Will Samsung Electronics and LG Display Become New Customers?

Since Samsung Display announced plans to invest 4.1 trillion KRW to establish an OLED production base in Asan, Chungnam, expectations have been growing that its competitor LG Display could attract Samsung Electronics as a new customer. Because Samsung Display’s new investment is focused on producing small- and medium-sized IT panels rather than large TV panels, an environment has been created where Samsung Electronics has no choice but to rely on LG Display for its panel shortages.

On the 20th, the electronics and display industry viewed the possibility of LG Display attracting Samsung Electronics as a new customer as higher than in the past. Although the possibility of LG Display contracting with Samsung Electronics was consistently raised last year, negotiations faced difficulties due to a slump in TV demand. However, the recent atmosphere is leaning toward resuming negotiations.

This is because TV panel prices have started to rise after hitting bottom, and Samsung Electronics has resumed OLED TV sales for the first time in 10 years, increasing the mutual benefits if LG Display and Samsung Electronics join forces. In particular, since Samsung Display is focusing its OLED production base in Asan, Chungnam on small- and medium-sized IT products, Samsung Electronics, which needs to secure OLED panels, has no choice but to consider LG Display as an alternative. Currently, Samsung Display, which has raised OLED panel yield rates to around 90%, can produce about 1.5 million panels annually. This is far less compared to LG Display’s large OLED panel production capacity of up to 10 million units per year.

The industry expects that if LG Display attracts Samsung Electronics as a new customer within this year, LG Display’s turnaround to profitability could be accelerated.

LG Display, which has focused on producing large panels, had TV panels accounting for one-quarter of its total sales as of the end of last year. Recently, TV panel prices have bottomed out and have been rising for three consecutive months. This is because TV manufacturers are stockpiling panels ahead of June 18, when Chinese online consumption peaks, and the upcoming Amazon Prime Day in July. Moreover, since the LCD TV panel business, which recorded significant losses until last year, has ended, there is growing optimism that profitability could return as early as the fourth quarter of this year. Dongwon Kim, a researcher at KB Securities, explained, “If LG Display partners with Samsung Electronics, shipments of large OLED panels in 2024 are estimated to increase by 67%. Profitability is possible due to increased operating rates from securing new customers.”

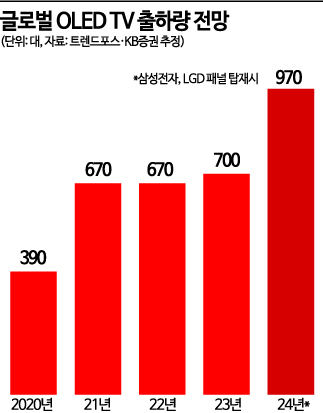

With Samsung Electronics, which secured panels, re-entering the global OLED TV market dominated by LG Electronics after 10 years, there are expectations that global OLED TV shipments will increase. The industry expects that if Samsung Electronics uses LG Display’s OLED panels, global OLED TV shipments could rise from 7 million units this year to 9.7 million units next year. The OLED TV penetration rate could also increase from the low 3% range this year to nearly 5% next year.

The global OLED TV market continues steady growth despite a sluggish TV demand environment. Market research firm Omdia forecasted that the global TV market size will decrease by 5.2% from last year to about 97.1 billion USD this year. In contrast, the OLED TV market size is expected to grow by 5.7% from last year, surpassing 11.7 billion USD, and the average price of OLED TVs is projected to rise from 1,704 USD last year to 1,752 USD this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.