Financial Services Commission Conducting Investigation into Unfair Trading Including Stock Price Manipulation

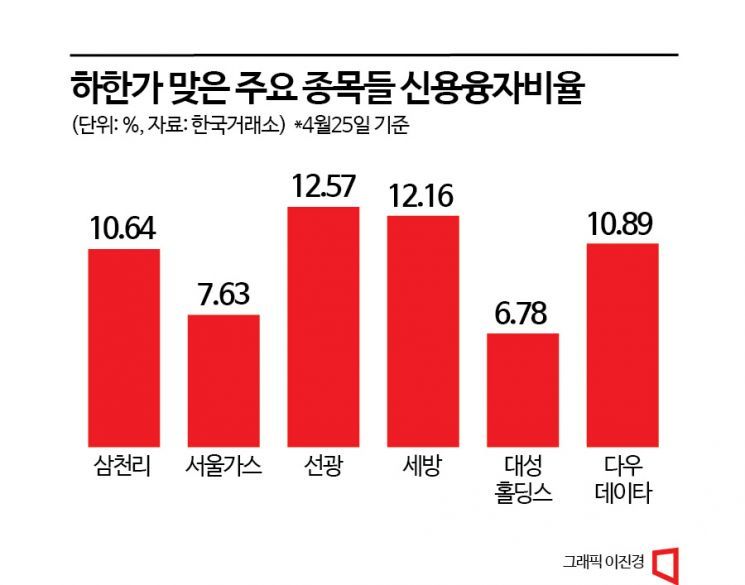

Direct Impact on Samchully, Seoul Gas, Seongwang, Sebang, Daesung Holdings, and Dow Data

Stock Prices Have Continued Upward Trend Over Past Three Years Without Significant Positive Factors

Six listed companies including Samchully, Seoul Gas, Seonkwang, Sebang, Daesung Holdings, and Dow Data have recorded the lower price limit (as of 10 a.m.) for two consecutive days following the previous day. As of the closing price on the 21st, the market capitalization of these listed companies exceeded 10 trillion won, but 5 trillion won disappeared in just two trading days. Until the previous day, the dominant analysis was that the sharp decline was due to forced liquidation caused by collateral shortage related to the flood of sell orders from Contract for Difference (CFD) accounts. Subsequently, more specific backgrounds were revealed. News that financial authorities have detected signs of stock price manipulation in these stocks and are investigating has led to a continued phenomenon of panic selling.

With the increase in credit loan balances in the stock market, if stock prices fall significantly, it can lead to forced liquidation, raising concerns about the damage to individual investors who engaged in so-called 'debt investment.' Park Jae-hoon, head of the Capital Market Investigation Division at the Financial Services Commission, stated, "We are conducting investigations related to unfair trading such as stock price manipulation targeting the stocks that hit the lower price limit the previous day." A source familiar with the financial authorities said, "The investigation is already underway, and related materials including allegations of collusive trading will soon be handed over to the prosecution."

Collusive trading refers to a practice where buyers and sellers prearrange prices and trade stocks with each other at certain times. It is prohibited under the Securities Exchange Act because it creates the appearance of active trading to gain unfair profits, potentially harming bona fide investors.

Use of Multi-level Marketing Method to Raise Funds in a Short Period

Those accused of stock price manipulation are known to have used a multi-level marketing method to raise huge funds in a short period. They used a method where existing investors bring in new investors and share part of the profits. They particularly moved stock prices slightly by 0.5% to 1% daily over about three years to avoid attracting the attention of regulatory authorities. They also showed meticulousness by collecting personal information and mobile phone numbers from investors, installing stock trading applications, and trading through investors' mobile phones under their names. The fact that eight stocks recorded suspicious lower price limits the previous day is interpreted as the stock price manipulation group recruiting investors in a multi-level manner to push up stock prices, then hurriedly exiting and dumping shares when the Financial Services Commission's investigation became known.

As of 10 a.m. on the 25th, Seoul Gas is trading at 229,500 won, down 29.92% from the previous day. Among the sell orders offered at the lower price limit of 229,500 won, the unfilled order volume reaches 510,000 shares (120 billion won). The remaining sell volume exceeds 10% of the total issued shares (5 million shares). Considering that the largest shareholder holds 60.3% of the shares, this reflects how strong the sentiment is to sell even at the lower price limit.

With Seoul Gas's stock price plunging again after hitting the lower price limit the previous day, its market capitalization shrank from 2.3375 trillion won on the 21st to 1.1475 trillion won. A total of 1.19 trillion won disappeared in two days. Samchully's stock price also plunged for two consecutive days, dropping its market capitalization from 2 trillion won to below 1 trillion won.

Over the past year, Seoul Gas and Samchully's stock prices surged. Despite no particular positive news, stock prices rose as buyers outnumbered sellers. The outbreak of the Russia-Ukraine war and the rise in natural gas prices led individual investors to start buying. Due to deficits and dividend non-payment by Korea Electric Power Corporation and Korea Gas Corporation, some demand shifted to city gas-related stocks. Nam Min-sik, a researcher at SK Securities, explained, "There is no correlation between natural gas price increases and the city gas business," adding, "There was no basis for earnings improvement to support the stock price rise." He continued, "The electricity and gas sectors are industries where sales ceilings are set by government regulations, making it difficult to exceed a price-to-book ratio (PBR) of 1.0. Based on the previous day's closing price, Samchully and Seoul Gas have PBRs of 1.4 and 2.1 respectively, so further declines are inevitable."

Common Features: High Largest Shareholder Stake and Low Trading Volume

Seonkwang, Sebang, and Daesung Holdings, which are also recording the lower price limit along with Seoul Gas and Samchully, have shown an upward trend in stock prices over the past one to two years without significant corrections. They share common features of having a high largest shareholder stake and low trading volume. Moreover, it is the same that sell orders poured out from the foreign securities firm SG (Soci?t? G?n?rale) Securities when the lower price limit was recorded the previous day. It appears that the credit loan balance ratio increased due to maximum leverage use through CFD accounts, and as stock prices plunged, forced liquidation occurred, leading to the lower price limit for two consecutive days.

CFD accounts allow leverage up to 2.5 times depending on the stock. For blue-chip listed companies, this means that with just 100 million won, one can buy stocks worth 250 million won. When the domestic stock market was shaken on the 20th and 21st, Harim Holdings, Sebang, and Dow Data also showed weak trends. For listed companies with a large proportion of purchases through CFD accounts, forced liquidation due to collateral shortage was possible.

The six listed companies had excessive credit loan balance ratios and loan provision rates compared to the market. The 5-day average credit loan provision rate for all KOSPI stocks is 7.44%, and the credit loan balance ratio is 0.98%, whereas KOSPI stocks that hit the lower price limit recorded credit loan provision rates around 30% and balance ratios of 10%. The higher the credit loan provision and balance ratios, the more the rapid selling phenomenon can be amplified when stock prices fall.

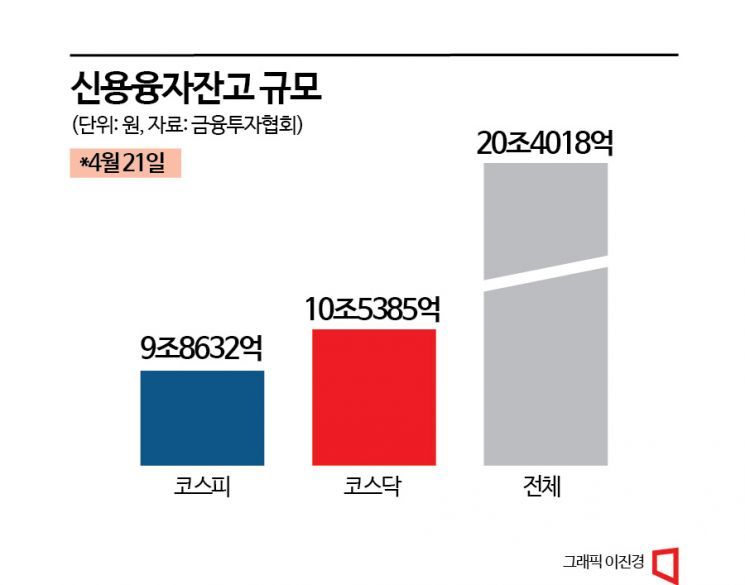

In Yeouido's securities market, it is advised to be cautious about stocks heavily invested in by individual investors using debt, in addition to the listed companies recording the lower price limit for two consecutive days. The credit loan balance in the KOSPI and KOSDAQ markets reached 20.4 trillion won, an increase of 3.9 trillion won compared to the beginning of the year. The KOSDAQ market alone reached 10.5 trillion won, reaching levels seen in April-May last year. The recent 20-day average of new credit loan amounts in KOSDAQ is 1.3 trillion won, higher than the level in 2020 when the Donghak Ant movement was active after the COVID-19 pandemic.

Lee Kyung-min, a researcher at Daishin Securities, explained, "Considering the status of credit loan transactions by market capitalization, volatility caused by supply and demand fluctuations should be watched especially in small-cap KOSPI stocks and mid-cap KOSDAQ stocks," adding, "The credit loan balance ratio and loan provision rate for small-cap KOSPI stocks are 1.7% and 8%, respectively." For mid-cap KOSDAQ stocks, these figures are 2.4% and 12%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)