Patent Expirations for Humira and Stelara This Year

Samsung Bioepis and Celltrion Prepare to Launch Biosimilars

As patents for blockbuster drugs expire en masse by the end of this year, a biosimilar (biopharmaceutical generic) market worth at least 45 trillion won is opening up.

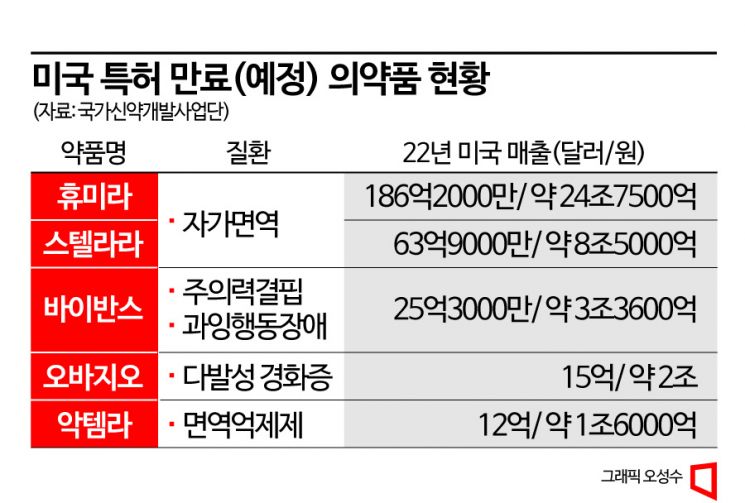

According to the National New Drug Development Center on the 20th, the combined sales of drugs whose patents expire this year and ranked in the top 10 in sales in the US market last year amount to $33.754 billion (about 44.86 trillion won). This is estimated to be the largest scale since the biosimilar market began. In particular, blockbuster drugs such as AbbVie's Humira and Johnson & Johnson's Stelara are included in the list of drugs with patents expiring this year, which is expected to expand the size of the biosimilar market.

Humira, a blockbuster-level autoimmune disease treatment drug with US sales alone reaching $18.62 billion (about 24.75 trillion won) last year, had its patent expire in January. Humira is an autoimmune treatment drug approved for multiple indications including rheumatoid arthritis, psoriatic arthritis, ankylosing spondylitis, and Crohn's disease, and was the highest-selling drug worldwide before the COVID-19 pandemic. Humira's patent expired in January, and immediately after expiration, the US pharmaceutical company Amgen was the first to launch the biosimilar 'Amjevita' on the market. Amgen reached an agreement in September 2017 to pay royalties for AbbVie's remaining patents and promptly began development. Korean companies Samsung Bioepis and Celltrion are also aiming to launch Humira biosimilars in July. Samsung Bioepis's 'Hadlima' has already received approval from the US Food and Drug Administration (FDA), and Celltrion is currently undergoing FDA inspection.

The autoimmune disease treatment drug 'Stelara' is also expected to have its patent expire in the second half of this year. Stelara is approved for indications such as plaque psoriasis, psoriatic arthritis, Crohn's disease, and ulcerative colitis. Stelara is administered intravenously only during the initial induction therapy, and thereafter can be given by subcutaneous injection at regular intervals, which is considered more convenient compared to existing drugs. No Stelara biosimilar has yet received FDA approval, but among Korean companies, Samsung Bioepis (SB17), Celltrion (CT-P43), and Dong-A ST (MB3115) are preparing biosimilars.

The patent for 'Vyvanse,' used to treat attention deficit and behavioral disorders, will expire in August. Vyvanse, whose ownership was secured by Takeda Pharmaceutical after acquiring Shire Pharmaceuticals, has biosimilars from pharmaceutical companies such as Teva and Amneal that have received tentative FDA approval, and biosimilar launches are expected to coincide with the patent expiration. Sanofi's multiple sclerosis treatment 'Ocrevus' had its patent expire in March, but its exclusivity has been somewhat weakened due to the launch of competing products like Novartis's 'Gilenya' and BMS's 'Zeposia.' Additionally, patents for Roche's immunosuppressant 'Actemra' (second half of the year), Jazz Pharmaceuticals' narcolepsy treatment 'Xyrem' (January), and AstraZeneca's asthma treatment 'Symbicort' (July) are either set to expire or have already expired.

Since the full-scale launch of biosimilars for drugs with patents expiring this year is mostly scheduled for the second half of the year, attention should be paid to the market situation in the latter half. Lee Jisoo, a researcher at Daol Investment & Securities, said, "Amgen's Amjevita, the first biosimilar of Humira, has a market share of only 0.3% since its launch on January 31, which is still minimal," but added, "With many biosimilars launching in July, prescription data in the second half of the year will be important."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.