Stock Market Adjustments Every May Historically Lead to Poor Returns

Worth Considering Buying Large-Cap Stocks with Improved Earnings at Low Prices

"Sell in May and go away, and come on back on St. Leger’s Day." This proverb, which originated in the London financial market, also fits well with the Korean stock market. This year is expected to be no exception. The securities industry generally suggested 'Sell in May' as the investment strategy for May. In particular, caution is advised because the current market is overheated. However, there was also much advice that large-cap KOSPI stocks expected to improve earnings could present buying opportunities at low prices.

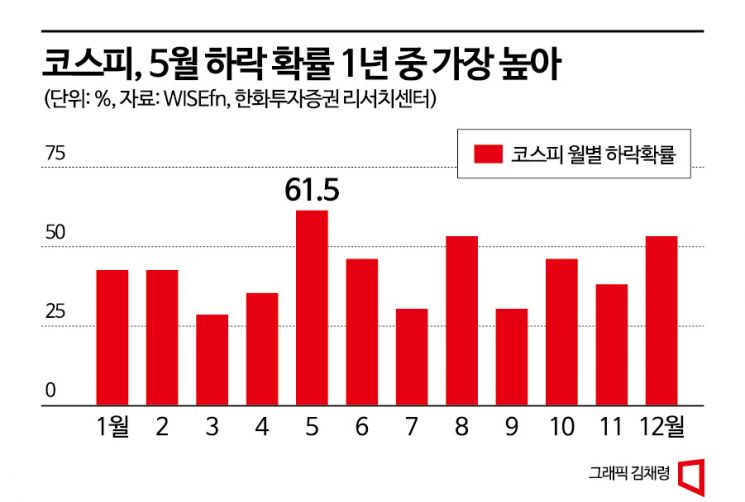

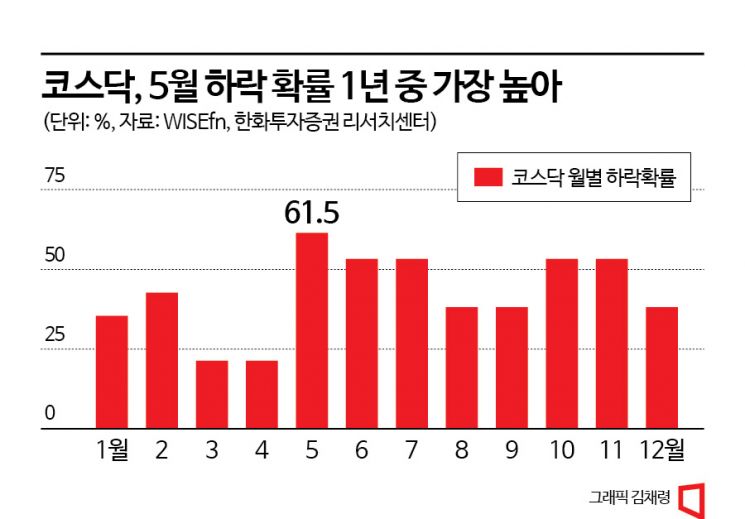

Probability of Decline in May: 61.5% for Both KOSPI and KOSDAQ

According to the financial investment industry, including Hanwha Investment & Securities and WiseFN, on the 25th, an analysis of monthly KOSPI fluctuations since 2010 showed that the probability of a decline in May was the highest at 61.5%. August and December had probabilities of 53.8%, and other months were below 50%. The average fluctuation rate was -0.88% in May, the second lowest after -1.06% in August. The KOSDAQ was no different, with May having the highest decline probability at 61.5%. The probability of decline from January to April for KOSDAQ was 30.3%, lower than KOSPI's 37.5%. The average fluctuation rate from January to April was also 1.60%, 0.70 percentage points higher than KOSPI's 0.90%.

Seasonality is repeating this year as well. In April, the average monthly fluctuation rates were 3.6% for KOSPI and 7.6% for KOSDAQ, much higher than the average of the past 12 years. The KOSDAQ's performance is described as exceptional. Park Seung-young, a researcher at Hanwha Investment & Securities, said, "The stock market is expected to be sluggish again in May this year," emphasizing, "From now on, it is necessary to reduce stocks and focus on risk management."

The background for the expected market sluggishness in May is earnings. When first-quarter earnings are announced, investors can get a sense of the annual earnings, and usually, the consensus for the current year's earnings begins to be revised downward. The reason KOSDAQ declines more in May is also due to earnings. KOSDAQ companies have high growth potential but low profits, so during earnings announcement seasons, demand naturally concentrates on stocks with good earnings. Researcher Park Seung-young explained, "Although the global economy is approaching a bottom, it is not a situation where interest rate cuts can be expected," adding, "The volatility index (VIX) has dropped to 17%, and the KOSPI 200 volatility index (VKOSPI) is at 15%, the lowest level since early 2020, reflecting that the lowered implied volatility in the stock market indicates a lack of market direction." KB Securities researcher Lee Eun-taek said, "Looking at past patterns, the KOSPI's earnings per share (EPS) estimates bottom out, and about two months later, the price-to-earnings ratio (PER) is adjusted," predicting, "Since the bottom was reached in March-April this year, adjustments are expected in May-June."

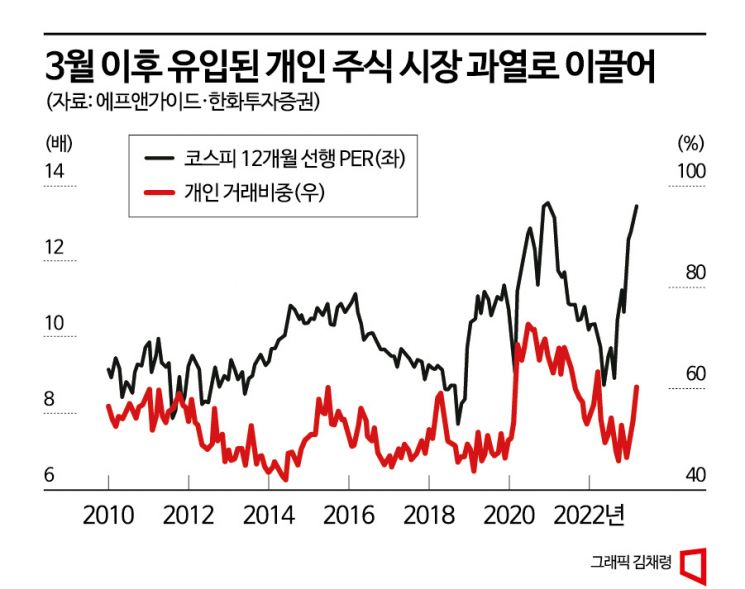

Rapid Increase in Margin Loan Balances... Market in Overheated State

The securities industry diagnoses that the current market is overheated. As individual investors flock to secondary battery stocks, volatility has increased, so more caution is needed regarding the possibility of a May correction. The usual participation rate of individual investors in the domestic stock market is around 50%. When themes like secondary batteries become popular, individuals flock, overheating the stock market. The individual investor proportion in the domestic stock market has gradually increased since hitting a low of 45% in October last year, surpassing 60% in April. This is the highest since September 2021 when KOSPI exceeded 3000. The securities industry sees secondary battery-related stocks, which individual investors entered late and pushed up, as targets for May corrections.

The sharp increase in margin loan balances is also interpreted as a sign of market overheating. In the case of KOSDAQ, margin loan balances have exceeded 10 trillion won, the first time since June last year. As of the latest available date, the 20th, KOSDAQ's margin loan balance recorded 10.4618 trillion won. An increase in margin loan balances means many people view the KOSDAQ market positively and have leveraged their positions. KOSPI also reached 9.8245 trillion won.

In 2020 and 2021, individual investors' net purchases in the KOSDAQ market were 16.3 trillion won and 10.9 trillion won, respectively, but the increase in margin loans was only about 4.4 trillion won (27% of individual net purchase amount) and 1.4 trillion won (12.8% of individual net purchase amount). Although margin loans increased, there were many 'pure cash purchases' accompanied by an increase in customer deposits.

However, this year is different. Individual investors' cumulative net purchases in KOSDAQ are about 4.7 trillion won, while the increase in margin loans is 2.4 trillion won. The increase in margin loans exceeds 50% of individual net purchase amounts. Park So-yeon, a researcher at Shinyoung Securities, warned, "The strength of the KOSDAQ market this year was greatly influenced by short-term leverage betting, and if a sudden margin loan liquidation occurs, the aftershock could be quite significant."

Due to the high possibility of a stock market correction in May, advice is to increase cash holdings and allow for some breathing room rather than responding with buying. Researcher Park Seung-young said, "I expect a full-fledged rally starting from the third quarter when the global manufacturing economy rebounds," advising, "Responding to the May correction with buying is premature; increasing cash is the best approach." He added, "Defensive stocks are unlikely to emerge as alternatives because the global economy is near the bottom," and "Large-cap KOSPI stocks with cheap valuations, such as finance and automobiles, could be alternatives. For investors who can wait, it is advisable to increase semiconductor, semiconductor equipment, and materials stocks during corrections."

A portfolio adjustment strategy was also suggested. Yang Hae-jung, a researcher at DS Investment & Securities, said, "Although May's average returns have been poor, there is no need to sell before confirming a turnaround," advising, "Although some concentration increases market volatility, major sectors are not excessively overvalued, so rather than selling the market, it may be better to shift the focus to KOSPI and large-cap stocks (IT, automobiles, materials)."

Lee Hyuk-jin, a researcher at Samsung Securities, also said, "The possibility of a sharp correction in the domestic stock market is limited during the dollar index decline and stock market deposit rebound phase," recommending, "It is time to reduce the proportion of overheated small and mid-cap stocks and selectively buy large-cap KOSPI stocks with high price attractiveness." Kim Byung-yeon, a researcher at NH Investment & Securities, suggested, "The May correction will serve as another buying opportunity," recommending expanding semiconductor holdings with attention to earnings rebounds. He expects confidence in the semiconductor sector to strengthen further after Samsung Electronics' earnings conference. He emphasized, "Turnaround (earnings rebound) and high quality (companies with sound financial structures) are still valid at this point."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)