The European Union (EU) semiconductor law implementation agreement, which aims to double the global semiconductor market share to 20% by investing 43 billion euros (approximately 62 trillion won) by 2030, is not expected to have an immediate significant impact on our semiconductor industry. This is because Korean semiconductor companies do not have production plants in Europe and their market share in Europe is low. However, as both the United States and Europe are striving to secure semiconductor manufacturing capabilities and enhance competitiveness, the burden on our companies due to intensified competition may increase.

On the 19th, the Ministry of Trade, Industry and Energy reported that the EU semiconductor law does not include explicit discriminatory provisions against foreign companies. The ministry stated, "Currently, since Korean semiconductor companies do not have production facilities in the EU, the direct impact may be minimal," adding, "However, if the EU strengthens its semiconductor manufacturing capabilities through this law, competition in the global semiconductor market could intensify." Of course, the expansion of semiconductor production facilities within the EU is also seen as an opportunity factor that could lead to increased export opportunities for domestic materials, parts, and equipment (MPE) companies.

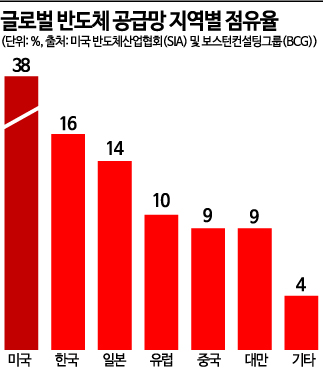

The global semiconductor supply chain market share by region is as follows: the United States (38%), Korea (16%), Japan (14%), Europe (10%), China (9%), and Taiwan (9%). The EU accounts for 20% of global semiconductor demand, making it the third-largest consumer market after the US and China, but its share of the semiconductor supply chain is only 10%. This is mainly because many fabless (semiconductor design) companies outsource production externally, resulting in insufficient manufacturing capacity.

The semiconductor industry also believes that the EU semiconductor law will not directly affect domestic companies due to Europe's low market share, but emphasizes that Korea must work to improve its weak areas to survive the intensified competition. Nam Geon-wook, a professor in the Department of Global Semiconductor Engineering at Far East University, advised, "As global competition intensifies by strengthening the overall supply chain, we also need to supplement our shortcomings," adding, "We should focus more on fostering semiconductor materials, parts, and equipment as well as fabless sectors to pursue overall industrial balance."

There is also analysis suggesting that Europe, which focuses on the automotive industry, is increasing local production and supply in preparation for the growing demand for automotive semiconductors, and that we should take note of this. Park Jae-geun, president of the Korean Semiconductor Display Society, said, "The number of semiconductors installed in electric vehicles is expected to be ten times that of internal combustion engine vehicles, so demand for automotive semiconductors will surge," adding, "The foundry plants that Intel and TSMC plan to build in Germany will ultimately help secure local automotive semiconductor supply, so we, whose main industry is automotive, also need support that is not inferior to competing countries."

Some argue that it will not be easy for the EU to secure a 20% semiconductor market share simply by enacting the law. An industry official explained, "From a company's perspective, there must be sufficient reasons to build factories, but apart from the automotive sector, Europe does not have many major customers, and there are concerns such as labor costs and workforce acquisition," adding, "The effectiveness of the law will depend on what further efforts the EU makes in the future."

The main contents of the EU semiconductor law are broadly threefold. First, 3.3 billion euros will be invested to promote the European Semiconductor Action Plan to strengthen semiconductor technological capabilities and foster innovation. The action plan includes investments in enhancing semiconductor design capabilities, training specialized personnel, and researching next-generation semiconductor technologies. Second, the law establishes grounds for subsidies for production facilities (integrated production facilities and open foundries) that can contribute to stabilizing the semiconductor supply chain within the EU. However, these facilities must be newly introduced within the EU, and investments in next-generation semiconductors must also be promised.

Additionally, a monitoring and crisis response system for the EU semiconductor supply chain will be introduced. In the event of a supply chain crisis alert, semiconductor operators will be required to provide necessary information such as production capacity, and integrated production facilities and open foundries may be obligated to prioritize production of crisis-related products.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.