Encar.com Big Data Analysis Request

Major Used Car Prices All Decline Compared to Early This Year

Renault SM6, Mini Cooper, BMW X5 Used Car Prices Show Clear Drop

Popular Models Like Kia Ray Sell Out Within Half a Month

This year, the used car market is experiencing a revival. As the supply of used cars increases due to replacement demand from new car purchases, used car prices are rapidly declining. Some major models have dropped nearly 16% in the past three months, changing the leading digit of their prices.

The rapidly rising used car installment interest rates have also slowed their increase this year. While consumers closed their wallets due to sharp rate hikes until the end of last year, this year, consumers who have adapted to the higher rates are gradually weighing their purchase decisions.

On the 19th, Asia Economy analyzed the used car prices of major domestic and imported models from January to April this year in collaboration with Encar.com, finding that most used car prices have fallen compared to the beginning of the year. This analysis focused on popular used car models from 2020, accident-free, with mileage under 60,000 km.

In the used car market, the Renault The New SM6 1.8 TCe Premiere dropped more than 16% from 27.65 million KRW in January to 23.08 million KRW in April over three months. The BMW X5 (G5) xDrive 30d xLine also fell from 83.71 million KRW at the start of the year to 70.21 million KRW in April, dropping into the 70 million KRW range. Other major models such as the Mini Cooper Basic 3rd Generation (22.37 million KRW → 18.78 million KRW), Ford Explorer 6th Generation 2.3 Limited 4WD (45.01 million KRW → 38.16 million KRW), and Volkswagen Tiguan 2nd Generation 2.0 TDI Prestige (32.04 million KRW → 27.32 million KRW) also saw their leading price digits change over the past three months.

On the other hand, some used car models defended their prices due to steady popularity. The Genesis GV80 Gasoline 2.5 Turbo AWD only fell 7.6%, from 71.20 million KRW at the beginning of the year to 65.75 million KRW in April. The Kia The New Niro 1.6 HEV Noblesse Special also held up well, dropping about 7% from 27.67 million KRW to 25.55 million KRW. The Hyundai The New Grandeur IG 2.5 Exclusive (32.65 million KRW → 30.04 million KRW), Hyundai The New Avante AD 1.6 Smart (15.52 million KRW → 14.18 million KRW), and Volvo XC60 2nd Generation T6 Inscription (57.19 million KRW → 52.01 million KRW) recorded price declines within 10%.

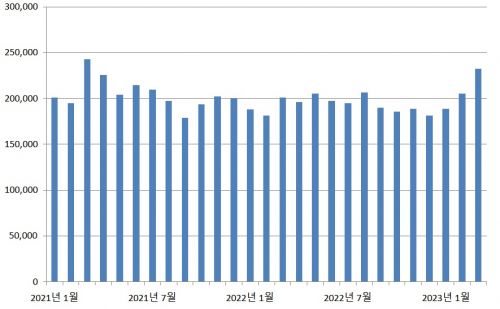

According to data from the Kaizyu Data Research Institute analyzing the Ministry of Land, Infrastructure and Transport's vehicle registration data, the actual number of used car transactions in Korea in March this year was 232,122 units, a 15% increase compared to the same month last year. The monthly used car transaction volume exceeding 230,000 units is the first time in two years since March 2021 (242,971 units).

Monthly Used Car Actual Transaction Volume (Unit: Units) [Data=Kaizyu, Ministry of Land, Infrastructure and Transport]

Monthly Used Car Actual Transaction Volume (Unit: Units) [Data=Kaizyu, Ministry of Land, Infrastructure and Transport]

Until two years ago, the used car market enjoyed a boom as new car demand increased with the recovery of consumer sentiment after COVID-19. The shortage of semiconductors further caused some used cars close to new car condition to surpass new car prices. The waiting demand to buy cars was high, but delayed new car deliveries led demand to shift to immediately available used cars.

However, last year the used car market froze solid. The Bank of Korea's sharp interest rate hikes caused used car installment rates to rise significantly. Even for high-credit borrowers, used car installment rates soared to around 15%, causing both new and used car buyers to hesitate in spending.

Although interest rates remain high this year, additional rate hikes have stopped. According to the Credit Finance Association's public information portal, borrowers with mid-level credit scores between 501 and 601 currently face annual average interest rates of 12-19% for 60-month used car installment loans. Compared to the 4-7% rates at the beginning of last year, this is nearly three times higher, but similar to the levels at the end of last year.

With the slowdown in interest rate increases this year, used car transactions also became more active in the first quarter. During the peak used car season in March and April, coinciding with school entrance and outing demand, the sales period for some models is shortening. This means that popular used cars are quickly purchased once listed on the market.

Asia Economy analyzed the sales period of major domestic and imported used car models in the first quarter in collaboration with Encar.com. Among domestic cars, the Kia Ray (17.6 days), Kia 3rd Generation K5 (19.9 days), Genesis G80 (21.4 days), and Kia Mohave The Master (21.8 days) were sold quickly. Imported cars such as the BMW X5 (G05) (25 days), BMW 7 Series (G11) (26.9 days), Audi A6 (C8) (27 days), Audi Q7 (4M) (27.3 days), and Jeep Wrangler (JK) (27.5 days) were sold within a month.

An Encar.com representative explained, "The abnormal transaction slump caused by the off-season and interest rate hikes at the end of last year is now normalizing. As we enter the peak season in March and April this year, transactions are steadily increasing, centered on actual buyers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.