KCCI, Q2 Retail Distribution Industry Business Outlook Index Survey

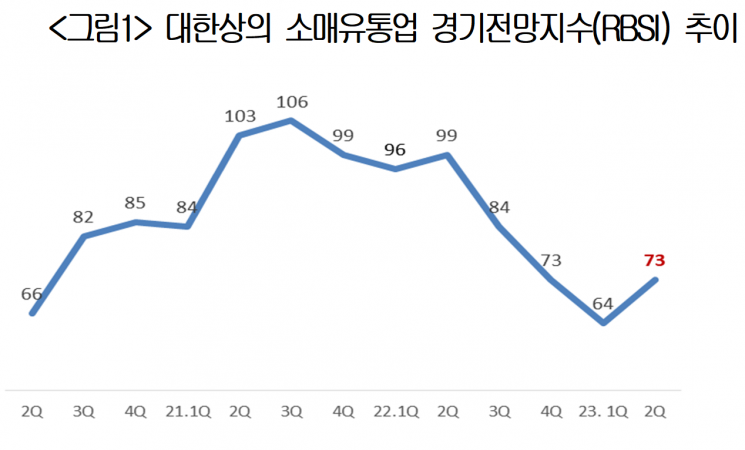

The retail distribution industry’s business sentiment, which has been on a continuous downward trend due to weakened consumer sentiment, is expected to remain negative in the second quarter. However, the index value slightly rebounded for the first time in a year (64→73).

The Korea Chamber of Commerce and Industry (KCCI) announced on the 16th that the ‘2nd Quarter Retail Business Sentiment Index (RBSI)’ surveyed among 500 retail distribution companies was recorded at ‘73’. The RBSI quantifies the business sentiment of distribution companies by investigating their business judgments and outlooks. An index above 100 means that more companies view the retail business outlook for the next quarter positively compared to the previous quarter, while below 100 indicates the opposite.

The KCCI analyzed, “With the mask mandate lifted for the first time in four years and mild weather increasing outdoor activities, some optimism has revived mainly in offline sectors.” However, it added, “High interest rates have increased debt repayments and made borrowing difficult, limiting consumer spending power, and the high cost of living, including food prices, has led to predominantly negative outlooks.”

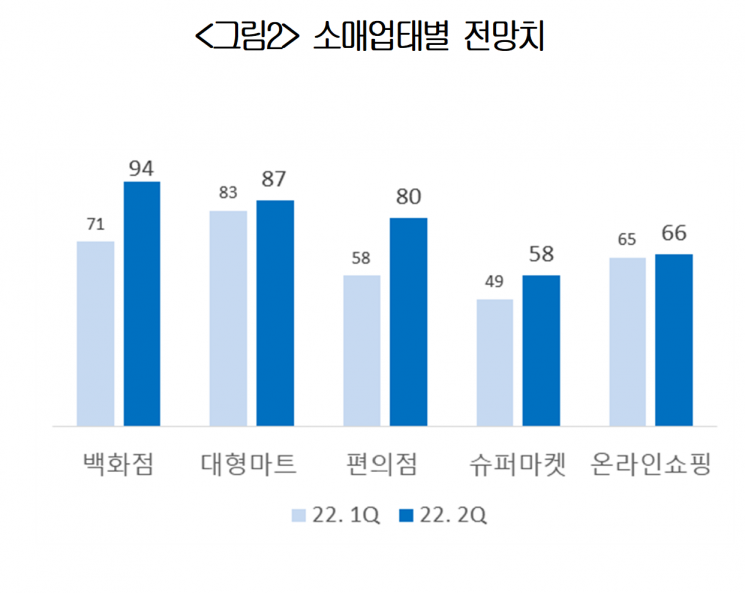

By business type, department stores (94) showed the most favorable outlook. Although luxury goods, which had driven department store growth amid weakened consumer sentiment and resumed overseas travel, are expected to slow down, the lifting of indoor mask mandates and increased outdoor activities are anticipated to boost sales in cosmetics, fashion, and other outing-related categories.

All sectors, including large discount stores (87), convenience stores (80), and supermarkets (58), saw their indices rise compared to the first quarter. Online shopping (66) showed only a slight increase from last year (65), as the shift from non-face-to-face to face-to-face consumption is expected to accelerate with the full recovery of daily life in the endemic phase.

Large discount stores are continuously planning sales and special promotions to reduce the burden on shoppers’ baskets caused by high prices, which is expected to positively impact sales growth. However, increased dining out due to warmer weather and high prices of processed foods and other staple goods were identified as negative factors.

Convenience stores (80) showed the highest expectations for sales growth, supported by steady demand for ready-to-eat and processed foods such as lunch boxes, and an anticipated increase in foot traffic and outing visitors during spring. The 5% increase in the minimum wage compared to last year is seen as a constraint on the rise in outlook due to increased labor costs. Supermarkets (58) recorded the lowest outlook among business types again this quarter. Competition is fierce not only with online and convenience stores but also with neighborhood grocery marts, and it is difficult to expand stores due to restrictions on new openings, resulting in a pessimistic outlook.

Jang Geun-moo, Director of the KCCI Distribution and Logistics Promotion Institute, said, “In an era of low growth with persistent high inflation and high interest rates, consumers prefer value-for-money shopping that is rational and economical.” He added, “It is necessary to actively target consumer segments trying to maximize their limited spending power due to elevated price and interest rate levels.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.