Five Years of Stagnation in Certified Public Accountant and Passer Numbers

Industry Faces 'Desperate' Labor Shortage

Insurance companies are facing difficulties due to a shortage of actuarial personnel. As new accounting standards such as IFRS17 and the new solvency regime (K-ICS) have been introduced, demand has increased further, and this 'labor shortage' is expected to continue for the time being.

According to the Financial Supervisory Service's statistics on the number of insurance actuaries as of the end of last year, there were a total of 1,173 insurance actuaries employed by insurance companies. Actuaries are considered key personnel in insurance companies, responsible for insurance accounting, insurance product development, and actuarial tasks. The number of actuaries has increased by about 150 over three years since surpassing 1,000 for the first time in 2019.

Only major large companies such as Samsung Life Insurance (141), Samsung Fire & Marine Insurance (141), Hyundai Marine & Fire Insurance (85), DB Insurance (71), KB Insurance (70), Kyobo Life Insurance (67), Hanwha Life Insurance (65), and Shinhan Life Insurance (50) secured more than 50 actuaries. There were also many companies with fewer than five actuaries, including Shinhan EZ Insurance (5), Chubb Life Insurance (5), Kyobo Lifeplanet (5), ACE Insurance (3), and Carrot Insurance (3).

The industry generally believes that more than 3,000 actuaries need to be supplied, but the current number is still less than half of that. Especially with the introduction of new accounting standards starting this year, complaints about labor shortages are emerging. Although the authorities have changed the qualification criteria for insurance actuaries and expanded the recognition of experience institutions, the response is still that it is insufficient.

Earlier, the Financial Services Commission amended the Enforcement Rules of the Insurance Business Act in 2018, extending the recognition period for scores in each exam subject to five years. If a score in one subject exceeds 60 points, it is recognized for up to five years. When all five subjects have scores above 60 points within the validity period of each subject's score, it is recognized as passing. Previously, without a recognition period for each subject, candidates had to pass the first exam and then achieve 60 points or more in all five subjects of the second exam within five years to pass. The institutions recognized for experience that exempts the first exam were expanded to include independent actuarial firms with five or more full-time actuaries, in addition to the existing Financial Supervisory Service, insurance companies, insurance associations, and insurance rate calculation institutions.

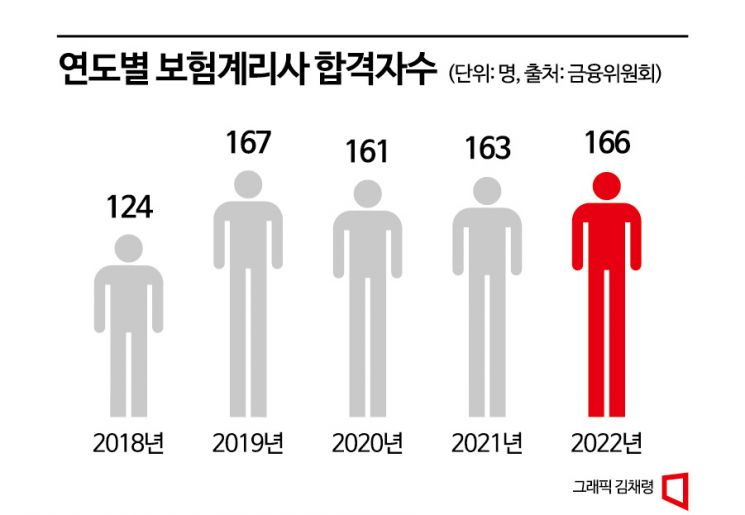

However, this alone is considered insufficient. Although various asset management consulting firms, accounting firms, securities companies, and banks also have personnel engaged in actuarial-related work, their experience is not recognized for exemption from the first exam. Since the introduction of the retirement pension default option (pre-designated operation system) in July last year, demand for actuaries has increased in other sectors as well, making it even more difficult for insurance companies to secure personnel. Considering that the number of new passers has hardly increased from the 160s since 2019, the 'supply shortage' is expected to continue for the time being. A representative of a large insurance company said, "With the accounting system reform, a lot of personnel are needed, but the supply is very limited, so we are severely short-handed," adding, "More measures are needed to expand the supply of actuarial personnel."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.