Highest in 10 Months Since June Last Year

KOSDAQ Index Rises About 33%... Investment Focused on 'Ecopro Brothers'

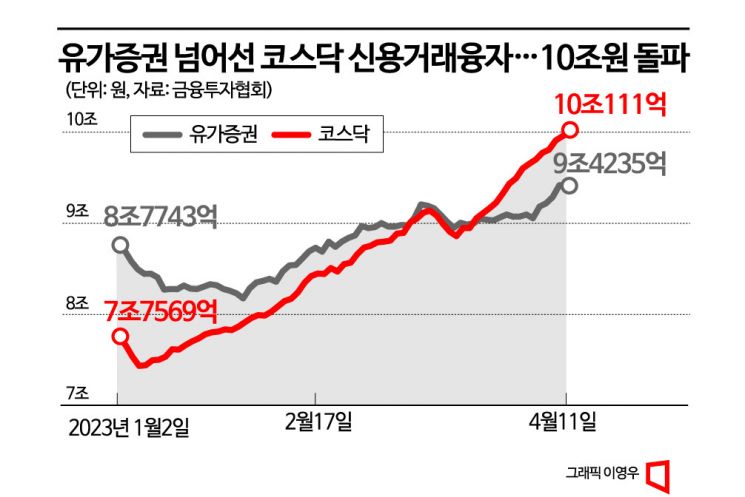

The scale of 'debt investment' in the KOSDAQ market has surpassed 10 trillion won. This is the highest level in about 10 months since June last year.

According to the Korea Financial Investment Association on the 14th, as of the 11th, the outstanding balance of margin loans in the KOSDAQ market was recorded at 10.011 trillion won. This is the first time since June 14 last year (10.1348 trillion won) that the KOSDAQ margin loan balance has exceeded 10 trillion won. Compared to the beginning of the year, it surged by 30% in just three and a half months, continuously setting new yearly highs.

Since mid to late last month, the margin loan balance in the KOSPI market has already been surpassed. The KOSPI margin loan balance was 8.7743 trillion won at the beginning of the year and recorded 9.4235 trillion won as of the 11th. The increase rate compared to the beginning of the year is about 7.4%.

The sharp increase in margin loan balances in the KOSDAQ market is attributed to the rapid rise of the KOSDAQ index this year. As of the previous day, the KOSDAQ index closed at 894.25. This is about a 33% increase compared to early January, and it is now close to reclaiming the 900 level. This is the steepest rise compared to global stock markets. Looking at trading trends by investor type, the rise in the KOSDAQ index was driven by 'Donghak Ants' (individual investors). During the period from January 2 to April 11, individual investors net purchased a total of 4.7529 trillion won in the KOSDAQ market. Institutions sold stocks worth 3.1024 trillion won, and foreigners also net sold 611 billion won.

However, it is difficult to say that the entire KOSDAQ market is booming. In reality, investors' funds have been concentrated in specific sectors such as secondary batteries. The so-called 'Ecopro brothers,' Ecopro and Ecopro BM, are representative examples. Individual investors invested a total of 1.9192 trillion won (Ecopro 1.1639 trillion won, Ecopro BM 755.3 billion won) in these two stocks from the beginning of the year to the 11th. These two stocks absorbed about 40% of the total net buying volume in the KOSDAQ market. This concentration intensified due to the poor performance of large-cap stocks like Samsung Electronics and SK Hynix amid the semiconductor industry downturn at the beginning of the year.

Especially in margin loan balances, the influence of the 'Ecopro brothers' was significant. According to KOSCOM CHECK, Ecopro BM ranked 2nd and Ecopro ranked 10th among the top 10 margin loan balances in both the KOSPI and KOSDAQ markets.

Because of this, the securities industry is sounding 'overheating warnings.' It is pointed out that Ecopro's stock price has already exceeded the company's value at this point. Hana Securities estimated Ecopro's value, including subsidiaries, at a total of 11.8 trillion won based on 2027. Currently, Ecopro's market capitalization is in the 16 trillion won range. Kim Hyun-soo, a researcher at Hana Securities, warned, "The current market capitalization has exceeded the expected corporate value five years from now, and a considerable period of adjustment is needed to confirm mid-term performance," adding, "Although Ecopro is a great company, it is difficult to consider it a 'good stock at present'." He issued a 'sell' investment opinion for the first time.

The situation is similar for Ecopro BM, Ecopro's subsidiary. Choi Bo-young, a researcher at Kyobo Securities, said, "The mid- to long-term industry outlook is expected to continue to be favorable," but added, "The current stock price level compared to the target price reflecting the favorable industry outlook and expectations is overheated, so the potential for further rise is limited," lowering the investment opinion from 'buy' to 'neutral (Hold).'

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.