On the 25th, Seoul Southern District Prosecutors' Office Indicts Shin Hyun-sung and 9 Others Without Detention

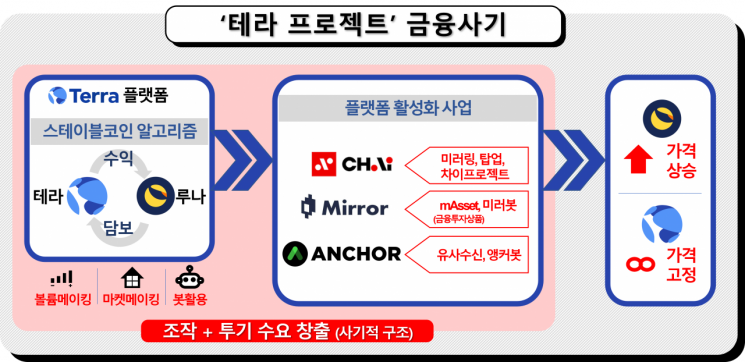

Shin Hyun-sung, former CEO of Chai Corporation, who was identified as a key figure in the 'Terra·Luna incident' alongside Terraform Labs CEO Kwon Do-hyung, has been indicted. The prosecution viewed that they pushed forward the 'Terra project' despite knowing from the start that it was an impossible business due to legal regulations and the fictitious nature of the price-fixing algorithm.

Shin Hyun-sung and 9 Others Indicted Without Detention

On the 25th, the Joint Investigation Unit for Financial and Securities Crimes of the Seoul Southern District Prosecutors' Office (Head Dan Sung-han) announced that they indicted former Terraform Labs founder Shin, along with three founding members and four Terra corporate executives, without detention on charges including fraudulent unfair trading under the Capital Markets Act.

Former TMON CEO Yoo was also indicted without detention on charges of accepting approximately 3.8 billion KRW worth of Luna coins as bribes from Shin (embezzlement by receipt of bribes), and individual A was indicted without detention on charges of accepting about 160 million KRW worth of Luna coins as bribes for mediating requests to bank vice presidents and others at Shin’s request (bribery under the Act on the Aggravated Punishment of Specific Economic Crimes).

According to the prosecution, eight people including Shin are charged with fraud and fraudulent unfair trading under the Capital Markets Act and fraud under the Act on the Aggravated Punishment of Specific Economic Crimes for falsely promoting the 'Terra project' as successfully progressing and manipulating transactions to trade Luna and Terra coins from July 2018 to May last year, thereby obtaining approximately 462.9 billion KRW in illicit gains and habitually defrauding about 379.6 billion KRW.

They are also charged with violating the Capital Markets Act by minting Luna coins, which are investment contract securities, and distributing and selling them to investors without submitting a securities registration statement from April 2019 to May 2020. From March 2021 to May last year, they are accused of violating the Act on the Regulation of Conducting Fund-Raising Business Without Permission by receiving deposits of about 51.5 billion Terra coins from many people under the agreement to guarantee principal and pay 19.56% interest when depositing Terra coins in the Anchor Protocol.

Shin was also charged with violating the Electronic Financial Transactions Act for unlawfully leaking 170 million Chai Pay transaction records over three years to make it appear that the Terra blockchain was used in Chai Pay, a general payment method. Although the leaked transaction information was merely replicated on the Terra blockchain, they falsely promoted that Terra blockchain technology was used in Chai Pay to reduce fees and generate profits.

Shin is also charged with fraud under the Capital Markets Act for separately promoting the 'Chai project,' which he spearheaded, and defrauding 122.1 billion KRW from investors through false promotion and transaction manipulation in a 'series investment' manner involving Chai convertible preferred shares. It is known that a significant portion of the victim funds consisted of public funds from the Ministry of Employment and Labor and the Korea Federation of SMEs. Shin also faces charges of breach of trust and embezzlement under the Act on the Aggravated Punishment of Specific Economic Crimes, violation of the Act on Reporting and Using Specified Financial Transaction Information, and breach of trust and mediation of breach of trust in business.

According to a prosecution official, the number of domestic Luna coin holders was about 100,000 with a market capitalization of approximately 330 billion KRW around June 2021, but by May last year, after the crash, the number of holders increased to 280,000 while the market capitalization dropped to 33.9 billion KRW.

'Pushed the 'Terra project' knowing it was impossible to realize'

The prosecution analyzed that Shin and Kwon pushed the Terra project despite knowing from the start that it was an impossible business due to legal regulations and the fictitious nature of the Terra price-fixing algorithm.

According to the prosecution, to evade legal regulations, they established Chai Corporation by appointing a figurehead CEO and registered it as an electronic financial business for a general simple payment service, claiming it was unrelated to the Terra blockchain to financial authorities. However, they falsely promoted to investors that the Terra blockchain was used in the simple payment system 'Chai Pay' to attract investment funds.

Seven early project members, including Shin, had already agreed to receive 130 million Luna coins in advance and succeeded in listing Luna coins through false promotion. Despite the Terra coin having almost no demand and the price-fixing algorithm not functioning, they inflated Terra coin trading volume by repeatedly engaging in wash trading using 'trading bots' and manipulated the price by repeatedly placing buy and sell orders at specific prices to maintain the price.

They falsely promoted that the prices of virtual assets sold through Mirror Protocol followed U.S. stock prices due to an algorithm, even though they were artificially manipulating the prices. They controlled supply by holding 80% of the total virtual asset volume and manipulated prices. After the launch of Anchor Protocol in March 2021, they falsely promoted that depositing Terra coins would pay 19.56% annual interest and that the interest funds could be secured through staking reward income from virtual assets, even though they were covering interest payments to Anchor Protocol Terra depositors through a Ponzi scheme.

The circulating supply of Terra coins, which was about 2 trillion KRW in May 2021, surged to about 21 trillion KRW in just one year by May last year. Until then, price fixing was possible through artificial Terra coin purchases, but as the coin circulation increased tenfold, it exceeded the range where price fixing (pegging) was possible, ultimately causing the Terra·Luna incident. The prosecution viewed that paying such interest without Terra coins being used as a means of payment was impossible from the start and that it was a 'Ponzi scheme' structure that could not be sustained without new investors.

The prosecution also added that Shin played a leading role in this incident. A prosecution official said, "Both CEO Kwon and former CEO Shin played key roles, but it was Shin who planned the promotion and manipulation to make Terraform Labs appear operational. Even just looking at Anchor Protocol, Shin continuously promoted it and sold his Luna coins as their market price rose."

The prosecution believes that after the bubble burst, they realized at least 462.9 billion KRW in profits by disposing of coins they held before the crash. According to the prosecution, Shin began selling Luna coins from the launch of Anchor Protocol and realized at least 154.1 billion KRW in profits until just before the crash. A prosecution official stated, "We have requested an order for seizure and preservation of the defendants' criminal proceeds and completed seizure and preservation measures for about 246.8 billion KRW."

"Luna coin has securities characteristics, reappeal for seizure preservation"

The prosecution applied charges for violating the Capital Markets Act to Shin, recognizing that Luna coin has securities characteristics. This is the first case in South Korea where a coin was prosecuted by acknowledging its securities nature.

The prosecution first viewed Luna coin as a financial investment product. Approximately 55 billion KRW was raised through 'Luna coin issuance and sales' to promote the Terra project, meaning investors bore the risk of principal loss and obtained rights to share business profits. Furthermore, the business performance of the Terra project was attributed to Luna coin, meeting the requirements of investment contract securities. Terraform Labs members also promoted that the price of Luna coins would increase as demand for the Terra blockchain increased to attract investment.

The prosecution recently reappealed after the dismissal of their seizure preservation request against Shin. On February 16, the Seoul Southern District Court dismissed the prosecution's immediate appeal against the dismissal of the seizure preservation request for Shin, stating, "It is difficult to consider Luna coin as a financial investment product regulated under the Capital Markets Act." A prosecution official said, "There was no reasoning on why it is not a financial investment product or what the requirements for a financial investment product are. We believe the court's judgment is unfair and have filed a reappeal."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.