①NAND Spot Prices Rose for the First Time in 100 Days

Changes in DRAM and NAND Prices Following Samsung's Production Cut Announcement

"Active Production Cuts Needed to Accelerate Market Recovery"

As the spot prices of DRAM and NAND flash rise, expectations for market recovery are growing. This is interpreted as the effect of Samsung Electronics' production cuts. It is evaluated that the larger the scale of production cuts by major companies, including Samsung Electronics, the faster the industry rebound can be accelerated.

On the 14th, market research firm DRAMeXchange announced that the price of the '3D Triple-Level Cell (TLC) 512Gb' NAND product, compiled the previous day, was $4.642. The spot price of this product rose 0.37% compared to the previous day. This upward trend has continued since Samsung Electronics' production cut announcement. On the announcement day, the 7th, it recorded $4.608, marking the first increase since December 22 last year ($4.94). Subsequently, prices jumped on the 12th ($4.625) and 13th ($4.642), showing a rapid upward trend.

Another NAND product commonly used in the market, '3D TLC 256Gb,' showed a similar trend in spot prices. After continuously declining since December 22 last year ($2.451), it first recorded $2.114 on the 7th, with prices rising. Although it seemed to pause briefly on the 10th, it rose continuously from the 11th, reaching $2.16 on the 13th.

In the case of DRAM spot prices, the rebound started later than NAND, on the 11th. The price of 'Double Data Rate (DDR)4 16 Gigabit (Gb) 2666' DRAM rose for the first time since March 7 last year ($7.873), recording $3.235, up 0.78% from the previous day. This is the first increase in 1 year and 1 month. Since then, prices have been maintained without decline for three consecutive days.

The semiconductor industry places significance on this price rebound. This is because DRAM and NAND spot prices rose for the first time in months immediately after Samsung Electronics' production cut announcement. With all major memory companies cutting production and the industry leader Samsung Electronics joining in, demand sources have responded, according to industry interpretation. For memory prices to rise, demand must increase alongside supply-side production cuts, and the fact that demand has moved this time can be seen as a signal of industry recovery.

Of course, there are also evaluations that it is difficult to overinterpret this. Spot prices are transactions centered on actual buyers conducted at dealerships. While they can quickly reflect market reactions, they tend to be highly volatile. There is a possibility that this price rebound is temporary. In fact, the DDR4 16Gb 2666 product whose spot price rose is for PCs. Since the PC market is expected to experience weak demand until the second half of the year, related DRAM demand may decrease at times. It is also important to note that spot prices of other general-purpose products used in PCs, such as 'DDR4 8Gb 2666,' are still on a downward trend.

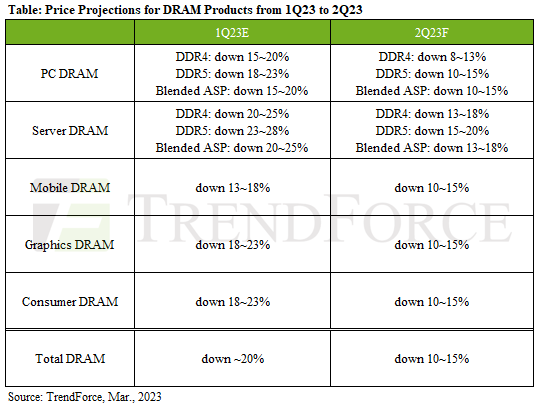

Quarter 1 and Quarter 2 Average Selling Price (ASP) Forecast Table by DRAM Item / [Image provided by TrendForce]

Quarter 1 and Quarter 2 Average Selling Price (ASP) Forecast Table by DRAM Item / [Image provided by TrendForce]

Market research firm TrendForce predicted that the average selling price (ASP) of DRAM could fall by 10-15% in the second quarter compared to the previous quarter. NAND prices were expected to decline by 5-10%, a smaller drop than DRAM. They anticipated prices would continue to fall in the second quarter following the first quarter but with a reduced rate of decline. However, the situation changed after Samsung, which accounts for half of the DRAM market, declared production cuts following the TrendForce announcement. Spot prices began to rise immediately. Spot prices ultimately influence fixed transaction prices.

The securities industry believes that to enhance the effect of industry rebound, memory suppliers must actively cut production. Song Myung-seop, a researcher at Hi Investment & Securities, said, "Since semiconductor companies have decided to cut production for industry recovery, the worse the industry condition, the more the scale of production cuts will increase," adding, "Even if costs rise and performance worsens in the short term, increasing production cuts to accelerate industry recovery is more profitable than incurring depreciation (fixed costs, expenses) due to delayed recovery."

Market attention is focused on the scale of Samsung Electronics' production cuts. Since Samsung Electronics has a high market share, the production cut announcement itself can be a positive signal for market recovery, but to amplify the effect, the production cut scale is evaluated to need to be around 30%. Kim Rok-ho, a researcher at Hana Securities, said, "The scale of production cuts will affect the extent of price declines in the second and third quarters," adding, "If there is a change in price trends in the second and third quarters, it can improve earnings."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.