③DDR5 Transition Speed Likely to Accelerate

NAND Also Expected to Recover After Production Cuts

"We focused on securing stable supply capacity in preparation for production constraints due to the high difficulty of front-end processes and the transition to Double Data Rate (DDR)5 DRAM. We believe we have secured quantities of certain memory products that can respond to future demand fluctuations."

Samsung Electronics officially announced production cuts along with its preliminary first-quarter earnings report on the 7th, mentioning the 'DDR5 transition.' This means they will reduce DDR4 production and focus on DDR5 production going forward. The statement that they have secured enough DDR4 quantities to respond even if demand for IT devices containing semiconductors increases can be interpreted as 'they will not increase DDR4 production even if demand rises.' A Samsung Electronics official said, "We said we would cut production of existing products including DDR4, and it was not a statement specifically about DDR4."

SK Hynix has already started cutting production focused on low-profitability DRAM since the fourth quarter of last year. Specifically, they are adjusting production centered on DDR3 and DDR4. SK Hynix's DRAM production is currently about 400,000 wafers per month on average, which is about 10% lower than last year's 460,000 wafers. Industry insiders expect SK Hynix's DRAM production to hit its lowest level in the second half of this year. Market research firm Omdia forecasts that SK Hynix's monthly average wafer shipments of DRAM in the second half of this year will be around 380,000 wafers, down 18-20% from the previous year.

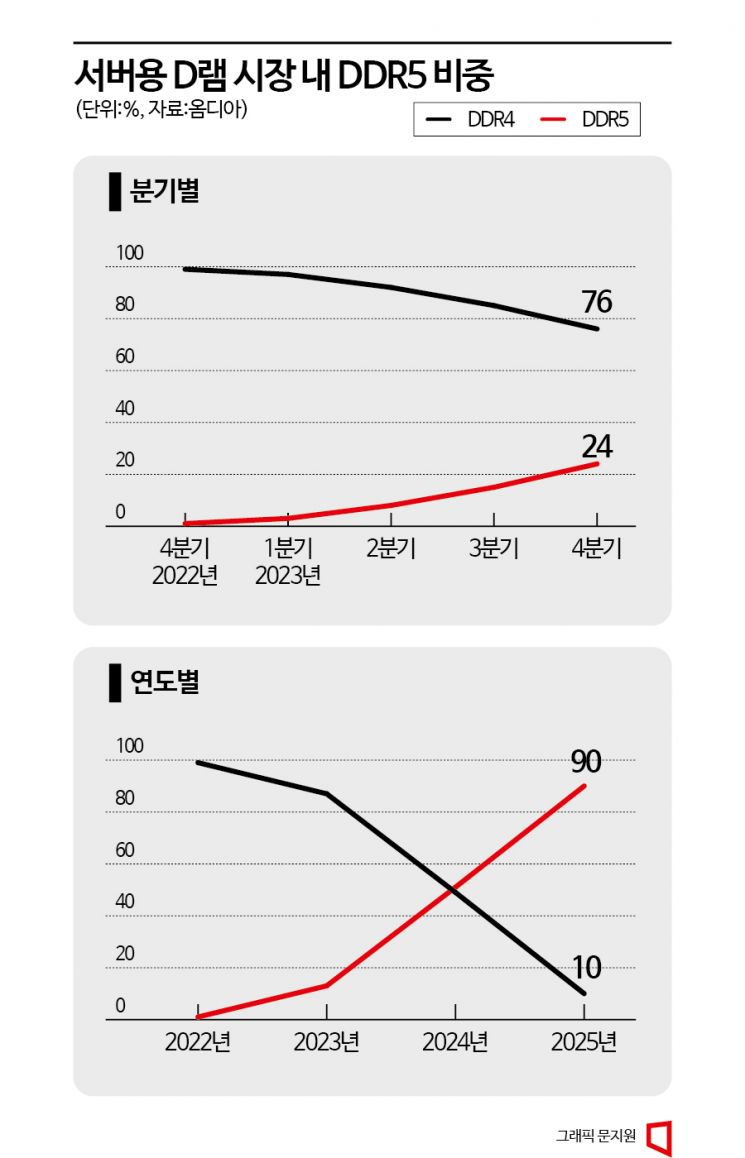

There have been consistent forecasts that the share of DDR5 in the DRAM market will increase. This is because Intel released the 4th generation model (code-named Sapphire Rapids) of its Xeon Scalable Processor, a server CPU supporting DDR5 products, earlier this year. With the generative AI market, including ChatGPT, which uses DDR5, expanding, optimistic views have emerged that demand will surge. Omdia expects the DDR5 market share in server DRAM to grow from 1% in the fourth quarter of last year to 3% in the first quarter of this year and 24% in the fourth quarter. Annually, it is expected to rise to 51% next year, surpassing DDR4's 49%.

The reason companies are rushing the DDR5 transition is because 'it is profitable.' DDR5 is priced about 30-50% higher than DDR4, has twice the computing speed, and 30% better power efficiency. SK Hynix continues to improve its product mix focusing on advanced products such as HBM (High Bandwidth Memory), a high-capacity, high-value-added product, and DDR5. They also expressed ambitions to secure new customers and expand market share through next-generation product development starting from HBM3. In fact, SK Hynix has recently increased operating rates focused on advanced products in some production lines. Kwak No-jung, President of SK Hynix, said, "We are currently raising operating rates mainly for certain advanced products," adding, "There is tight demand for some DDR5 and HBM products." The term 'tight' is used when demand exceeds supply, allowing production without inventory concerns. Park Jung-ho, Vice Chairman of SK Hynix, also recently told reporters, "We seem to be the most ahead in transitioning to DDR5."

In the case of NAND flash, SK Hynix, Kioxia, and Micron have already started production cuts. Samsung Electronics is also reportedly pushing for production cuts. SK Hynix stated that it is adjusting production mainly for products with fewer than 128 layers. An SK Hynix official explained, "As of the end of last year, production at the 176-layer level accounted for more than 60% of total NAND," adding, "Products with fewer than 128 layers are practically obsolete now." Market research firm TrendForce said that if additional NAND production cuts occur, prices could rise around the fourth quarter.

There is optimism that if prices of products such as DDR5 and NAND rise, memory semiconductor companies' earnings will improve and the market will recover. However, cautious views are also raised that supply reduction alone is not enough and demand must increase together for prices to rise. One clear point is that DDR4 production cuts are likely to lead to the expansion of the DDR5 market, which will act as a positive factor for the semiconductor industry in the long term, with no disagreement. A Samsung Electronics official said, "If supply is insufficient at the time when DDR5 demand surges in the future, prices could rise." Nam Dae-jong, a researcher at Ebest Investment & Securities, said, "If Samsung Electronics reduces DDR4 production, it will lead to an increase in DDR5 product production," adding, "In this case, not only memory semiconductor companies but also backend process companies such as SFA Semiconductor could benefit in the long term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.