High Interest Rates and Economic Downturn Cause Hesitation in 'High Risk High Return' Investments

Venture Fund Formation in Q1 at 569.6 Billion KRW, Compared to 2.6668 Trillion KRW in Same Period Last Year

Exit Strategies Under Consideration... Financial Group-affiliated VCs Expected to Play a Rescue Role

The venture investment market has yet to regain its momentum. Venture capitalists (VCs), known as the epitome of alternative investments and pursuers of 'high risk high return,' are taking a conservative stance. High interest rates and an economic downturn have made it difficult to deploy investment funds easily.

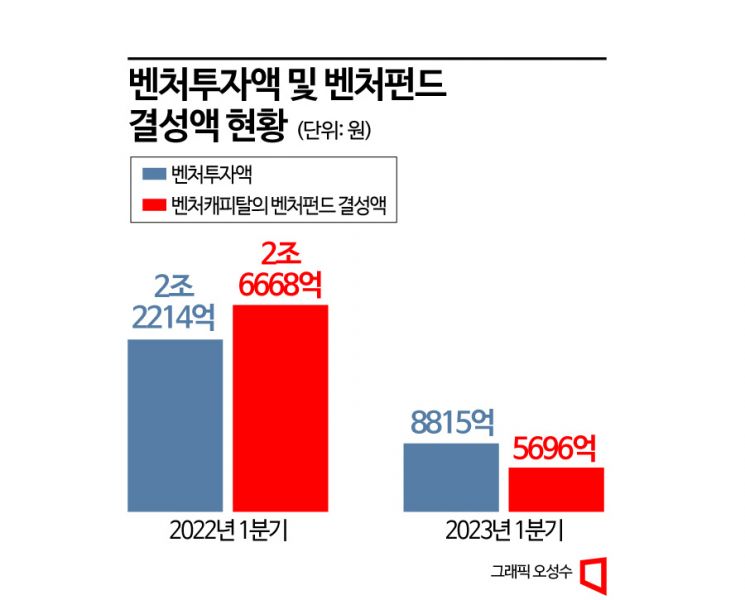

The frozen venture investment market can also be confirmed by the numbers. Venture investment in the first quarter of this year decreased by more than 60% compared to the same period last year, plummeting from 2.2214 trillion won to 881.5 billion won. The amount of venture fund formation by venture capital also dropped from 2.6668 trillion won to 569.6 billion won. It is pointed out that the venture investment market has shrunk due to a reduction in the mother fund budget, unlike previous years.

Minister Lee Young of the Ministry of SMEs and Startups and Chairman Kim Joo-hyun of the Financial Services Commission are announcing the "Measures to Support Funding and Strengthen Competitiveness of Innovative Venture Startups" on the 20th at the Government Seoul Office in Jongno-gu, Seoul. Photo by Yoon Dong-joo doso7@

Minister Lee Young of the Ministry of SMEs and Startups and Chairman Kim Joo-hyun of the Financial Services Commission are announcing the "Measures to Support Funding and Strengthen Competitiveness of Innovative Venture Startups" on the 20th at the Government Seoul Office in Jongno-gu, Seoul. Photo by Yoon Dong-joo doso7@

As a result, many startups are struggling. Especially companies in the Series B and Series C stages, which are in the full-fledged growth phase, are having difficulties securing funding. Even promising companies considered unicorns or prospective unicorns are not avoiding restructuring such as business unit consolidation.

Venture Investment Amount and Venture Fund Formation Both Decline... Startups in Crisis

Even when they barely secure investments, many startups proceed with investment rounds at valuations equal to or lower than the previous ones. Cases of practically surviving with the help of existing investors rather than new investors are increasing. Strange rounds, such as Series A1, which were not seen in a liquidity market, are even emerging.

A startup CEO currently seeking Series A investment said, “We are diligently conducting IRs targeting venture capitalists, but they only show interest without actual investment, and the timing for securing investment is being delayed.” He added, “Even if matching occurs, the strong demand for valuation discounts is discouraging, but since survival is at stake, we will somehow secure investment.”

Venture capitalists, who play a role as the catalyst for startup growth, are also struggling. The core of venture capital profits is exit (investment recovery). They sow seeds diligently for years and wait for harvest. The problem is that as the seeds dry up, harvesting becomes difficult. The threshold for initial public offerings (IPOs) has also risen, making exits through listing increasingly difficult.

According to the Disclosure of Information on Small and Medium Enterprise Venture Investment Companies (DIVA), 218 venture funds will mature from this month until the end of the year. The total formation amount reaches 5.3517 trillion won. Adding the 3.3592 trillion won (114 investment associations' formation amount) maturing in the first half of next year (January to June), the total exceeds 8.7 trillion won. Although they need to exit and liquidate the funds, they are stuck in a vicious cycle.

Government Announces Support Measures Worth 10.5 Trillion Won

These are mostly entrusted management companies (GPs) that have formed funds after securing capital through limited partners (LPs). They have the obligation to recover investment funds and distribute them to the LPs. Therefore, they must actively promote IPOs of invested companies or consider mergers and acquisitions (M&A). Secondary funds, which mainly invest in existing shares held by existing funds, could be an escape route but the situation is not easy.

A lead fund manager of a venture capital said, “When the market is booming, other venture capitals would demand to buy existing shares through secondary funds, but now it is hard to expect that,” adding, “Cases where funds cannot start liquidation at maturity and extend the maturity will increase.”

As the market downturn continues, authorities have stepped up to devise countermeasures. The Ministry of SMEs and Startups and the Financial Services Commission announced on the 20th the ‘Innovation Venture and Startup Fund Support and Competitiveness Enhancement Plan’ with additional support measures worth 10.5 trillion won. This is an additional measure announced three months after the January announcement to newly inject 29.7 trillion won of policy funds into venture companies.

For early growth-stage companies, a total of 6.1 trillion won will be supported, including 1.2 trillion won in loans, 200 billion won in funds, and 4.7 trillion won in research and development (R&D). The Korea Technology Finance Corporation and the Korea Credit Guarantee Fund will provide an additional 1.2 trillion won in guarantees to early growth companies struggling to raise growth capital, and the guarantee-linked investment scale for underinvested areas such as angel investment and regional companies will be expanded by 60 billion won. Industrial Bank of Korea will establish a subsidiary to create a startup support fund worth 100 billion won.

Financial Groups with Sufficient Capital Expected to Play Role as KOSDAQ VCs

The ‘Venture Investment Promotion Act Amendment Bill,’ which can ease regulations during fund investment operations, has passed the Industry, Trade, and Small and Medium Enterprises Committee. The Ministry of SMEs and Startups plans to encourage investment activation through enforcement ordinance revisions once the bill passes the Legislation and Judiciary Committee and the plenary session. The industry agrees that since the authorities have sent positive signals, it is now time for venture capitals to actively move.

Currently, operators with sufficient capital are mainly mentioned. First, venture capitals affiliated with financial groups can be cited. Representative examples include Woori Venture Partners (formerly Daol Investment), recently acquired by Woori Financial Group, KB Investment, Shinhan Venture Investment, Hana Ventures, NH Venture Investment, BNK Venture Investment, Hi Investment Partners, and JB Investment.

Operators already proven their capabilities and listed on the KOSDAQ market are also of interest. DSC Investment, led by Yoon Geon-su, chairman of the Korea Venture Capital Association, and LB Investment, affiliated with the LG group, which recently succeeded in entering the stock market, are attracting attention. In addition, houses such as Mirae Asset Venture Investment, SBI Investment, Lindemann Asia Investment, TS Investment, Daesung Startup Investment, Woori Technology Investment, Now IB Capital, and Stonebridge Ventures are also playing their roles in the venture investment market. Asia Economy plans to showcase their activities through the 'VC Exploration' series.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.