[At a Crossroads: Korean AI]③

Frozen Investment Sentiment

Continuous Decline Since 2020... "Investment Has Completely Stopped"

Even AI with Relatively Better Conditions Faces Widespread Restructuring

Government Policies Needed to Ignite Investment Sentiment

Companies nurturing artificial intelligence (AI), the top priority for future food sources, are facing an emergency. External investments have completely dried up since last year. The aftershocks have been particularly severe in the startup sector, which heavily depends on investment. Some have undergone large-scale restructuring or are facing existential crises. Although the government has announced support measures, critics say they are insufficient to revive the extinguished investment sentiment.

70% of AI Companies Received No External Investment for 3 Years

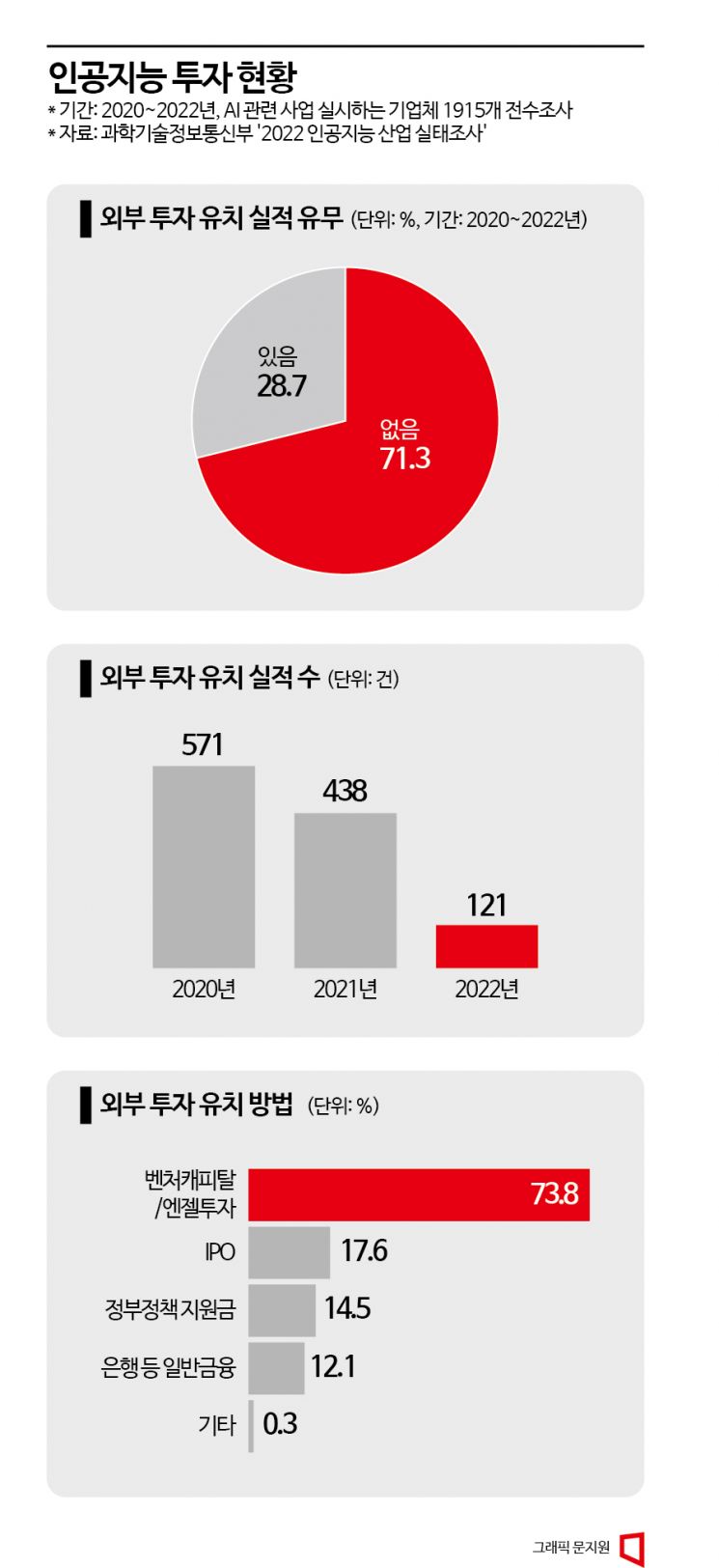

The Ministry of Science and ICT and the Software Policy Research Institute released the '2022 AI Industry Survey.' In this report, which surveyed all 1,915 companies engaged in AI-related businesses, 70% responded that they had not received any external investment in the past three years.

Investment in AI companies has been cut off. The number of external investment deals was 571 in 2020. It slightly decreased to 438 in 2021, but plummeted to 121 last year, which is about one-fifth of the 2020 level. The investment cliff is widely expected to be just beginning, as the entire investment market has frozen due to recent events such as the bankruptcy of Silicon Valley Bank (SVB) in the United States.

The most common method of attracting external investment was 'venture capital and angel investment' at 73.8%. This was followed by 'IPO (initial public offering, listing, stock issuance)' at 17.6%, 'government policy grants' at 14.5%, and 'general finance such as banks' at 12.1%. The recent contraction of the investment market is a greater crisis than ever for AI companies that heavily rely on venture capital and angel investment.

A financial officer at an AI-related startup said, "It has been seven years since we were founded, but this is the first time investment sentiment has been so depressed," adding, "The situation is so difficult that I have not heard any news of investment attraction since the first half of last year."

Despite the Investment Cliff... If Investing, Ultimately AI

Even with investment sentiment frozen solid, investors are still turning to AI. This is based on the judgment that AI is ultimately the industry that will generate money in the future.

The startup 'Goodging Labs' secured new investment this year from Naver's startup nurturing organization D2SF. This company is developing technology that uses AI to realize users' facial expressions and motions as real-time 3D avatars.

The AI solution startup 'Corka' raised 7 billion KRW in a pre-Series A investment. In addition to existing venture partners, KB Investment and Laguna Investment newly participated. Most of the other startups that attracted investors this year also possess AI-related technologies.

However, the situation is 180 degrees different from the past when money poured into AI industries. A representative of a startup developing visual AI technology said, "Investors are now asking specific questions about how much profitability can be generated from AI right now," adding, "It is difficult to find investors who invest based on growth potential."

Urgent Need for Government Support to Revive Investment Sentiment

The government has announced policies to revitalize the AI industry, but the evaluation is that they are insufficient. There is a call for direct support for AI personnel and measures to activate the extinguished investment sentiment.

The government recently announced policies to strengthen super-large AI competitiveness and nurture it as a future strategic industry. It plans to start investing 390.1 billion KRW this year and proceed with policy tasks. Specifically, funds will be invested to ▲expand AI technology and industrial infrastructure ▲create a super-large AI ecosystem ▲establish AI innovation systems and culture.

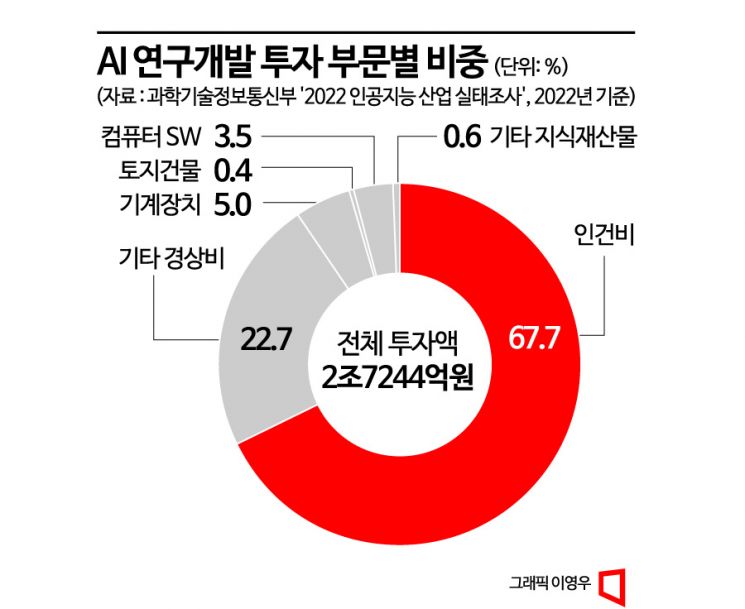

Industry voices express disappointment over this. They say the investment scale is relatively small and the support direction does not reflect the industry's difficulties. Last year, AI-related companies invested more than 2.7 trillion KRW in AI research and development, of which 67.7% was labor costs.

Startups, which heavily depend on external investment, say direct investment is urgent. Recently, several startups have carried out workforce restructuring. An AI startup representative said, "It is not difficult to see places worried about unpaid wages around us," adding, "A solution is needed to prevent losing AI talent immediately."

The lack of government support measures to revive investment sentiment is also a problem. AI companies cited difficulties in attracting investment as a bigger challenge in business operations than infrastructure shortages. In the '2022 AI Industry Survey,' 63% of AI companies said it was difficult to attract investment, while only 6% said they did not feel difficulty in attracting investment.

A representative of a company operating AI services said, "Most companies except for some rely heavily on external investment, so measures to revive investment sentiment are necessary," emphasizing, "The government should meet with the investment industry and devise policies that can rekindle investment flames."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)