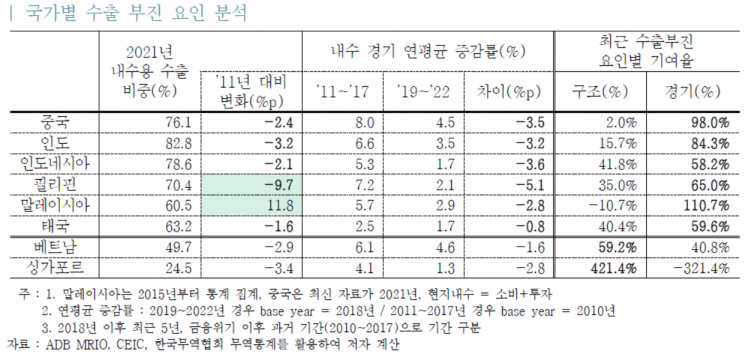

The background of this phenomenon lies in economic factors. Poor domestic demand in China, India, Indonesia, the Philippines, Malaysia, and Thailand has affected South Korea's export volumes. In 2021, exports to these countries were heavily weighted toward domestic consumption, accounting for over 60%.

In particular, consumption factors influenced Malaysia and the Philippines, while investment factors were more prominent in China, Indonesia, and Thailand. For Vietnam and Singapore, factors such as inter-country product sourcing and changes in the input structure of Korean and local intermediate goods led to export slowdowns.

The report emphasized that to recover exports, it is necessary to analyze local investment demand and trends by country and develop entry strategies accordingly. Especially, aligning with the Chinese import market's preference for high value-added products, it recommended promoting export support projects focused on mid- to high-end and advanced technology products.

It also suggested expanding presence and strengthening marketing in various regions within China where infrastructure investment is active. Since local governments have been increasing investments post-COVID-19 pandemic, the report highlighted the need to enhance cooperation with China in domestic strength sectors such as hydrogen and mobility. Entering the Indian consumer market was also presented as a task.

Kang Nae-young, a senior researcher at the Korea International Trade Association, stated, "Since investment fluctuates more than consumption, discovering a variety of consumer goods is necessary for stable exports," adding, "It is essential to respond to changes in China's consumption structure, including silver, angel, single-person households, pets, and home economy."

She also added, "Since re-export through Singapore and Vietnam is concentrated in certain items such as petroleum and IT, it is necessary to diversify these and explore ways to expand exports for local domestic consumption as well."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.