Decline in Last Year's Performance at Segyero Mart and Others

End of Large Mart Regulation 'Reflex Benefit'

Impact of Post-COVID Non-Face-to-Face Consumption Establishment

Last year, the sales of major domestic food ingredient marts decreased compared to the previous year. It is said that the growth momentum, which had benefited from the regulatory restrictions on large supermarkets, has reached its limit. There is also an analysis that the industry itself has entered a decline phase due to the increase in non-face-to-face consumption since COVID-19.

A food ingredient mart located inside a traditional market in Gangseo-gu. Photo by Dongju Yoon doso7@

A food ingredient mart located inside a traditional market in Gangseo-gu. Photo by Dongju Yoon doso7@

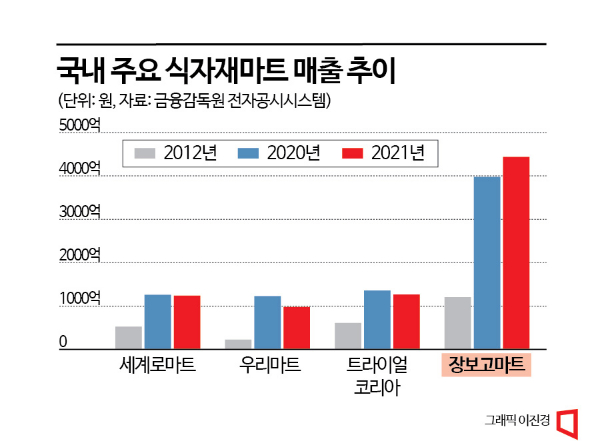

According to the Financial Supervisory Service's electronic disclosure system on the 25th, Segyero Mart's sales decreased from 125.9 billion KRW and operating profit of 6.9 billion KRW in 2021 to 124 billion KRW in sales and 4.8 billion KRW in operating profit last year. Woori Mart also saw a decline last year with sales of 97.8 billion KRW and operating profit of 2.5 billion KRW compared to the previous year (sales of 122.8 billion KRW and operating profit of 4.1 billion KRW). Trial Korea's sales also dropped from 135.9 billion KRW in 2021 to 126.5 billion KRW.

This is the first time that the sales scale of major food ingredient marts has decreased. Until now, food ingredient marts have aggressively expanded every year by taking advantage of the large supermarket business regulations implemented in 2012. At that time, the government mandated that marts with a store area exceeding 3,000㎡ or large corporation-affiliated supermarkets must close twice a month. Food ingredient marts exploited this by operating year-round, 24 hours a day, as their store areas did not exceed 3,000㎡ and they were not affiliated with large corporations.

The growth of food ingredient marts during this period is also confirmed by their performance. Segyero Mart had sales of only 52.5 billion KRW in 2012 but continued to grow, surpassing 100 billion KRW in sales in 2018. Woori Mart's sales were 22.3 billion KRW in 2012 but jumped more than fourfold to 100 billion KRW in 2019, just seven years later. Operating profit during this period also soared from 1.2 billion KRW to 3.6 billion KRW.

The food ingredient marts, which had been growing continuously, reached a turning point due to COVID-19. As face-to-face consumption shrank, in-store sales took a direct hit. One of the causes was the failure to properly grasp the shift in consumer patterns toward online-centered shopping. An industry insider said, "'Online grocery shopping' has become routine, and offline store sales trends have declined compared to before," adding, "It seems that food ingredient marts are moving from a growth phase into a decline phase."

This downward trend is expected to accelerate in the future. Consumers have already become accustomed to non-face-to-face consumption, and there is no clear solution for food ingredient marts to overcome this situation. Professor Eunhee Lee of Inha University's Department of Consumer Studies said, "With non-face-to-face consumption becoming established, growth will be difficult with the existing business methods," and predicted, "Store environments such as interior design will also fail to meet consumer needs, making things increasingly difficult."

Jangbogo Food Ingredient Mart, based in the Daegu and Gyeongbuk regions, is cited as a case that continued its growth by expanding into the non-face-to-face (online) sector. Jangbogo Food Ingredient Mart's sales increased from 397.6 billion KRW in 2021 to 443.8 billion KRW last year. Operating profit also rose about 15%, from 4 billion KRW to 4.6 billion KRW. Jangbogo Food Ingredient Mart operates not only offline stores but also an online mall called ‘Jangboja.com’.

However, there is considerable caution regarding whether Jangbogo Food Ingredient Mart can sustain its growth going forward. Professor Yonggu Seo of Sookmyung Women's University’s Department of Business Administration said, "Although Jangbogo Mart operates both online and offline, the food ingredient mart industry itself has entered the early stages of decline, and the number of product categories is also limited," adding, "More analysis (time) is needed to determine whether the online operation is effectively extending its lifespan."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.