It is evaluated that there are no explicit discriminatory provisions against offshore companies included.

The government views that the immediate impact of the EU Semiconductor Act trilateral agreement on our semiconductor industry may be minimal. Although intensified competition in the global semiconductor market is expected to follow, the reaction is that the ripple effect will not be significant given the EU's low semiconductor market share.

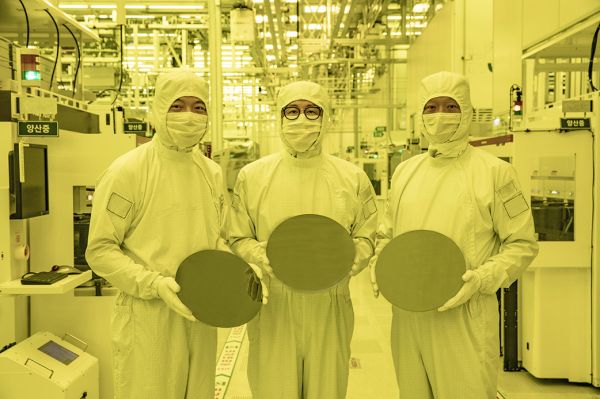

On the 19th, the Ministry of Trade, Industry and Energy stated regarding the trilateral agreement on the EU Semiconductor Act, "It is assessed that the EU semiconductor bill does not include explicit discriminatory provisions against non-EU companies," and "Since the production facilities of our country's semiconductor companies are not currently located in the EU, the direct impact may be minimal." However, it was noted that if the EU's semiconductor manufacturing capabilities are strengthened through this bill, competition in the global semiconductor market could intensify. Of course, the expansion of semiconductor production facilities within the EU also presents an opportunity factor that could lead to increased export opportunities for domestic material, parts, and equipment (MPE) companies.

The Ministry plans to closely communicate with the domestic semiconductor industry going forward, thoroughly monitor the remaining legislative process of the EU Semiconductor Act, analyze the impact on the industry until the bill is finally confirmed, and focus on seeking countermeasures. Additionally, it stated that it will continuously consult with EU authorities to minimize the burden on our companies and maximize opportunity factors.

This trilateral agreement refers to the political agreement reached among the three parties?the European Parliament, the Council, and the European Commission?regarding the EU Semiconductor Act initially proposed by the EU Commission in February 2022. The EU Semiconductor Act will subsequently go through approval procedures by the Council and the European Parliament, be published in the official journal, and take effect after publication. The final confirmed bill can be checked upon publication in the official journal.

According to the EU Commission, the goal of the Semiconductor Act is to invest 43 billion euros from both private and public sectors by 2030 to expand the EU's global semiconductor market share to 20%. The EU accounts for 20% of global semiconductor demand, making it the third largest consumer market after the US and China, but its share of the semiconductor supply chain is only 10%. This is mainly because many fabless (semiconductor design) companies outsource semiconductor production externally, resulting in insufficient manufacturing capacity. Recently, the EU has recognized semiconductors as a core item of economic security and has been promoting the enactment of this bill to strengthen semiconductor manufacturing capabilities within the EU and stabilize the supply chain.

The main contents of the EU Semiconductor Act can be broadly divided into three parts. First, 3.3 billion euros will be invested to promote the European Semiconductor Execution Plan to strengthen semiconductor technological capabilities and foster innovation. The execution plan includes investments in enhancing semiconductor design capabilities, training specialized personnel, and researching next-generation semiconductor technologies. Second, a basis for providing subsidies for production facilities (integrated production facilities and open foundries) that can contribute to stabilizing the semiconductor supply chain within the EU will be established.

However, these facilities must be newly introduced within the EU, and there is a condition to commit to investing in next-generation semiconductors. Additionally, a monitoring and crisis response system for the EU semiconductor supply chain will be introduced. In the event of a supply chain crisis alert, semiconductor operators will be required to provide necessary information such as production capacity, and integrated production facilities and open foundries (semiconductor foundry services) may be obligated to prioritize production of crisis-related products.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)